Following 2022’s downtrend, the cryptocurrency industry was finally getting back on track. The last couple of months has been significantly beneficial for Bitcoin [BTC] and the rest of the market. Whales, in particular, have become significantly active, in comparison to 2022.

Recent data noted that a majority of the largest transactions of 2023 took place in March. Earlier today, a whale reportedly transferred a total of 20,000 BTC worth about $564 million. While transactions of this magnitude are usually beneficial for the king coin’s price, it should be noted that “the big influx of coins” was being moved back into exchanges.

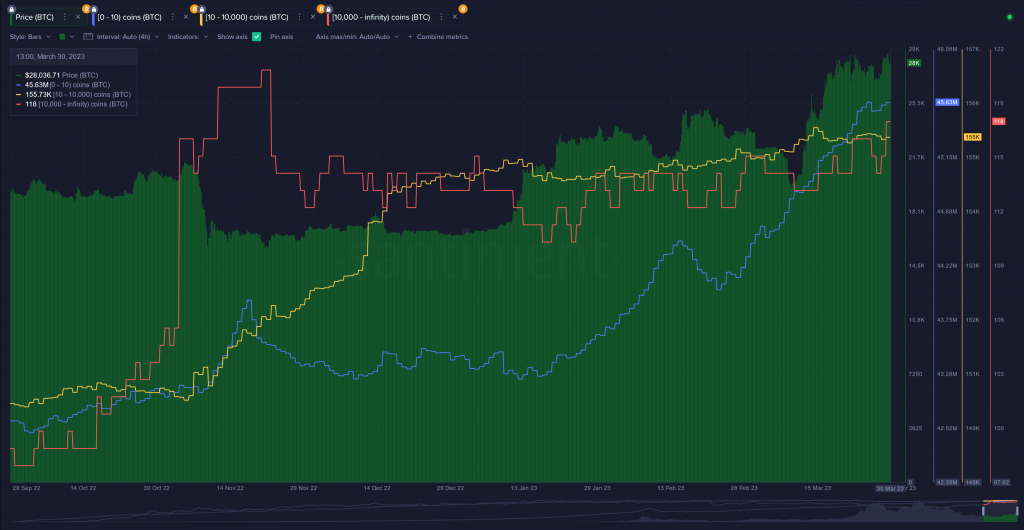

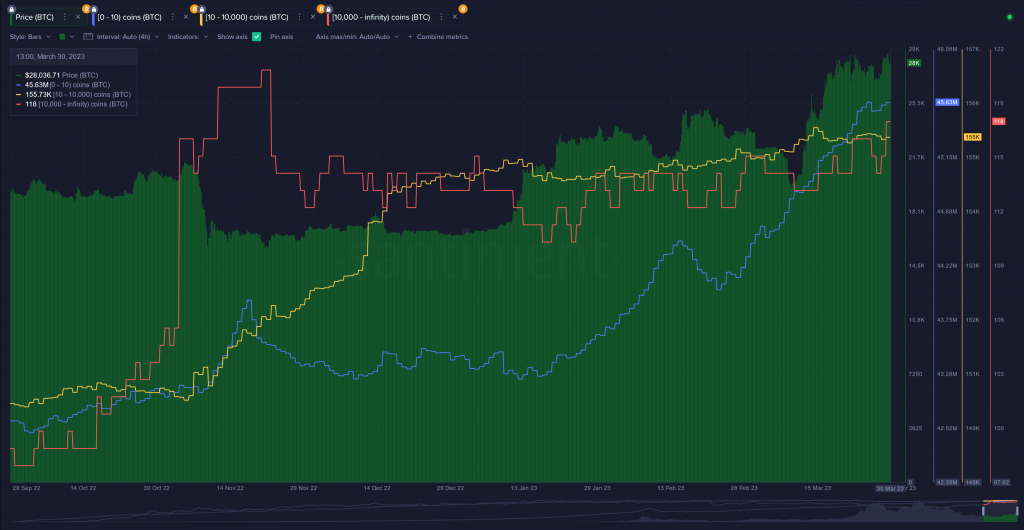

Santiment noted how, it’s encouraging to observe that in March, both the overall number of active sharks and whales [yellow] and the number of dormant whales/exchange addresses [red] are continuously increasing. However, the yellow line—which is presumably the most valuable—is rising considerably more slowly now than it did in November and December when prices were at their lowest points. Further elaborating on the same, the on-chain analytics firm wrote,

“Based on the very large transactions going on in March, as well as the 10-10k BTC address tier continuing to slide down (by percentage) and taper off (by total addresses), it does look like there are some legitimate caution flags to be weary of if you’re hoping to see Bitcoin surge to $35,000 and beyond.”

In addition to these whales, institutions were also seen pouring funds into the market. A recent CoinShares report pointed out that Bitcoin encountered weekly inflows worth $127.5 million. Therefore, the upcoming or ongoing rally is said to be backed by whales, and institutional as well as retail traders.

Is there room for correction in the Bitcoin market?

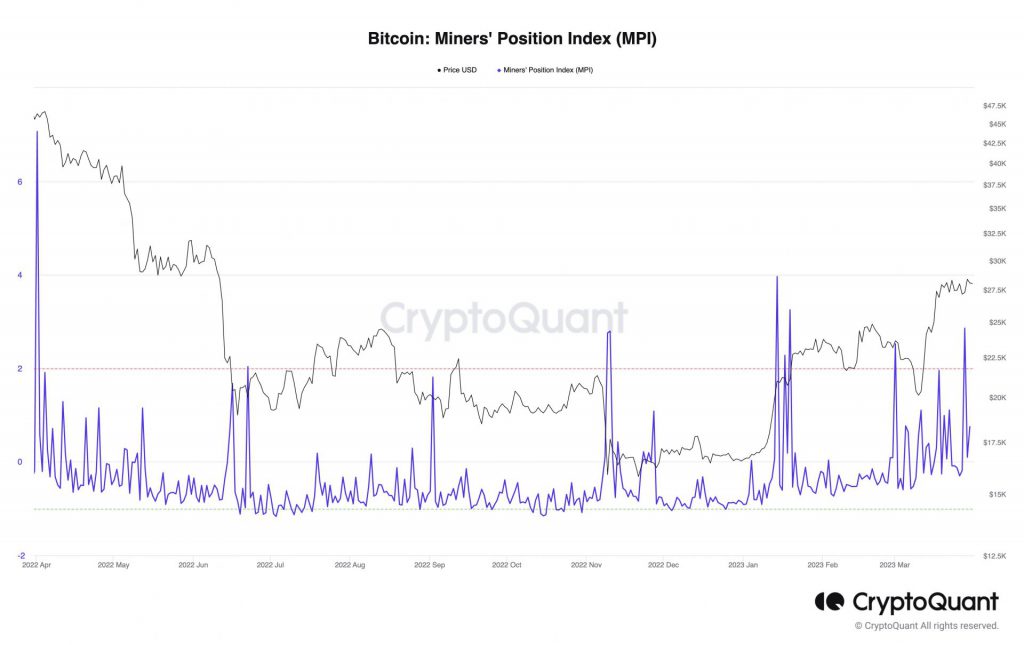

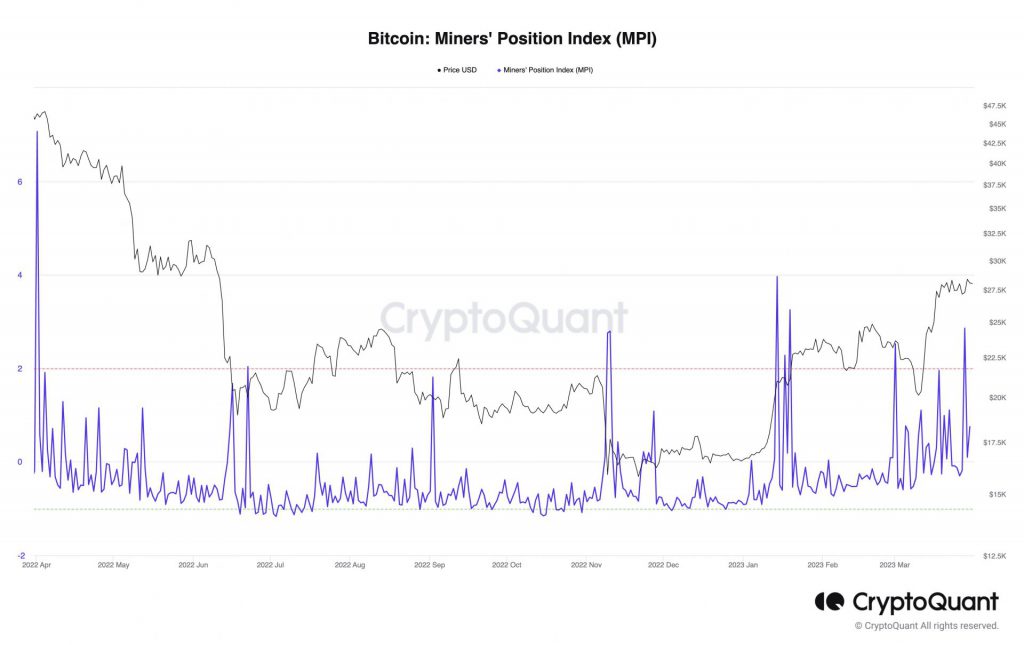

Bitcoin miners were finally out of the 2022 slump. These miners reportedly gained a whopping $718 million in March. This is their highest earning since May 2022. Along with this, the hash rate of Bitcoin surged by 20% since early March. All of this pointed out how miners have remained active in the market.

However, according to data from CryptoQuant, the Miners’ Position Index [MPI] was on the lower end today. This majority highlighted the outflows that the mining space experiences.

While the miner revenue remains high, the fear around increased sell pressure continues to haunt the market. Considering the fact that the fiscal year is coming to an end, the chances of a miner sell-off were strengthened. Therefore, the community is expected to experience slight corrections before another breakout rally.