Credit Suisse is the talk of the financial town. If you’re an avid social media user, you would have most likely come across tweets like “Debit Suisse” and “BREAKING: Credit Suisse” over the past day. So, what exactly is happening? And why are investors panicking?

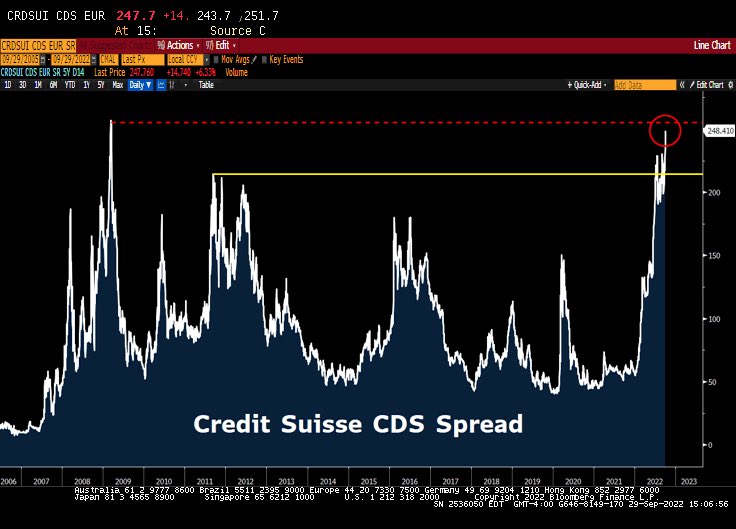

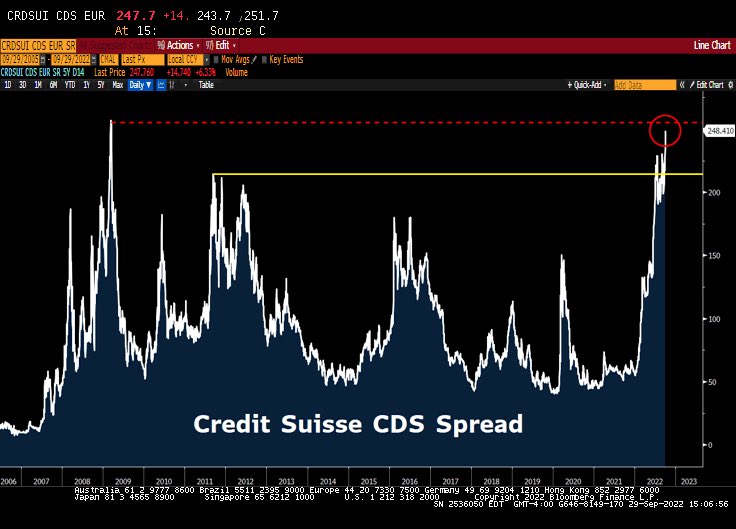

Well, Credit Suisse has been in the news of late owing to the surge in its credit default swap spread. Simply put, a credit default swap is a derivative that allows an investor to swap or offset their credit risk with that of another investor. To swap the risk of default, the lender buys a CDS from another investor who agrees to reimburse them if the borrower defaults. More often than not, a high CDS indicates a strong market-wide belief that a credit swap is going to fail.

Credit Suisse’s CDS spread currently stands at levels not noted since 2009. As illustrated below, the cost of insuring the firm’s bonds against default climbed about 15% last week to the said highs.

Alongside, and the market capitalization of the Swiss bank dropped to around 10 billion Swiss francs [$10.1 billion] as the shares of the company tumbled below $4 to create a new all-time low last week.

The state of the Deutsche Bank is quite similar. It has been trading at 0.3x tangible book value(TBV). TBV is what common shareholders can expect to receive if the firm goes bankrupt. The current numbers have already been labeled to be “very distressing” by many.

Is the current state of affairs concerning?

Chalking out the ripple effects that can be triggered going forward, TradingView India’s Community Manager—Rajat Kumar Singh—took Twitter to elucidate:

Yet, the banks are not letting things slip away. Credit Suisse’s CEO has asked investors for less than 100 days to deliver a new turnaround strategy. Per Bloomberg, Ulrich Koerner reassured staff that the bank has a “strong capital base and liquidity position” and told employees that he will be sending them regular updates until the firm announced a new strategic plan on 27 October.

As far as the Deutsche Bank is concerned, Singh opined that there’s a “good chance” of the German government going all out to save the financial institution because it’s the biggest bank in Germany. However, he underlined that the size of the bailout was a “matter of concern.”

The combined asset base of the two banks roughly stands around $2 trillion, which is thrice the asset base of Lehman Brothers at the time of its collapse. A few from the space feel that the said banks could instigate another “Lehman event.”

Of late, a host of companies have succumbed to collapses, breakdowns, and bankruptcies. With macroeconomic pressures mounting at this stage, there’s no surety that these banks will be able to tread through or not. But if they indeed become the next victims, it’d be a catastrophe and there’d be utter chaos all across the board.

Singh concluded his thread by cautioning,

“No one really knows when the system will start collapsing. But when it does, it will be extremely brutal. It’s a ticking time bomb.“