The BRICS alliance is looking to launch a new currency to settle international trade by sidelining the U.S. dollar. The next summit in South Africa will see the creation of a new tender that could challenge the U.S. dollar. The hegemony of the USD faces an existential crisis as developing countries advance to uproot it from the global reserve status. The new BRICS global currency could gain strength as newer nations accept it to settle cross-border transactions.

Also Read: What Happens if Saudi Arabia Accepts BRICS Currency?

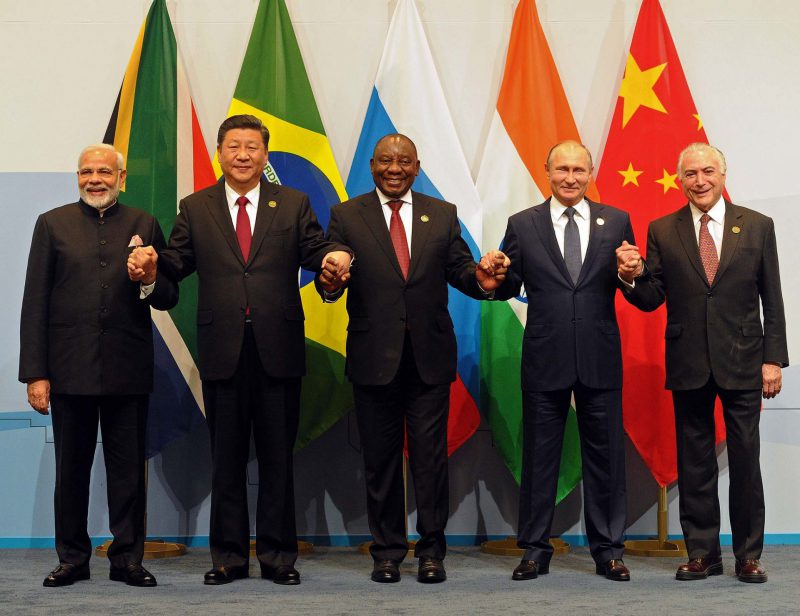

BRICS is an acronym for Brazil, Russia, India, China, and South Africa. So will the U.S. dollar fade into the wilderness if the BRICS currency gains prominence? Well, the answer is not so fast.

BRICS: The Alternative Global Currency

While the U.S. dollar is the de facto and supreme currency, the new BRICS tender might be an alternative payment method. For BRICS currency to survive, it needs to compete with other existing currencies like the Dollar, Euro, Pound, and Yen. It takes years to establish trust in the markets and the new currency will not have it easy.

Also Read: After BRICS, 10 ASEAN Countries Ditch The U.S. Dollar

The majority of the world prefers trading in the U.S. dollar. Only a portion of the global trade could be settled in the new BRICS currency. The United States is the most influential country that commands the top position in the global markets. While other countries could diversify their reserves with gold and BRICS, the U.S. dollar will remain dominant.

In the long run, both the U.S. dollar and BRICS could go hand-in-hand and survive in the global financial markets. There are relatively slim chances for global trade to survive without the backing of the U.S. dollar.

Also Read: Ahead of Joining BRICS, Iraq Issues Ban on U.S. Dollar Transactions

However, the developments indicate that the developing countries are looking to end reliance on the U.S. and begin fresh. In conclusion, this could lead to reduced exposure for the U.S. to dictate financial policy decisions on developing nations.