Of late, a few dormant Ethereum addresses have been moving tokens. A recent tweet by on-chain smart money tracking platform Lookonchain revealed that an address that had been inactive for more than five years recently transferred out 10,266 Ether tokens worth around $16 million.

Furthermore, the platform revealed that the said tokens were obtained via mining back in 2017. For context, miners used to be granted rewards for mining blocks on the Ethereum blockchain until mid-September last year. However, as a part of Ethereum’s shift to the Proof of Stake [PoS] consensus mechanism, these stakeholders were eliminated from the equation and validators took their place.

Among all the tokens sent out by the said dormant address, ETH worth $2 million [i.e.1322 tokens] were transferred to the Poloniex exchange. The said action likely indicates that the holder is perhaps cashing out and booking profits at this stage.

Also Read: Voyager Freshly Dumps 300 Billion Shiba Inu, 4000 Ethereum Tokens

Crypto lending firm Voyager has parallelly been on a dumping spree lately. In a recent article, Watcher Guru highlighted that Voyager is currently selling its assets at a rate of $100 million per week. Towards the end of the last week, the lender transferred 4000 ETH tokens worth $6.6 million to Coinbase.

The bigger picture

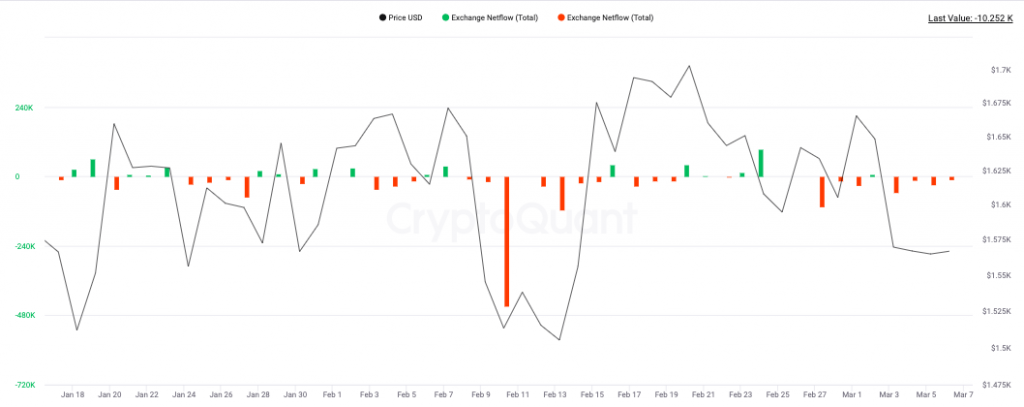

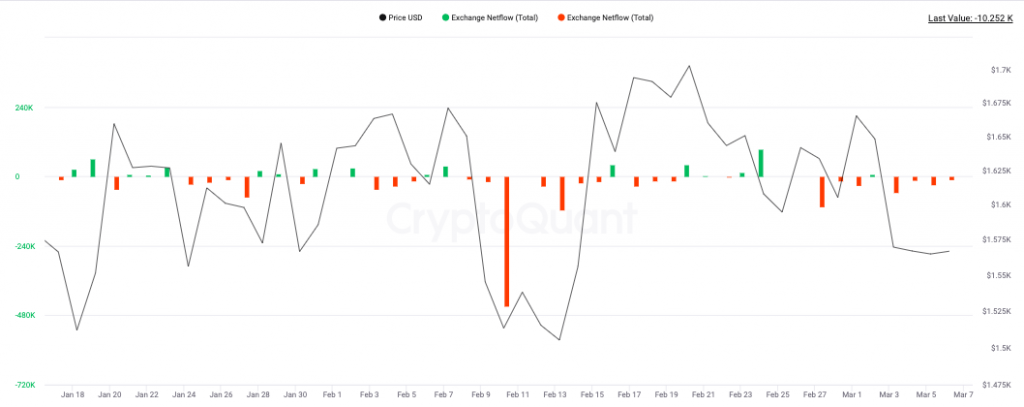

On the whole, participants seem to be staying away from the market for now. The net-flows have seen no major inflow/outflow spike. Conventionally, high values indicate increasing selling pressure and low values bring to light the improving buying intent of traders and investors. Thus, the current monotonous state of this metric indicates that market participants are waiting for a clear directional bias to transpire before re-stepping into the market.

Ethereum’s price has been on the downfall of late. Over the past day, it has peeled around 1% of its value. Over the past week, on the other hand, its price has depreciated by 5%. At press time on Monday, the largest Altcoin was trading at $1566.

Also Read – DeFi: After $766M Bitcoin, Ethereum Loss, Babel Plans to Launch ‘Recovery Coin’