The broader market has been trading in green since the beginning of the week. While most alts have noted minor gains and gradually erased losses, tokens like Ethereum Classic have been standing apart and delivering double-digit daily gains back-to-back. Friday was, however, the day of DeFi tokens.

On the daily, Yearn Finance was up by 25% and was trading around 9k. On the other hand, Curve DAO’s native token CRV was up 16%, exchanging hands at the brink of $1.5. Aave also was trading in green at $99 but had noted only a single-digit gain figure of 7%.

Whales caused the DeFi pump?

With the price fluctuations in full swing, whale activity has been on the rise of late. Data from WhaleStats brought to light that large Ethereum HODLers were eying DeFi tokens on Friday.

Just a couple of hours back, for instance, AAVE flipped Lido Finance’s LDO to become the most traded token among the top 2000 ETH whales. Alongside, Curve Finance had also made its way to the top 10 tokens by trading volume list among the 500 biggest Ethereum whales.

On the other hand, Yearn Finance went on to script another record. Over the past 24 hours, it was among the top 1000 ETH whales among the most used smart contracts.

Suppose the price movement dots and rise in whale trading activity are connected. In that case, it can be speculatively contended that prominent market participants, via their transactions, have been pushing up the prices of DeFi tokens.

Alongside whale activity, the macro dynamics of the said DeFi networks have also sharpened. For starters, active addresses on Yearn Finance noted one of its steepest inclines in weeks and was at its one-month high at press time.

Per ITB’s stats, Curve Finance had also noted a 30% incline in its active addresses. Aave’s metric, however, reflected a 2.2% dip in the same daily timeframe. And perhaps that’s why its pump lacked vigor compared to the other two tokens.

Macro recovery

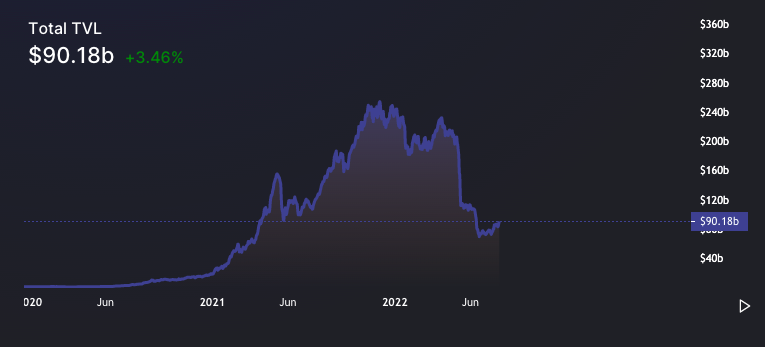

The DeFi market, as a whole, has been in its recovery mode of late. Since June, the total value of all the assets locked in the ecosystem has been inclining. At press time, the same reflected a value of $90.18 billion relative to its 20 June low of $72 billion. The rise in liquidity, by and large, points towards the fact that the DeFi market is recovering, which is a healthy sign.