Short and green, long and green, long and green, short and green – This is typically how the last four daily candles of Ethereum Classic can be characterized. Owing to the rapid northbound movements being made since Friday, this Ethereum forked token had appreciated by almost 50% in the said timeframe.

Despite the bulky short-term hike, Ethereum Classic has miles to go before it even reaches close to its $180 peak registered during last May. With time, the token has been losing its relevancy in the market. In fact, the coin is no more a part of the top 20 list too. Despite reflecting a bloated market cap of $5.2 billion, ETC ranked 29 at the time of press.

Ethereum Classic’s fundamentally weak tale

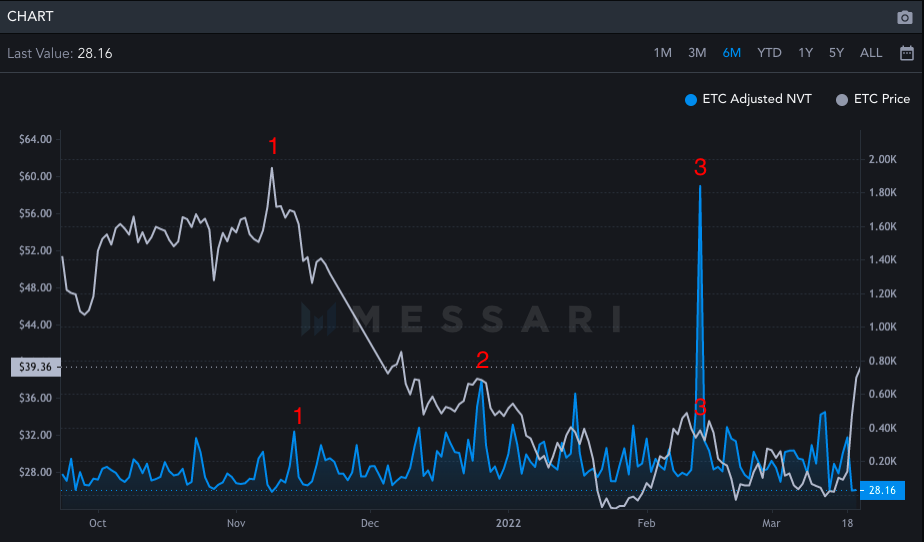

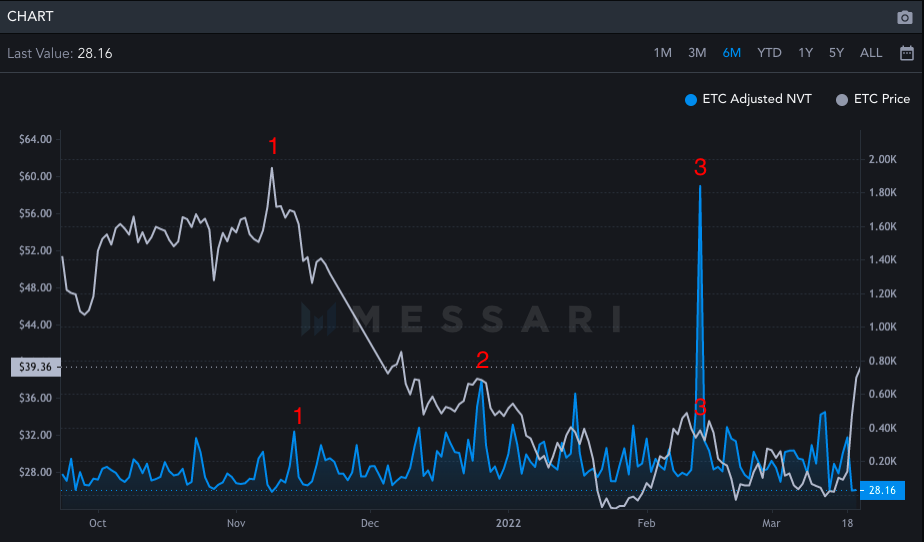

Over the past 6 months, Ethereum Classic’s price pumps have been accompanied by a rise in the Network Value to Transaction [NVT] Ratio. High ratio numbers usually indicate that the network value is outpacing the value being transferred on the network. The same have historically coincided with rally periods for ETC.

As can be seen from the chart below, even though the intensity of the hikes has not been consistent that consistent of late, they’ve more or less moved in tandem in the direction of the price.

However now, despite the rise in price, the value of this metric was hovering around its multi-month low at 28.16 at the time of press, raising questions around the sustainability of ETC’s uptrend.

Would ETH’s transition to PoS change ETC’s fate?

Ethereum’s consensus mechanism transition is on the cards, and the said event might end up becoming a boon for ETC.

ETC’s hashrate on the macro chart has been able to well maintain its uptrend. Of late, the same has been oscillating around 24 H/s. This metric, as such, gauges the total computational power used by a PoW cryptocurrency network to process transactions. A high number is indicative of strong security because it ultimately means that a large number of miners are verifying transactions.

Even though the same has not much to do with the underlying price of the asset, it does have a say in whether or not the project possesses the potential to thrive going forward.

So, when Ethereum’s transition happens, miners would have to leave that landscape and migrate elsewhere. As a result, the Ethereum Classic blockchain could become a considerable option for them.

Thus, it’d be worth keeping an eye on this token and its price movements going forward. In fact, Chinese journalist Colin Wu tweeted something on similar lines recently:

“With the approaching of Ethereum PoW to PoS, ETC may undertake some miners’ hashrate and become an object of capital speculation.”