Alt heading: $aUSD: Acala Builds Stablecoin For Polkadot and Kusama Ecosystems

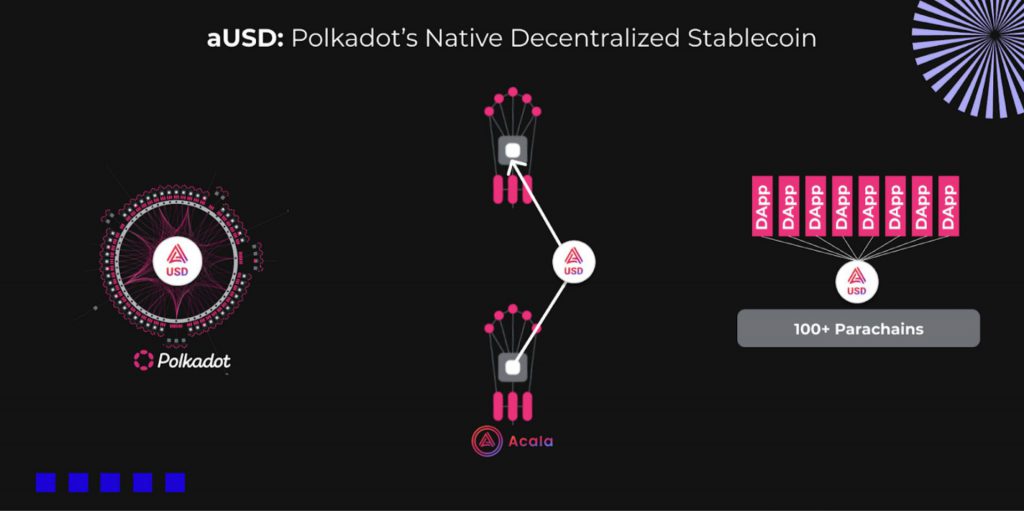

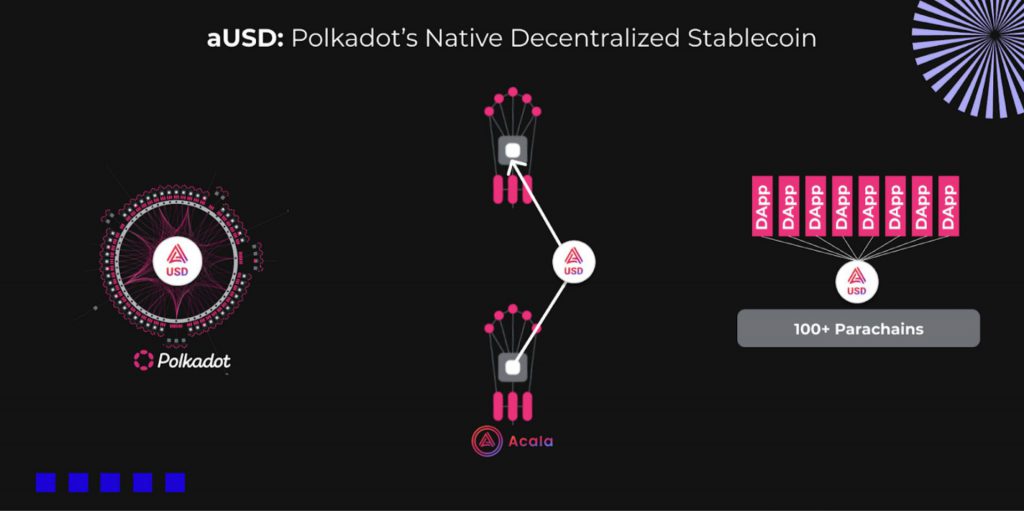

Acala has launched the Acala Dollar, a decentralized, multi-collateral stablecoin. Acala’s Decentralized Monetary Reserve and $aUSD are at the heart of Acala’s DeFi ecosystem and will serve as a stablecoin for the Polkadot and Kusama ecosystems.

After weighing Ethereum, ETH2, Cosmos, and Polkadot, the four Acala co-founders decided to develop on Polkadot.

How the Acala $aUSD functions

The fuel to run the Acala machine is Acala’s fee, governance, and utility token, ACA. ACA gives users the ability to transact on the network, as well as an ownership stake in the network’s on-chain Treasury, voting rights in all governance decisions, and a collateral asset for minting $aUSD.

To establish a stablecoin soft-pegged to the US Dollar, Acala’s stablecoin protocol employs a multi-collateral backing method. The Acala stablecoin protocol functions as a Decentralized Monetary Reserve, minting a stable currency from a pool of reserve assets. This allows consumers to use $aUSD to transact, trade, and conduct services while preserving control of their reserve assets such as ACA, DOT, DOT derivatives, parachain assets, and assets bridged from other consensus networks such as BTC or ETH.

A method known as Collateralized Debt Positions is used to create the aUSD. The value of an aUSD token is fixed to the value of a US Dollar through the aUSD stablecoin protocol on Acala, which includes a set of incentives, supply and demand balancing, and risk management methods. $aUSD also has an on-chain liquidator, which eliminates centralized third-party risk, as well as oracle quality of service, which ensures that oracle price feeds are included in every block. As a result, the $aUSD protocol can manage risk more autonomously and efficiently.

Every CDP stores the collateral assets and associated $aUSD debt position deposited by the user who opened the CDP that created the $aUSD tokens. The CDP’s deposited collateral assets are locked, and the user cannot withdraw them until the corresponding $aUSD obligation is paid off. Active CDPs are always over-collateralized, with the value of the collateral exceeding the debt value. A Stability Fee, or interest, is paid to the protocol as well as liquidity providers (LPs) of $aUSD stablecoin pairings in Acala Swap when a CDP is opened.

The early bootstrapping steps of $aUSD have begun with today’s launch. The stablecoin will first be integrated into all live parachains and DApps in the Polkadot and Kusama ecosystems, after which its liquidity will be built upon the Acala blockchain. The purpose of $aUSD is to be the most useful decentralized stable currency in the Polkadot ecosystem, acting as the default pair, routing asset, and means of exchange for all users and developers.

The launch of the $aUSD will involve three primary events:

1.LCDOT/aUSD Bootstrap on Acala Swap

2.Enabling DOT as a collateral for minting aUSD

3.Enabling LCDOT as a collateral for minting aUSD

The next stages are to enable LCDOT/aUSD trading once the Bootstrap is complete and to start the ACA/$aUSD Bootstrap and trading, as detailed in the governance post.