In mid-November 2022, Bitcoin’s market cap dominance dropped down to 35.27%. Post a gradual recovery, the number now stands at ~40%. The market cap dominance reveals the asset’s percentage share in the total crypto circulating market cap. Thus, the higher the percentage, the more dominant and vice versa.

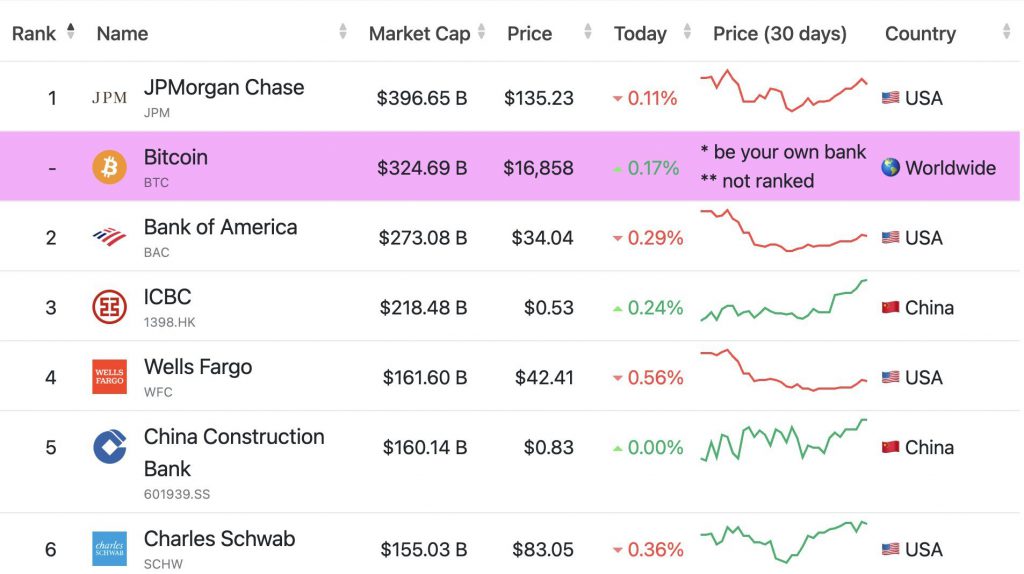

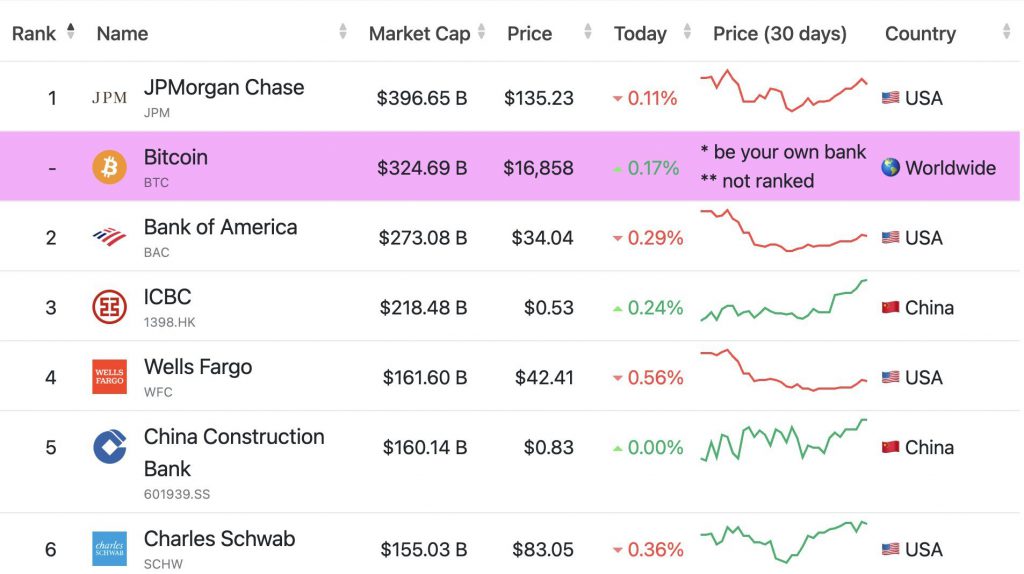

Leaving aside the crypto industry, Bitcoin’s market cap exceeds a host of prominent names from traditional finance. Multinational financial service companies and investment banks like Bank of America, Insurance Corporation of British Columbia [ICBC], and Wells Fargo are currently valued at $273 billion, $218.4 billion, and $161.6 billion respectively.

China Construction Bank, one of the “big four” banks in China, is worth $160.1 billion, while Charles Schwab’s valuation currently stands at $155.03 billion.

Trading at a price of $16.7k at press time, the cumulative worth of Bitcoin stood at $324.6 billion. Only JPMorgan Chase had a higher valuation than Bitcoin. It stood at around $396.6 billion on Friday.

Also Read: Bitcoin: Will 2019’s Tale Repeat In 2023?

Opining on the same, Gabor Gurbacs, VanEck’s Digital Assets Strategy Director, tweeted,

“Bitcoin still exceeds almost all of the world’s top banks by market cap. The future is bright.”

Leaving aside banks, data from Infinite Market Cap revealed that Bitcoin’s aggregate valuation is also higher than the likes of Samsung, Pfizer, Alibaba, Coca-Cola, Pepsico, Reliance Industries, Shell, L’Oréal, Nike, and Toyota.

Also Read: Is Bitcoin More Popular Than Andrew Tate?

Bitcoin Adoption Continues To Rise

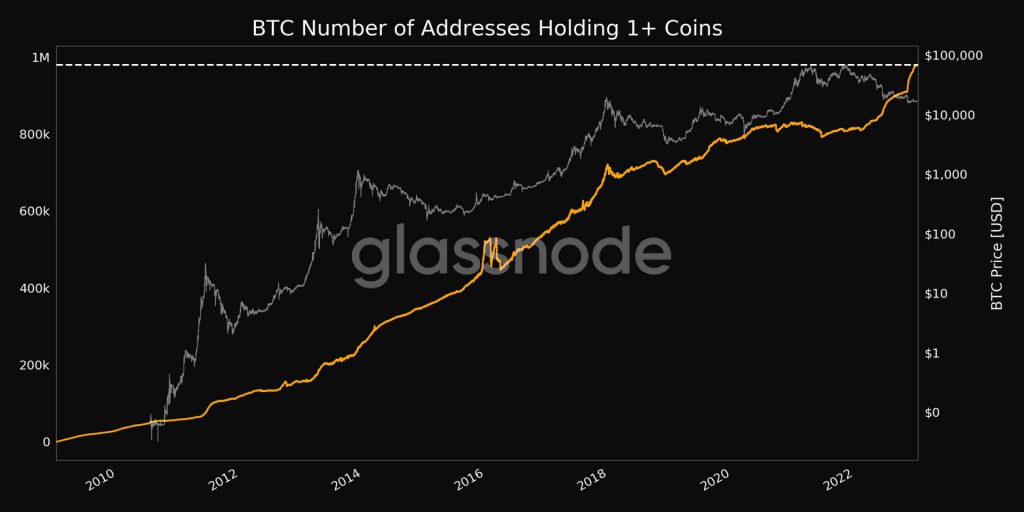

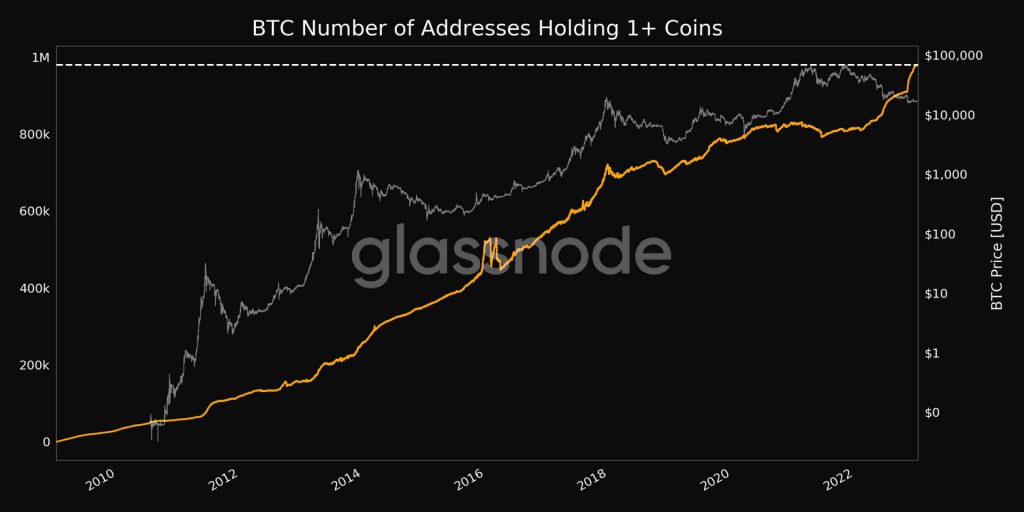

Despite the stagnated price of the asset, market participants have been adding BTC to their wallets. Data from Glassnode revealed that the number of addresses holding more than 1 BTC reached an all-time high of 979,707 on Friday.

As illustrated, the tail of the curve became steeper lately, indicating that investors have been taking advantage of the current discounted price of the asset.

Also Read: Will This ‘Gap’ Pull Bitcoin Down To $9.6k In 2023?