A day back, IMF Chief Kristalina Georgieva warned that 1/3rd of the global economy will be in recession this year. She also cautioned that 2023 will be “tougher” than last year as major economies including the US, EU and China will see their economies slow down. Georgieva added,

“Even in countries that are not in recession, it would feel like a recession for hundreds of millions of people.”

In fact, the probability of another wave of recession hitting the US shores in the next 12 months is 65%.

Also Read – Bitcoin: Will 2019’s Tale Repeat In 2023?

With economic woes deepening, the investor class is looking toward assets that can help them sail through this phase. The past year was quite disappointing. Bitcoin depreciated by more than 60% and wasn’t essentially able to deliver any significant returns.

However, with a recovery initiation expected to unfold in the months to come, can the asset live upto the legacy it has set for itself? Or will investors will have to turn to traditional assets like Gold?

Bitcoin vs. Gold: Head To Head

Prominent Economist Peter Schiff recently chalked out that Gold’s value appreciated by more than $15 to trade above $1840 on Monday. He asserted that the said move was “even more significant” because it was the first trading day of the new year.

Schiff further added that Gold looked “poised” to start 2023 with some “fireworks” of its own. Post giving gold due credit, he did not miss the opportunity to take a dig at Bitcoin. He said,

“Bitcoin is a dud.”

Per data from macro trends, Gold opened at a price of $869.75 in 2009. Throughout the year, its average close price hovered around $973.66. From the said levels, the asset does not even depict a 2x growth at press time. However, Bitcoin has grown multi-fold in the same time period.

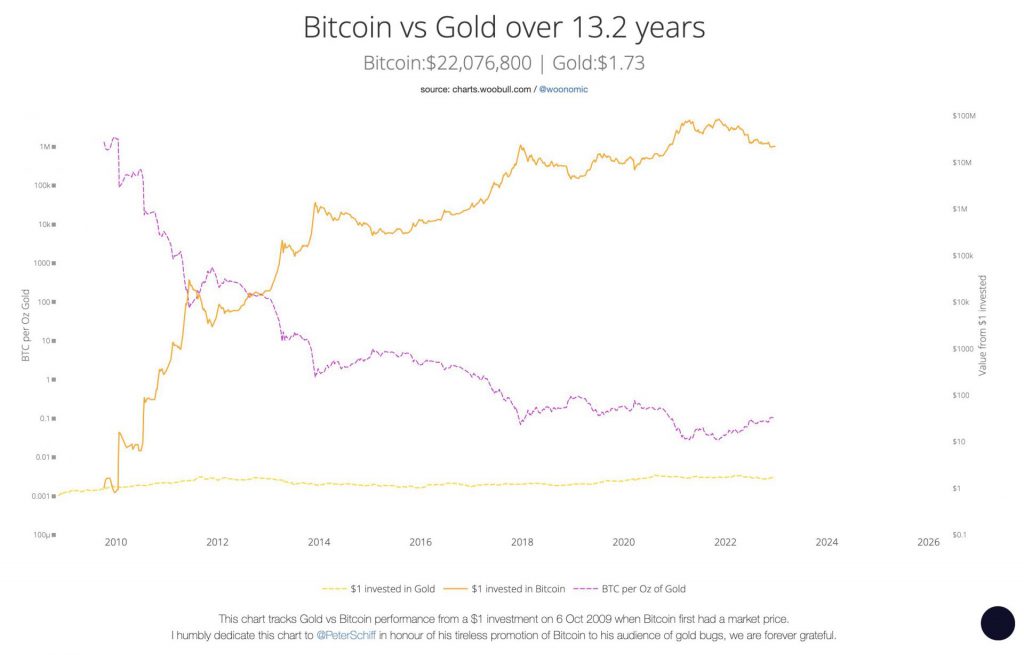

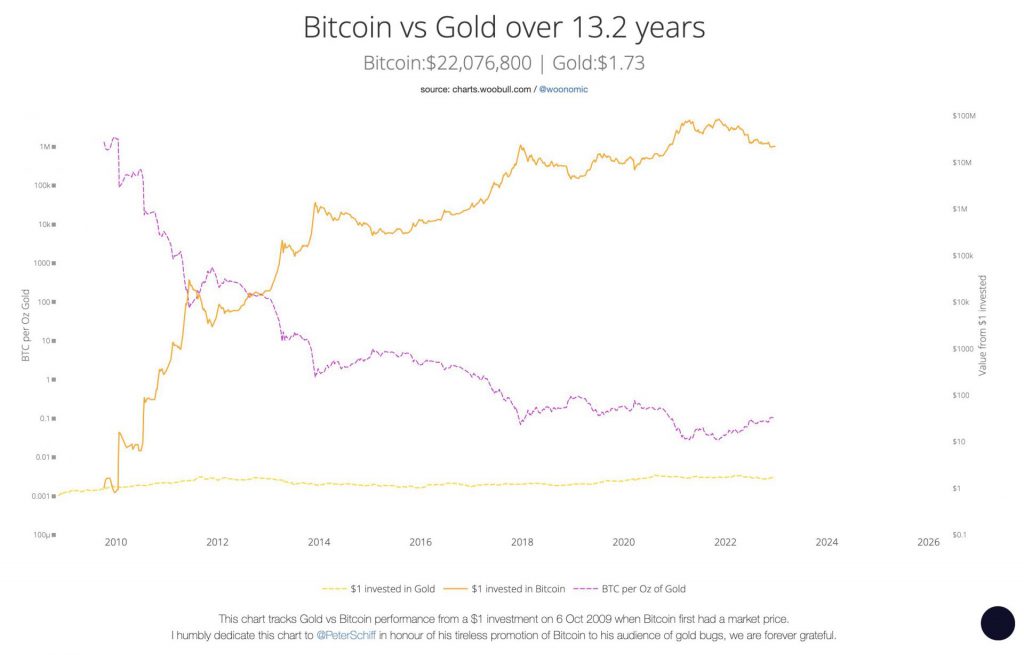

In fact, a recent tweet by Willy Woo showed how the assets fared against each other over the past 13.2 years. As shown below, if $1 was invested in Bitcoin 13.2 years back, it would now be worth $22.076 million. However, the number merely stood around $1.73 for gold.

Several proponents have reaffirmed that inflation is likely to stay. Thus, having a portfolio comprising both traditional and digital assets could be a strong strategy. Tweeting on similar lines, prominent analyst Michaël van de Poppe also supported the idea of having eggs in both baskets this time.