Switzerland-based investment bank and financial services firm Credit Suisse was in the news at the beginning of the month owing to its deteriorating fundamentals and the surge in its credit default swap spread.

The effect of the same was visible in the firm’s quarterly results announced today. Credit Suisse registered a net loss of a whooping 4.034 billion Swiss francs [$4.09 billion] in the third quarter when compared to contracted analyst expectations of 567.93 million Swiss francs. The figure was also well below the 434 million Swiss franc profit made during the same quarter last year.

Also Read: Credit Suisse CDS at 14Y high, Deutsche Bank suffers from distressed valuation

Job cuts, and other restructuring plans revealed

The bank announced a series of measures to stem losses. Via its proposed strategic shift, Credit Suisse will “radically restructure” to cut its exposure to risk-weighted assets and leverage exposure. The bank intends to chop its cost base by 15%, or 2.5 billion Swiss francs, by 2025.

As a part of the restructuring plan, the company will also cut down over 9000 jobs. Credit Suisse said that it expected to run the bank with roughly 43,000 staff by the end of 2025 compared to 52,000 at the end of September. The same reflected the headcount reduction.

Commenting on the restructuring plan, the new Chief Executive of the bank—Ulrich Koerner—said in a statement,

“This is a historic moment for Credit Suisse. We are radically restructuring the investment bank to help create a new bank that is simpler, more stable and with a more focused business model built around client needs.”

Furthermore, the bank intends to raise capital worth 4 billion Swiss francs via the issuance of new shares to qualified investors, including Saudi National Bank, which has committed to invest up to 1.5 billion Swiss francs. Doing so would give it a 9.9% stake in the firm.

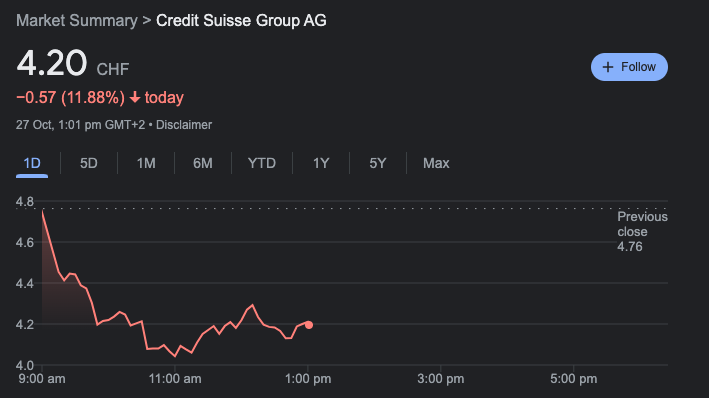

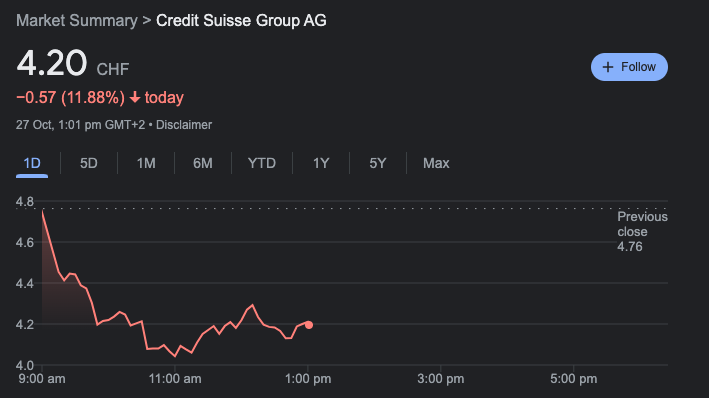

Despite the restructuring plans being announced, pessimism prevailed among investors. The same was visible in the share price of Credit Suisse which stood at an 11% discount at press time on Thursday.

Also Read: Tron’s Justin Sun shows interest in Credit Suisse assets, shares