Hedge Fund Fir Tree has filed a lawsuit against Grayscale Investments. It’s asking for information to investigate “potential mismanagement and conflicts of interest” at its $10.7 billion Bitcoin fund. The information sought could be used to force changes to the way Grayscale runs its flagship Bitcoin Trust—GBTC.

A recent Bloomberg report outlined,

“Fir Tree, which manages $3 billion, wants to use the information to push Grayscale to erase the discount by lowering fees and resuming redemptions, said people familiar with the hedge fund’s plans. The trust has roughly 850,000 retail investors who have been “harmed by Grayscale’s shareholder-unfriendly actions,” the firm said in the complaint.”

Also Read: Grayscale sues SEC over Bitcoin ETF conversion rejection

Fir Tree Wants To Stop GBTC’s Conversion To An ETF

Fir Tree claimed that Grayscale’s redemption bar—dated from 2014—was “self-imposed.” It added that there was no legal reason that stopped the trust from allowing investors to exit. Nevertheless, Grayscale has said in regulatory filings it can’t offer an “ongoing redemption program.”

The hedge fund further alleged that Grayscale refused to redeem shares because the said move would slash down profits. Per the lawsuit, the firm sold “an immense number” of new shares between 2018 and 2021. It charged 2%, higher than competitors, on the market value of its Bitcoin HODLings instead of the lower market price of the shares. Fir Tree also noted that Grayscale collected $615.4 million in fees last year.

Fir Tree also wants Grayscale to stop its efforts to convert the trust into an ETF. On its part, Grayscale has time and again claimed that doing so was the only way it could legally redeem shares. A Grayscale spokesperson told Bloomberg via an emailed statement,

“In 2013, we launched Grayscale Bitcoin Trust (GBTC) to provide investors with access to Bitcoin, and always with the intention of converting it to an ETF when permitted by US regulators. We remain 100% committed to converting GBTC to an ETF, as we strongly believe this is the best long-term product structure for GBTC and its shareholders.”

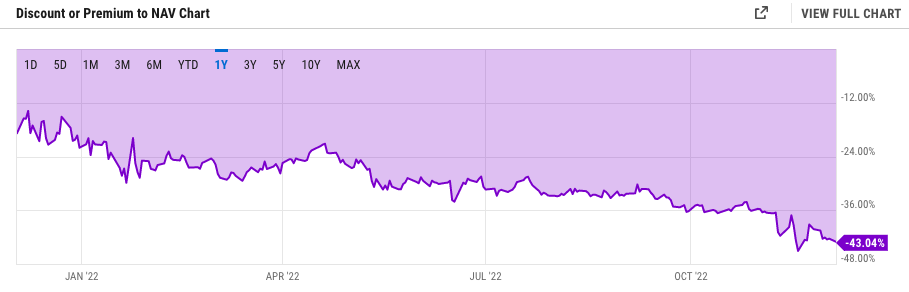

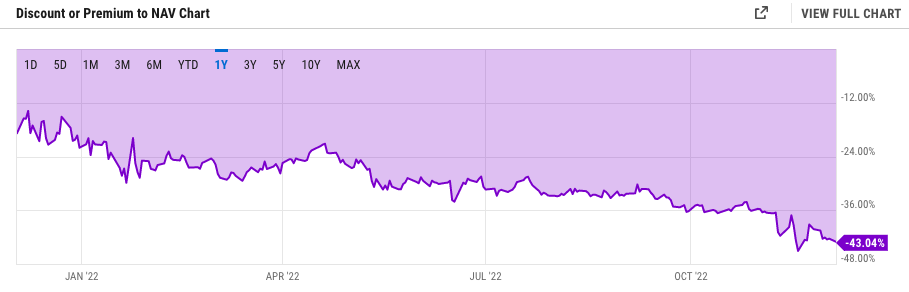

GBTC shares have been trading at a discount since last February. At press time, the discount gap stood as wide as 43.04%.

Also Read: Bitcoin: Grayscale pins SEC over ‘special harshness’ to spot ETFs