As per a recent letter to shareholders, German Bitcoin (BTC) mining firm Northern Data is expecting $202 million to $206 million in revenue. If the target is achieved, the revenue will account for a 1.11% growth from 2021’s $202 million. It should be noted that 2021’s revenue was ten times the earnings in 2020. However, the firm expects profits, regardless of the bear market.

CEO Aroosh Thillainathan noted that the firm does not have any financial debts. The lack of debts gave it a “unique opportunity to consolidate and expand our current position in BTC mining.”

Additionally, the letter noted that Northern Data would continue to utilize “BTC mining to strengthen and expand its HPC (High-Performance Computing) activities.” The firm expects “significant opportunities in the HPC markets” they are targeting. Despite the competition, the firm was able to expand its mining market share in 2022. Currently, the firm’s entire computing capacity (3.3 EH/s) could produce more than 300 Bitcoin each month (assuming there are 250 EH/s on the market).

The letter stated,

“Northern Data’s monthly BTC production could already be around 500 BTC mathematically (at the current mining difficulty). Because with energy costs of around EUR 0.03/kWh, the production of a Bitcoin for around EUR 10,000, and therefore high profitability at the current BTC price, is still possible”

However, the CEO noted that “scaling in conjunction with the expansion of mining will require significant investment.”

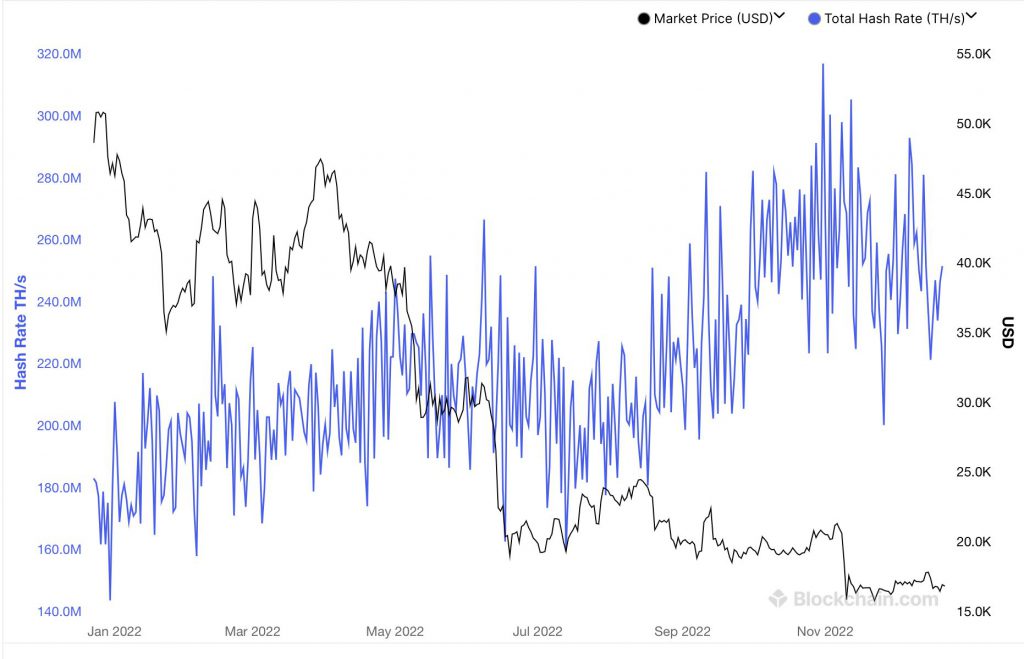

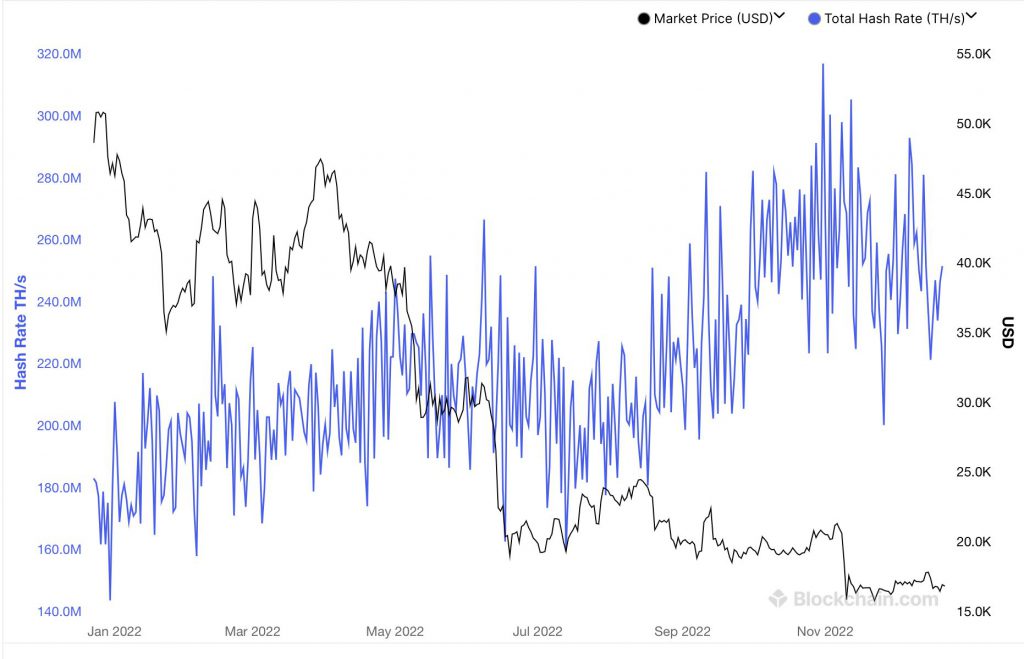

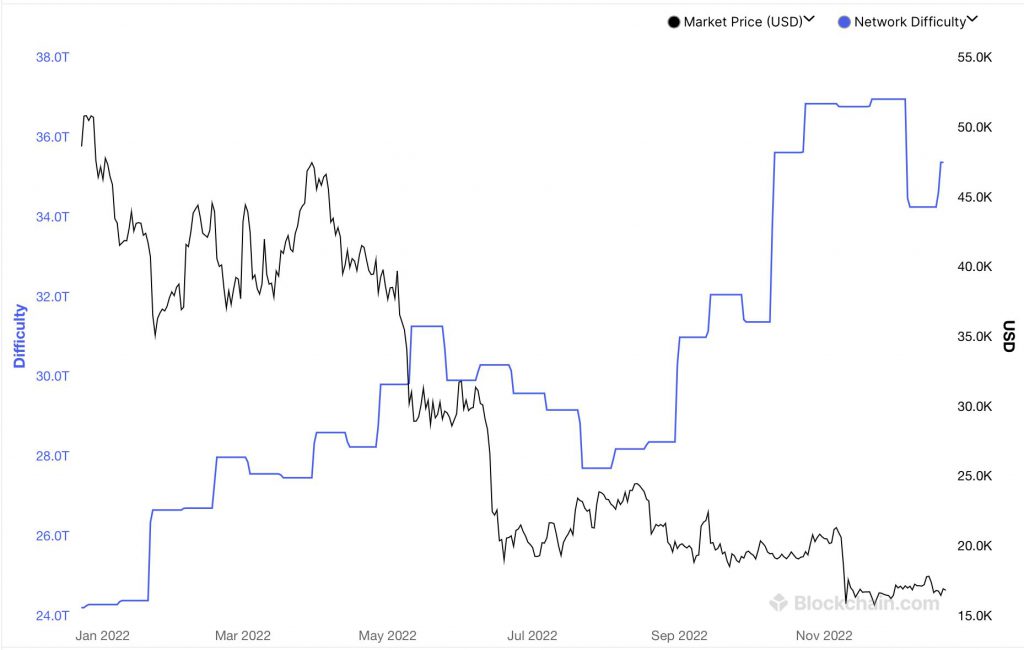

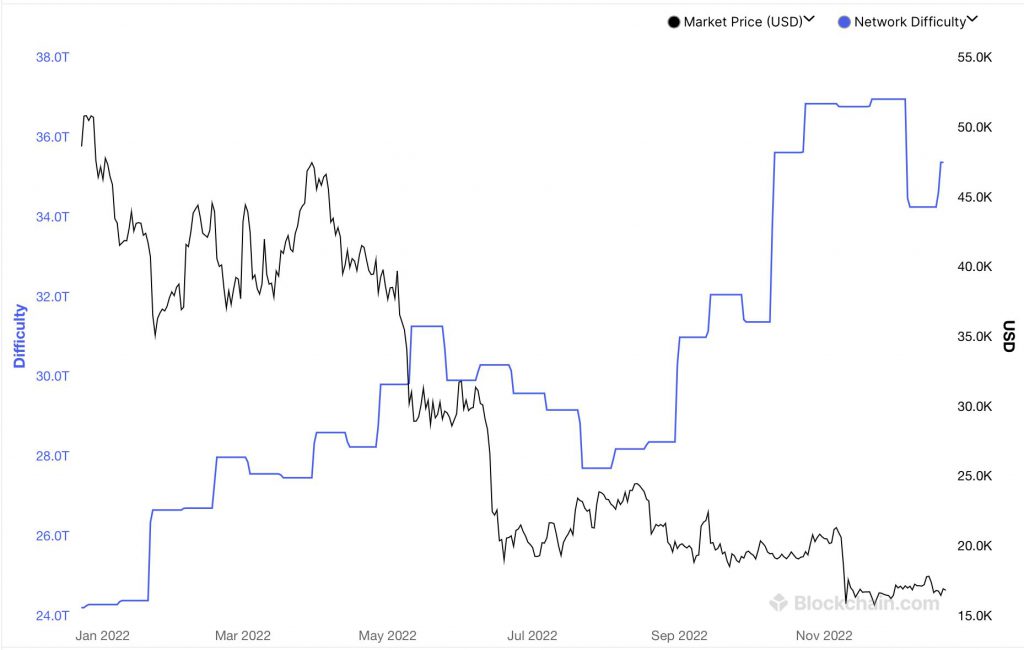

The letter indicated that a combination of a “+46% YTD [year to date]” rise in hash rate, “BTC prices down over 60% since the beginning of the year,” and “severe increases in power prices” is to blame for the absence of growth in its business expectations as a whole.

Bitcoin miners continue to struggle through the winter

The news about Northern Data’s expectations comes amid Bitcoin (BTC) mining giant Core Scientific’s bankruptcy filing. Miners have been facing the brunt of the bear market with high sell pressure.

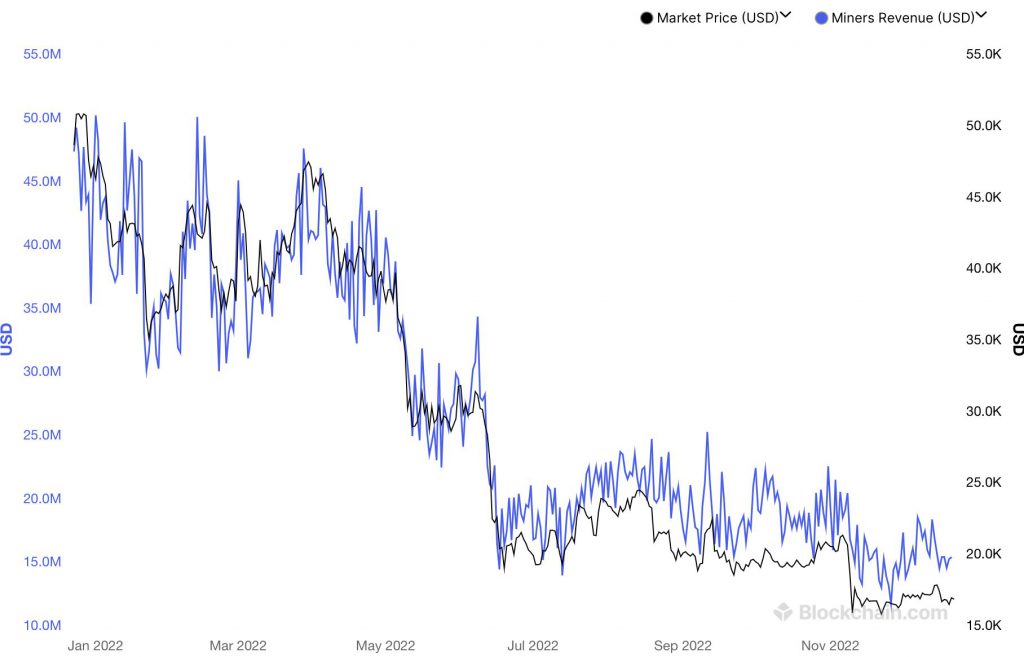

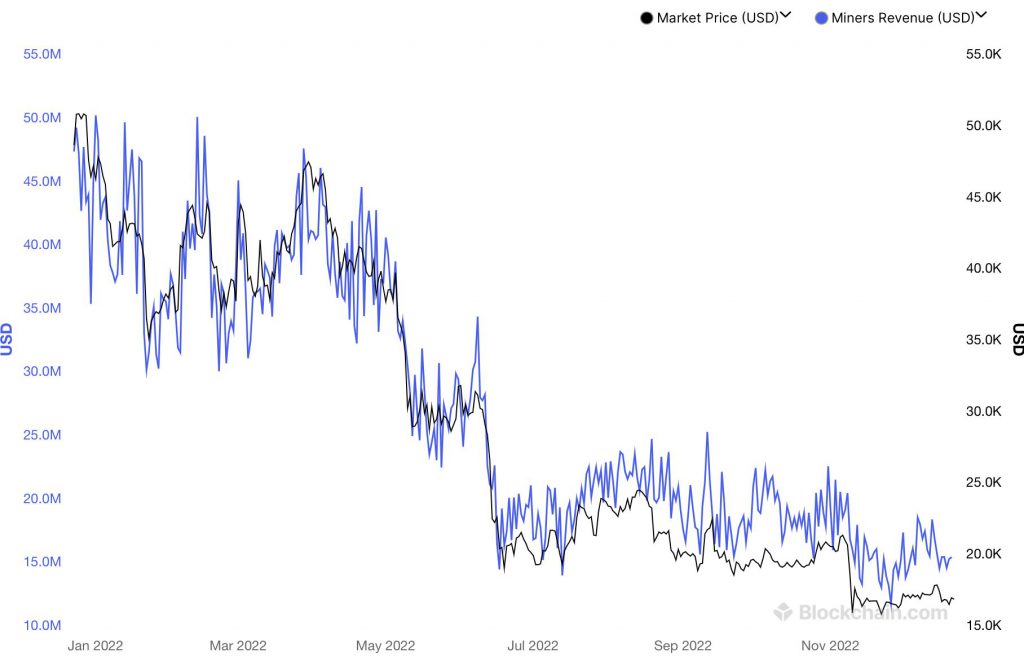

Miner revenue continues to move sideways, with BTC prices moving down.

On the other hand, the hash rate continued to peak every few months, albeit it decreased after peaking in late October.

Earlier this month, network difficulty also reached an all-time high.

At press time, Bitcoin (BTC) was trading at $16,811.31, down by 0.1% in the last 24 hours.