The release of CPI numbers last January triggered the drop in the Nasdaq-100 [NDX] index. From the high of 16.5k points, the index reading is currently down to 11k. Evidently, equities’ contagion spread to the crypto market and Bitcoin ended up shaving 60% of its value over the past year.

There are a couple of events lined up for this week. Fed Chair Jerome Powell is set to speak on Tuesday and the CPI numbers are scheduled to be announced at 8.30 am ET on Thursday.

The to-be-released numbers will set the markets’ tone for the coming months. So, should one expect a similar situation like 2021 to pan out this year also or will the tables turn?

Current Projections

Inflation in the US has dropped from its peak over the past few months. The declining energy costs can be credited for the same. The Fed, however, remains concerned that inflation in the service sector is not falling fast enough due to higher wage costs.

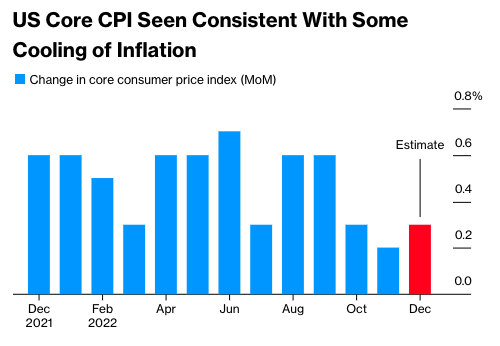

The consumer price index excluding food and energy [core CPI] is projected to have risen 0.3% in December. As illustrated below, the same is slightly higher than in November. However, the estimate is in line with the average for the quarter.

Projecting the macro picture, a recent Bloomberg report stated,

“The Labor Department’s CPI is expected to show core inflation increased 5.7% from a year earlier. That would be the highest December-to-December print since 1981.“

Economists are expecting a 25 basis-point increase in the Fed’s interest rate going forward. Having said that, officials have indicated a half-point hike could also be possible.

Gauging the Sentiment

The overall-market sentiment has been oscillating back and forth of late. Consider this; CBOE’s equity put-call ratio has dropped from December’s peak of 2.4 to 0.9, indicating a bullish flip in sentiment. However, the same might not be all that positive.

CBOE’s put-call ratio is a popular indicator to gauge the macro market sentiment. A high ratio suggests that the market is bearish and that stocks might rebound. Conversely, low numbers suggest that market exuberance could result in a sharp correction.

On social platforms like Twitter, the hashtag “bullish” was trending on Monday, indicative of the collective sentiment and the potential for trend reversal.

Bitcoin’s price has slowly, yet steadily inclined over the past few days. From its 30 December lows, the asset’s price is already up by 5%. As a result, it was trading at the brink of $17.2k at press time.

At this stage, both markets are interdependent. So, if the losses in the equity markets mount, a Bitcoin depreciation could be expected. In such a scenario, the latest rise will prove to be a bull trap and the asset could drop down in the $15.5k to $16.6 range to collect liquidity.

However, if the macro market reacts positively, then Bitcoin would be in a position to continue its gradual incline.