According to analysis firm Dune, NFT (non-fungible token) sales and volumes witnessed a surge yesterday. Both the volume per user and sales per user reached 90-day highs, indicating a rise in market activity. About 106K sales were reported, while 26K users traded around 70K ETH. As per the statistics, the volume was worth $4,470 per user.

Since its Feb. 14 debut, the Blur NFT marketplace has steadily increased its market share. It achieved a staggering 57.3% of all sales, 83.2% of all volume, and 40.2% of all unique users on Feb.16. The launch of $BLUR is likely responsible for this increase in activity.

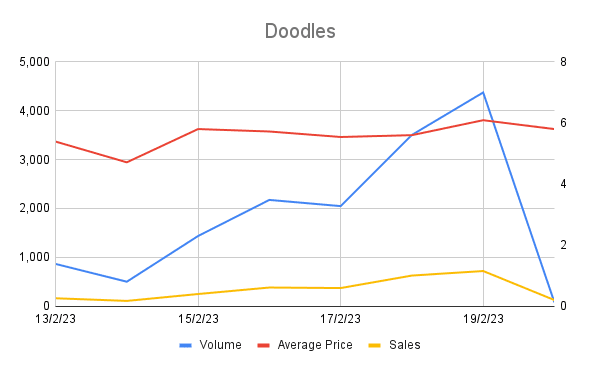

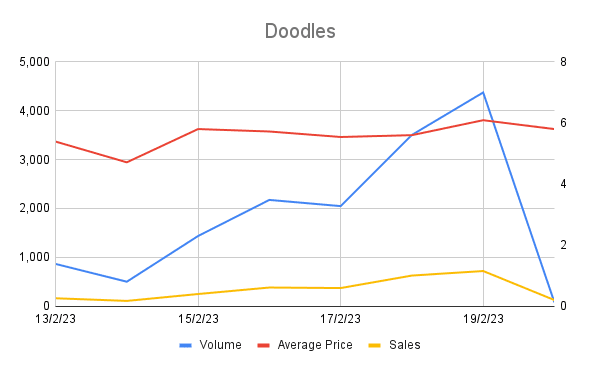

The traded volume for the NFT project Doodles has increased as well. It reported 14.8K ETH (or around $25M) being transacted on OpenSea over the last seven days. On Feb. 19, 718 sales totaling 4.3K ETH were made.

A spike in Doodles sales may be attributed to the project’s purchase of Golden Wolf on Jan. 23. Golden Wolf is an animation company that collaborated with Disney and worked on the well-known animated series Rick & Morty.

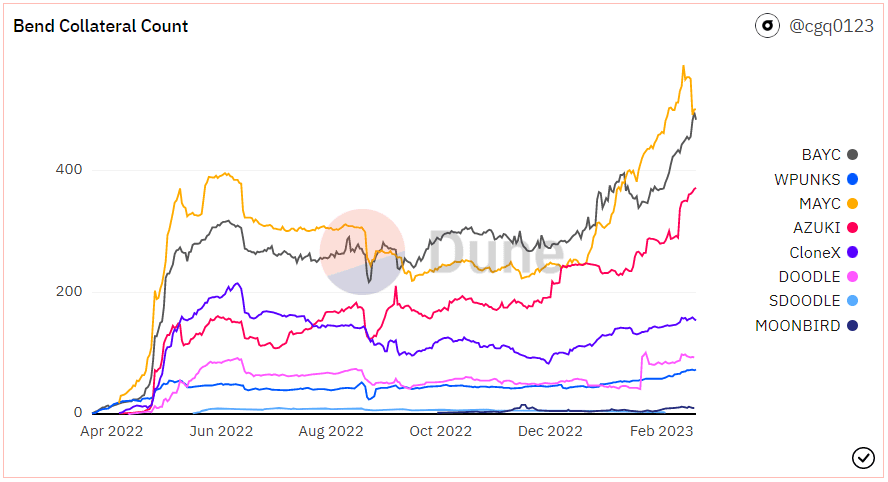

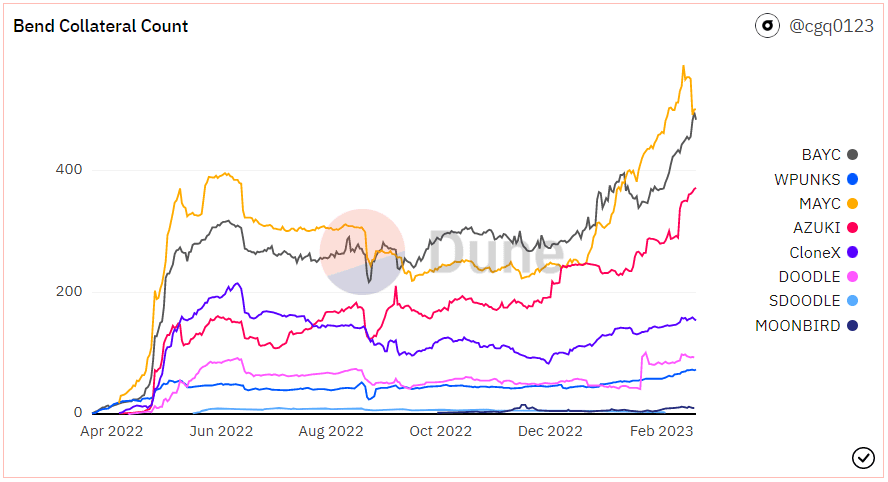

Moreover, after reaching an all-time high of MAYCs (Mutant Ape Yacht Club) on Feb. 13 with 574 NFTs, a batch of 59 Mutant Ape Yacht Club (MAYC) NFTs were removed from the BendDAO collateral on Feb. 18.

Additionally, with a total of 156K ETH in deposited and borrowed TVL, the BendDAO collateral now holds a variety of NFTs, including 489 BAYCs, 372 Azukis, 156 CloneXs, 86 Doodles, and 73 Cryptopunks, among others.

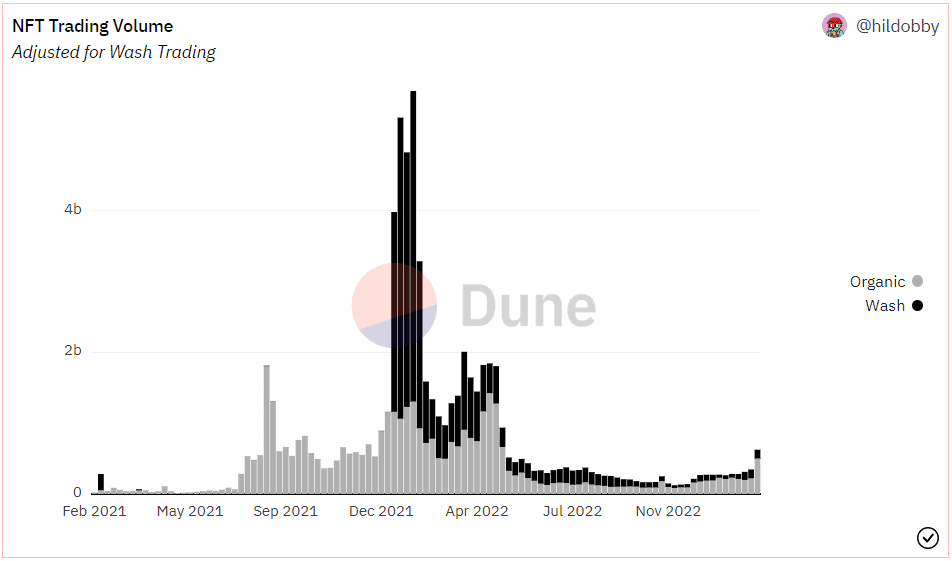

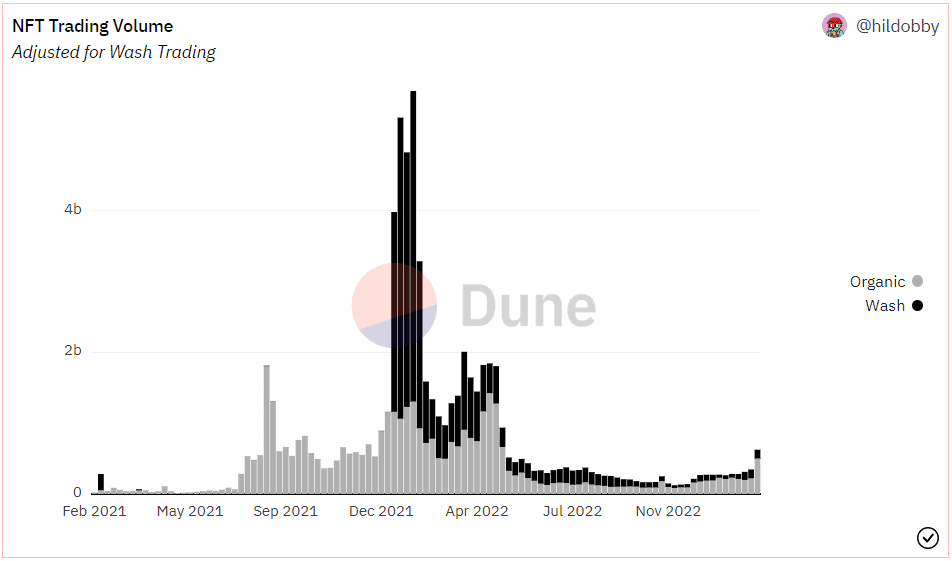

Wash trading still prevalent in the NFT space?

Although the spike in NFT trading was welcomed, the Ethereum market did see a rise in suspected wash trading. Compared to the prior week, which saw $124M from 5,738 trades, a total of $123M from 6,784 trades was thought to be wash trades. Moreover, this development raises questions since it might lead to market manipulation.