Crypto lending firm Voyager has been on a dumping spree lately. In a recent article, Watcher Guru highlighted that Voyager is currently selling its assets at a rate of $100 million per week. Additionally, it was revealed that it currently holds almost $700 million in two “very large wallets.”

A recent tweet from Peckshield revealed that Voyager might be still offloading. According to the blockchain security and analysis company, Voyager has transferred 4000 ETH tokens worth $6.6 million, 300 billion Shiba Inu tokens worth $3.7 million, and 5 million Voyager tokens worth $2 million to Coinbase over the past day.

Bringing to light the involvement of a dormant address this time, PeckShield’s tweet highlighted,

“Before transferring out, Voyager received 68B SHIB (~820k) from a dormant address 0x31FC. The address had received 68B SHIB 2 years ago (~$528 at the time of transfer).”

Also Read: Voyager Sends 250 Billion Shiba Inu Tokens to Coinbase Worth $3.4M

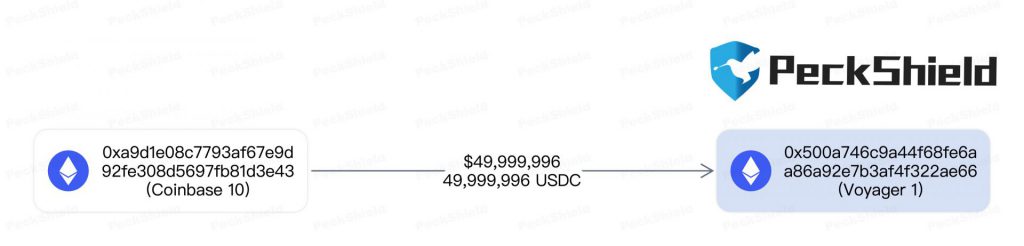

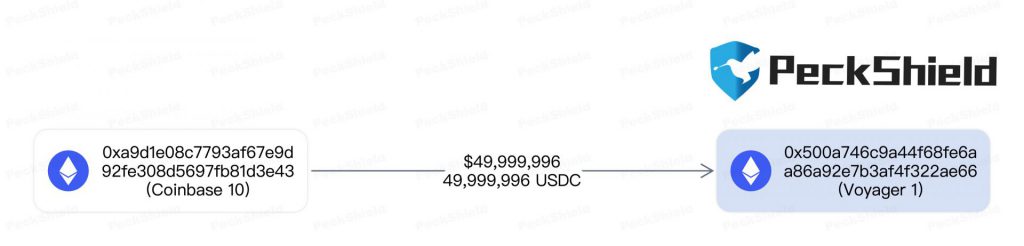

In another subsequent tweet, the blockchain security platform revealed that an address labeled Voyager received 50 million USDC tokens from Coinbase within the last 8 hours. The inflow likely points toward the amount received by Voyager from the sale of assets.

Also Read: Binance.US & Voyager’s $1B Deal Opposed by SEC

As pointed out recently, the firm has received about $150 million worth of USDC from Coinbase over the past few days. Furthermore, it is worth noting that Voyager’s aggregate deposits to exchanges sum up to $121 million since Mar. 1. The broker has transferred approximately $54 million in cryptocurrency to exchanges including Coinbase and Binance.US over the past week alone. It sent at least $24.7 million of Ethereum, $12.2 million of Shiba Inu, and $2.5 million worth of Chainlink.

Also Read: Voyager Dumps Shiba Inu, Ethereum: Selling $100M Assets Weekly

Is there a pattern to Voyager’s actions?

Since the selling has been happening for a while, it can be speculated that the firm is in dire need of liquidity. Its $1 billion deal with Binance U.S. has been garnering opposition from regulators. Thus, it can be said that Voyager is doing everything in its capacity at the moment to check the liquidity box.

However, it is worth noting that not all of Voyager’s investments and finance-related decisions have been exemplary. The firm, notably, gave a $654 million loan to Three Arrows Capital last year. That made up around 58% of its loan portfolio. Now, a recent court filing from Tuesday, Feb. 28, pointed out that Voyager did not carry out adequate due diligence. Only one verification call was conducted between the two firms, which lasted for thirty minutes to an hour.

The latest filing went on to reveal that Voyager’s due diligence team did not ask 3AC if it was profitable; how it computed its NAV, the extent to which its NAV had changed up or down over any prior period of time; the proportion of its encumbered, staked, illiquid assets; its net concentration of alt-coins; and the proportion of its VC investments. According to the document,

“The Voyager due diligence team did not have 3AC’s income statements, cash flow statements, or balance sheet. It did not do any stress testing of 3AC’s liquidity. During our interviews, numerous employees involved in due diligence told us that they did not have a background in credit risk evaluation.”

Without proper financial statements, Voyager served 3AC with funds on a platter. So, given that the crypto bull run has yet to begin, the latest sell-off may be a bit reckless. Nevertheless, if it holds on a bit longer, it could possibly benefit from the same.