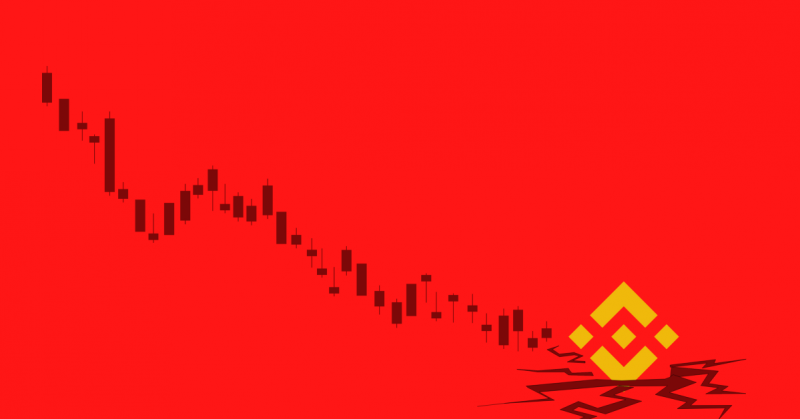

Bitcoin (BTC) and BNB plunged on April 3 after rumors about Binance’s CEO having been served an Interpol Red Notice. The rumors stemmed from a coded tweet from popular cryptocurrency proponent, Cobie. The tweet was in fact just a jumble of letters and numbers. The actual message had been encrypted using SHA-256. For those not aware, SHA-256 is the same cryptographic encryption method used in some of the cryptocurrencies.

Nonetheless, people online began attempting to crack the code. Soon enough the code was broken and it revealed the message “Interpol Red Notice for CZ.” The message spooked the community and led to a plethora of tweets and articles, spreading the rumor and creating a new FUD around Binance.

Popular cryptocurrency researcher, FatManTerra, took to Twitter to explain what happened with the Cobie tweet. According to FatManTerra, hash predictions are a common practice in the crypto community. He said that people post such predictions for two primary reasons. The first is to prove that someone knew something without having to spook the market. Once the event plays out, the string is revealed to show that the person actually did predict it.

The second, FatManTerra said is to chase clout. When a SHA256 hash prediction is made and it is accurate, the string can be revealed, making the author appear to be an absolute genius. However, you can either delete the tweet or completely disregard it if it doesn’t come true.

Nonetheless, in this case, people took it very seriously and Binance’s BNB token and Bitcoin (BTC) paid the price.

Binance FUD proves Cryptocurrency investors are just as trigger-happy as TradFi?

Some believe that cryptocurrency investors are less prone to rumors and dubious hearsay. However, that is not the case it seems. As proven by Cobie’s tweet, people were faster to sell their assets, than they were to verify the rumor. It is understandable that people get spooked and protecting one’s finances should be a primary priority. However, having said that not everything that is posted online is accurate. There should be some amount of research before taking drastic steps

Cryptocurrencies remain more volatile than any other asset. On top of that, such rumors cause mass hysteria among people, especially when it involves the largest exchange in the world by volume.

Moreover, it is possible that people feel that by the time they verify the rumor, it may be too late and their assets will have dwindled in value. It is a legitimate feeling of helplessness that cannot be helped. However, keeping your emotions out of your investments is one of the best abilities one can develop as an investor.