Binance is swarming crypto headlines after the U.S. Commodity Futures Trading Commission [CFTC] decided to slap charges against the CZ-led firm. The CFTC has launched multiple complaints against the exchange and Changpeng Zhao. In the midst of this, a Bernstein study raised the prospect of Binance ceasing operations in the United States.

According to the article, as part of a potential settlement, the CFTC could advise Binance to shut shop in the United States. Analysts Gautam Chhugani and Manas Agrawal further pointed out that this wouldn’t bring down Binance drastically. They believe that the exchange would focus on other regions where its business is thriving. The analysts added,

“[Binance will] safeguard its dominant international business, which is its cash cow, and where it has worked on licenses in Europe, Africa, and Australia.”

In addition to failing to register as a futures commissions merchant, designated contract market, or swap execution facility, the CFTC accuses Binance of breaking laws pertaining to futures offerings, illegal off-exchange commodity options, and other violations of its know-your-customer [KYC] or anti-money laundering [AML] procedures.

It should be further noted that Binance with a trading volume of $11,367,592,076 is the largest exchange in the space. While CZ has called out the CFTC for its latest charges, fear was instilled in the crypto community.

Bitcoin balance on Binance dips by 3.6K BTC

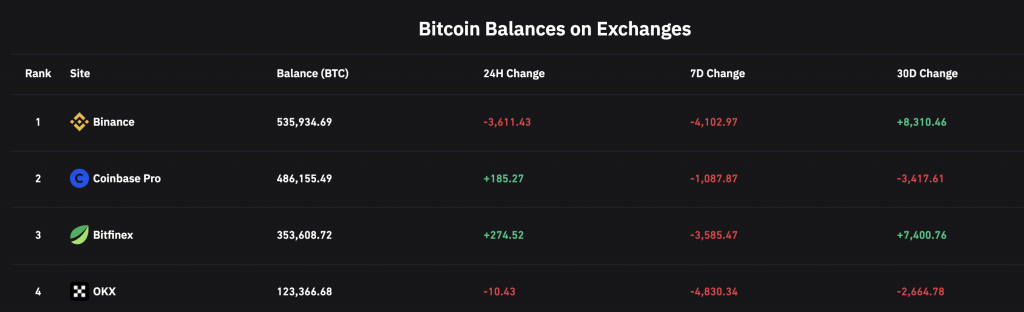

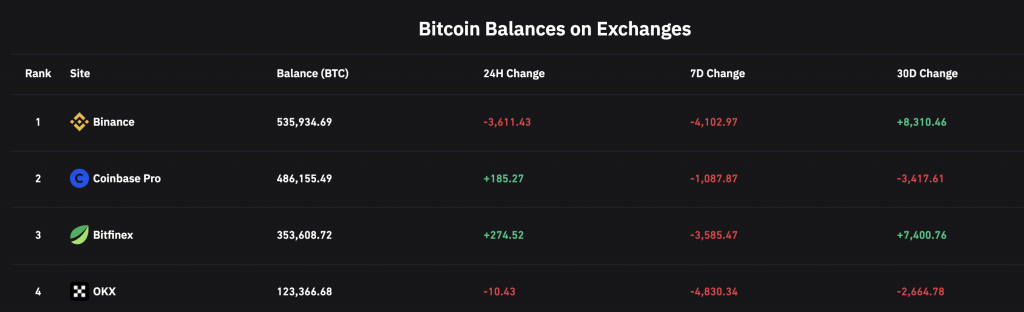

According to data from Coinglass, Binance entails the highest Bitcoin balance when compared to its counterparts. However, following the latest news, the exchange’s BTC balance dipped by over 4,100 over the last seven days.

The previous 24 hours accounted for the outflow of 3,611 BTC. At the moment, there is a total of 535,934.69 BTC on the platform. This wasn’t all. Just before the accusations came to light, about $1.5 billion worth of cryptocurrencies left prominent exchanges like Kraken, Coinbase, Bitfinex, and obviously Binance.

Additionally, CZ-led exchange accounted for $850 million of the aforementioned withdrawals. After the lawsuit was out in public, $240 million was moved out of the exchange. Furthermore, this outflow was attributed to the fear of a potential Binance collapse.