The cryptocurrency market is down on Wednesday as Bitcoin dipped below the $23,000 mark while Ethereum slipped under $1,500. The markets registered a decent rally this month but currently experiencing a slight correction after the price spurt. The markets started 2023 on the front foot delivering good returns to investors who saw constant losses in 2022. Wednesday’s correction is not hurting the markets and seems to be a healthy takedown in the indices.

Also Read: Is Bitcoin’s Next Stop at $25,000?

Why is the Cryptocurrency Market Down?

The cryptocurrency markets are down today because short-term investors appear to be booking profits. Short-term Bitcoin investors sold BTC at $23,000 levels on Wednesday after making decent profits during January’s CPI data-induced rally.

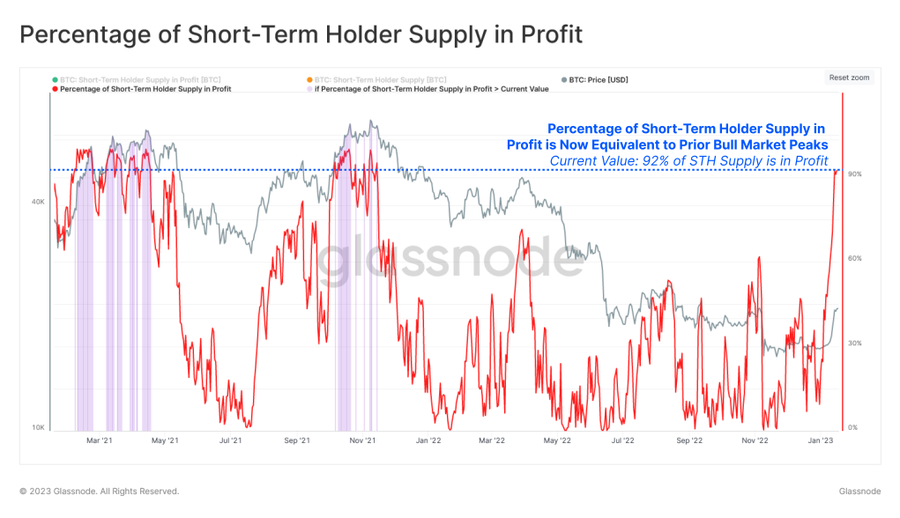

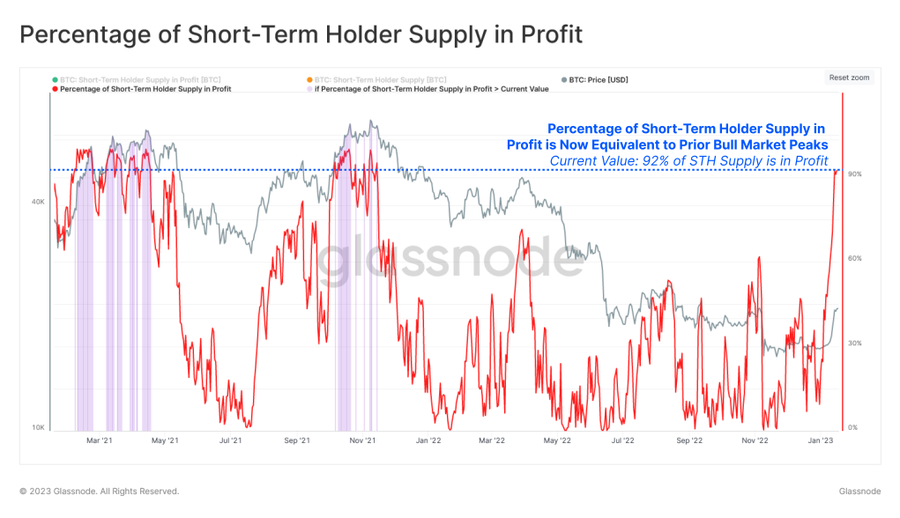

Glassnode noted that the majority of profit bookings came from short-term sellers. “Given this substantial spike in profitability, the probability of sell pressure sourced from short-term holders is likely to grow accordingly. The percentage of STH supply in profit has reached 92%, a level last seen during the May 2021 rounded top, and the Nov 2021 ATH,” noted Glassnode.

Also Read: Bitcoin ‘Excessively Overbought’ After Its $23,000 Climb

In addition to the sell-offs, the overall cryptocurrency markets saw a liquidation of more than $200 million in the last 24 hours.

According to data from Coinglass, 90.29% of these liquidations occurred on traders who took long positions on the market. Total liquidation at press time topped $223.43 million which eventually dragged Bitcoin and the overall markets down.

Leading Altcoins are down more than 5% in the day’s trade after remaining on the positive side for two weeks. However, the markets seem to be taking a healthy correction as the fall is not dramatic. Bitcoin and the larger markets could rebound after the sell-offs and look to climb up further in the indices.

At press time, Bitcoin was trading at $22,620 and is down 2.1% in the 24 hours day trade. BTC is also down 67.2% from its all-time high of $69,044, which it reached in November 2021.