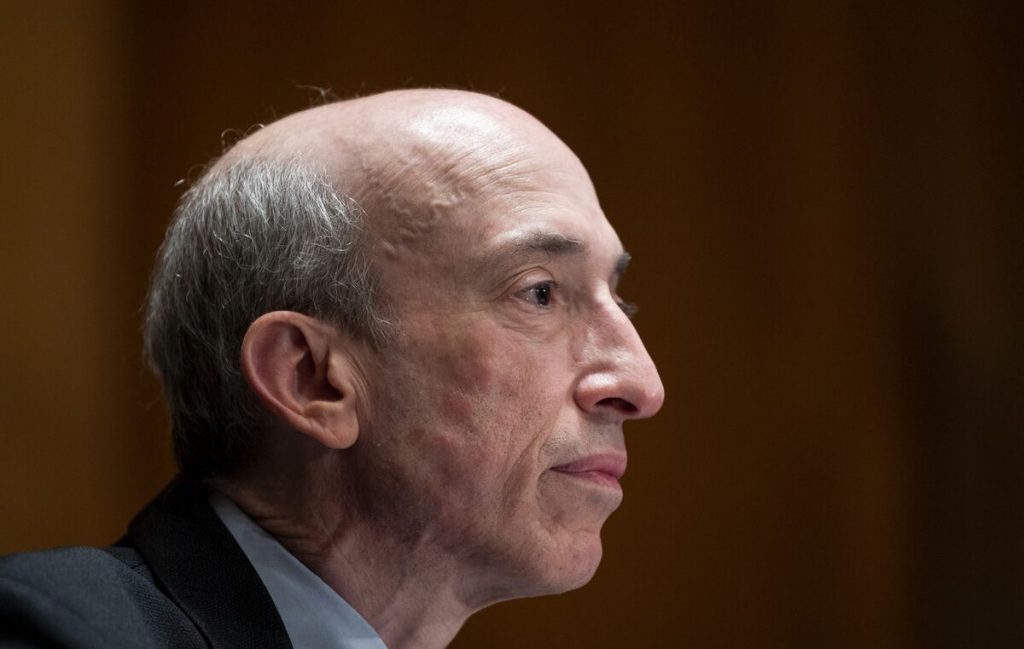

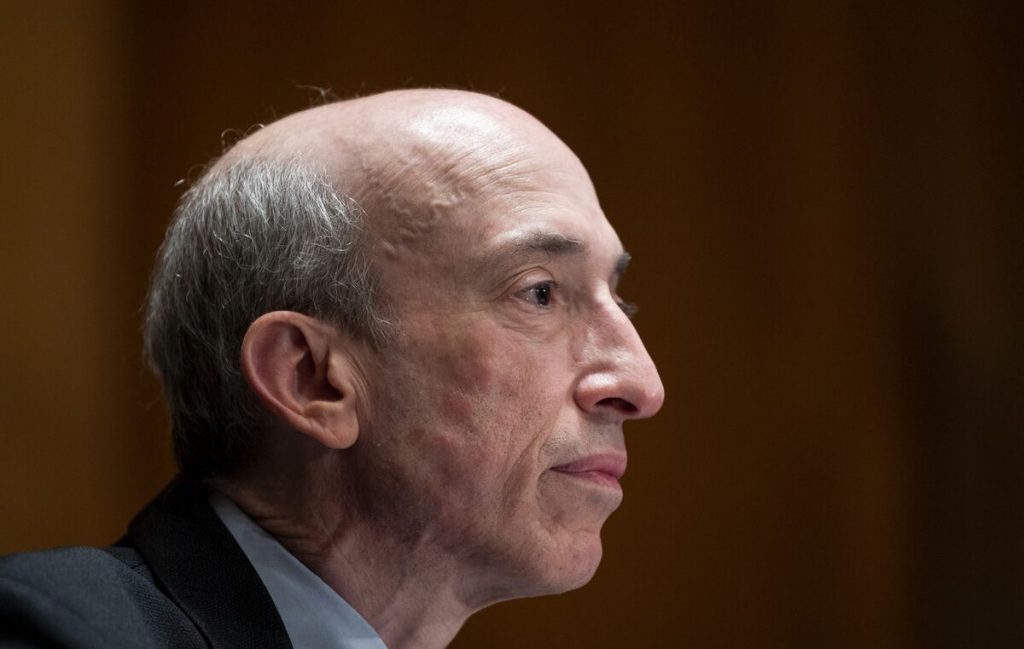

Following his Congressional hearing yesterday, it is clear that SEC Chairman Gary Gensler has no interest in altering his approach to crypto regulation. Moreover, Gensler reiterated that crypto platforms are “a bunch of intermediaries” that must come into compliance with the law.

The hearing concluded with US Congressman Warren Davidson officially presenting legislation to restructure the SEC. Subsequently, the bill would eliminate the position of chair within the agency, replacing it with an executive director that reports directly to the board.

Gensler Standing Firm on Crypto Perspective

In a marathon hearing that took place yesterday, the man behind the US Securities and Exchange Commission’s approach was confronted. Consequently, Congress was not delicate in its assistance with answers to the agency’s actions with regard to regulatory enforcement in the crypto sector.

Yet, despite the contents of the Congressional hearing, it appears that SEC chair Gary Gensler has no interest in altering his approach to crypto regulation. Specifically, amidst the hearing, Gensler affirmed his view on compliance in crypto.

Gensler stated, “We have a whole field in crypto that understands the law, and if they are providing exchange services, broker-dealer services, clearing services of crypto security tokens, they should come into compliance. They don’t have a choice.”

Additionally, the SEC chair remarked, “They’re noncompliant generally, and they need to come into compliance.” Conversely, the SEC chair was faced with clear disapproval from Congress. Specifically, Committee Chairman Rep. Patrick McHenry spoke against these actions.

“You’re punishing digital asset firms for allegedly not adhering to the law when they don’t know it will apply to them,” McHenry stated. However, Gensler affirmed his belief that firms do understand the law. Moreover, he stated his belief that a clear regulatory framework does exist within the industry.

Ultimately, Gensler’s beliefs about his performance do not predict his fate. Subsequently, the House Financial Services Committee will glean from the testimony what it will. Yet, if Davidson’s perspective is shared, it appears as though Gensler’s perspective may not matter.