According to data from crypto staking data provider Staking Rewards, Polygon (MATIC) is the top staking asset in the first week of 2023. The firm noted that the network hit an all-time high for its staking balance of $3.55 billion. MATCI’s weekly inflow increased to $127.99 million, accounting for a 4.60% rise.

Polygon (MATIC) is closely followed by Ethereum (ETH), which had an inflow of $122.01 million, a 0.57% increase. The largest Altcoin may be in for a positive scenario as the imminent Shanghai upgrade dominates market attention.

The upgrade which is planned for March 2023, will greatly lower the risk associated with staking ETH. Furthermore, it will give liquidity staking platforms a chance to develop. Hence, as the anticipation grows, some of these protocols’ governance tokens are rallying over the past week.

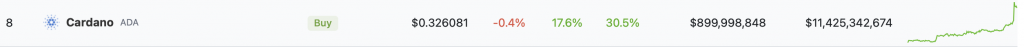

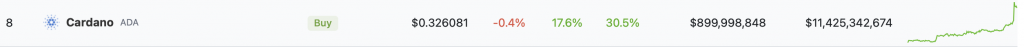

Ethereum (ETH) is followed by Cardano (ADA), with an inflow of $78.20 million, a 1.1% increase. Additionally, Cardano (ADA) is one of the best-performing crypto projects this week, with a 17.6% rally in the last 24 hours, and 30.5% in the last week.

Crypto projects with poor staking performance

Binance Coin (BNB) has the highest outflows at the moment. The exchange’s native token witnessed outflows of $12.61 million, a 0.20% drop. However, BNB is still close to its ATH staking balance. Moreover, the reward rate decreases as the staking balance increase for BNB. Therefore, the reward rate has dropped to an all-time low of 2.4%.

GMX had the second-highest outflow this week. The project witnessed outflows of $6.94 million, a 1.90% decrease. Lastly, GMX is followed by Flow and Radix, which witnessed outflow rates of 0.51% and 1.80%, respectively. At press time, the global crypto market cap stood at $884 Billion, up by 3.1% in the last 24 hours.