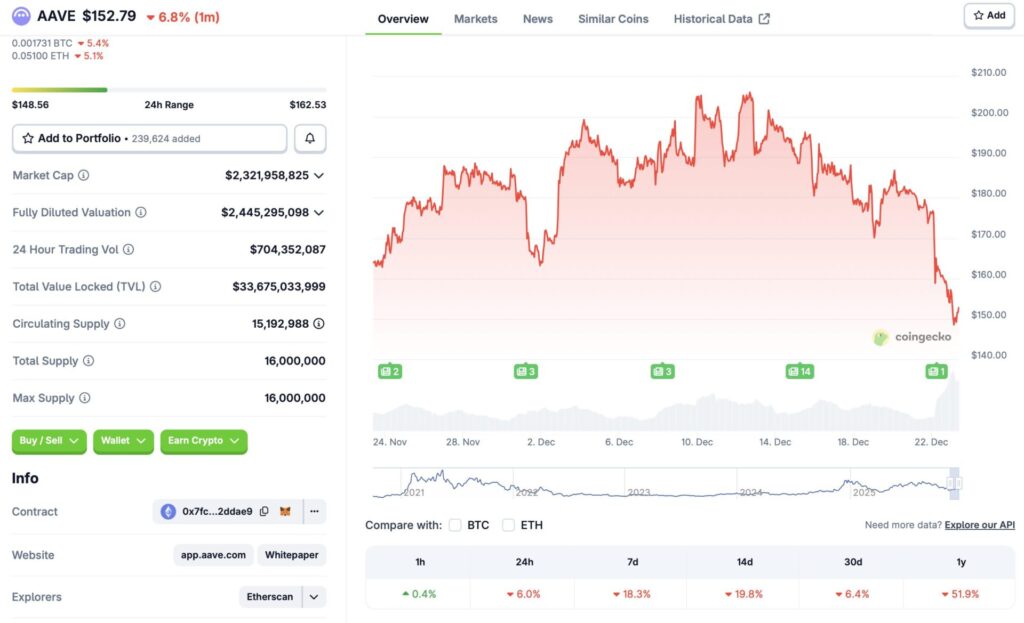

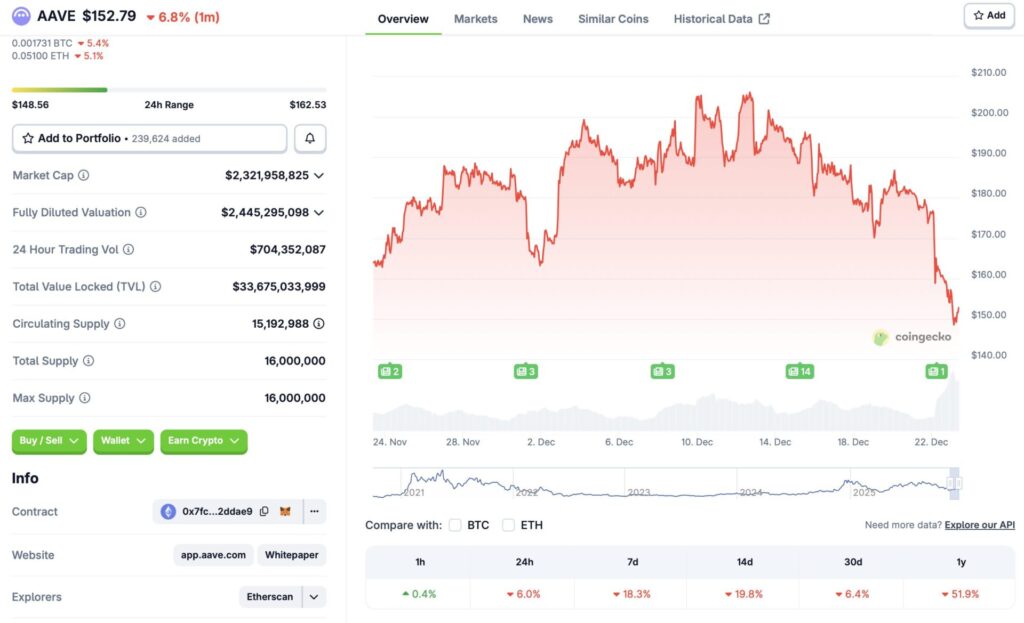

Aave (AAVE) seems to be facing a governance rift amid a price crash. According to Coin Bureau, AAVE faced a 10% price crash after a whale dumped $38 million worth of coins. AAVE’s price has since recovered slightly. According to CoinGecko data, AAVE is down 6% in the last 24 hours, 18.3% in the last week, 19.8% in the 14-day charts, and 6.4% over the previous month. Moreover, the asset has also faced a 51.9% correction since late December 2024. Let’s discuss what’s going on behind the scenes at AAVE, and if the asset will recover soon.

Will AAVE Recover From Its Price Crash?

AAVE’s ongoing downtrend comes amid a larger bear market. Bitcoin (BTC) has fallen below the $88,000 mark, and most other assets are following BTC’s trajectory. Macroeconomic uncertainties most likely led to the market-wide correction. Although the Federal Reserve has rolled out two interest rate cuts since October, investors continue to take a risk-averse approach. The development is strange, given that investors usually take on more risks after interest rate cuts.

AAVE is also going through a power struggle, which may have further added to its woes. The Aave Dao is protesting against Aave Labs for diverting revenue without its permission. The rift between the two groups has led to substantial worry among investors. DeFi protocols should follow a fixed set of rules. Pivoting from the norm could spell disaster for the project.

Also Read: Largest Ethereum Wallets Increase Holdings Despite Weak Price Action

AAVE’s recovery will most likely depend on the larger crypto market. Market participants are staying away from risky assets, and the crypto market will likely not rally unless that sentiment changes. Macroeconomic uncertainties also have to cool down before the crypto market can make a move. Many anticipate the market to rebound in 2026, with many anticipating Bitcoin (BTC) to hit a new all-time high. BTC hitting a new peak could trigger another market-wide rally.