According to Bank of America (BOA), the U.S. could see a significant fall in its inflation numbers, without the country going into a recession. If things pan out according to the bank, Americans could see a substantial drop in prices.

Analysts at BOA point to the inverted 2-year and 10-year Treasury yield curves to support their argument. The Treasury yield curve is known as a recession indicator. The metric has accurately forecasted numerous downturns most notably in 1990, 2001, and 2008. Short-term yields exceeding those of longer-term bonds have historically been a sign that investors expect a slump. Last week, the gap between the 2-year and 10-year Treasury yields grew to a full percentage point. The inversion is at its sharpest point in more than 40 years.

Also Read: Is Bank of America in Financial Trouble?

But this time, the signal is more indicative of an impending hard landing for inflation than for the overall U.S. economy, according to the BOA. The bank mentioned that the U.S. economy is still averting a sharp decline.

U.S. inflation to reach its 2% target in 2025?

In a recent interview with CNN, BOA CEO, Brian Moynihan said that the U.S. could reach its inflation target of 2% by 2025.

Moynihan stated, “We think it will take all of this year and all of next year and into 2025 before they get inflation in line with their long-term target.”

As per the Fed’s current projections, inflation in 2025 could be around 2.1%, down from the current 4.4%.

Also Read: Turkey’s Central Bank Pushes Interest Rates to 15%

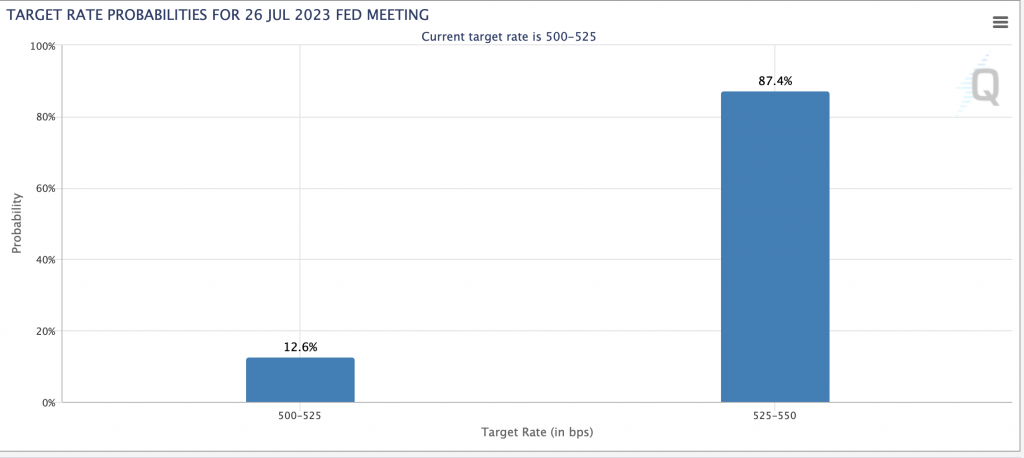

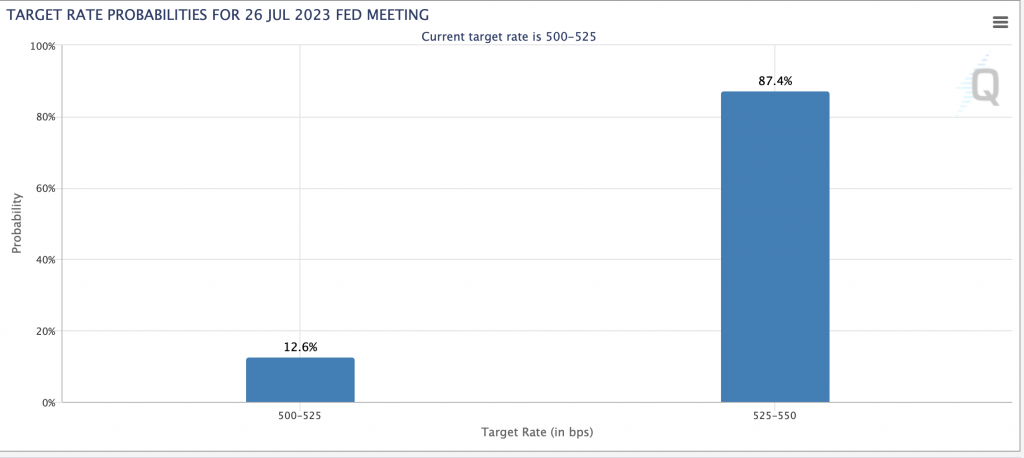

The Fed rapidly increased interest rates to control inflation over the past year. Consequently, investors have been looking out for a potential recession. Currently, rates are at their highest point since 2007. Moreover, the Fed has said that it may increase rates again later this year. The odds that the Fed will increase interest rates by another 25 basis points at its policy meeting in July are at 87%.