Losses made over the weekend have dragged Dogecoin to an important support zone but chances of a temporary rally do not look promising. A drop in daily active addresses and negligible assistance from whales even threatened another sell-off if DOGE closed below $0.12 this week.

Dogecoin has struggled to maintain momentum ever since a 17% jump on 5 April, which came right after ‘Doge’ father Elon Musk’s 9.2% stake in Twitter became common knowledge. The situation worsened last week, with DOGE recording 5 red candles in seven days of trade.

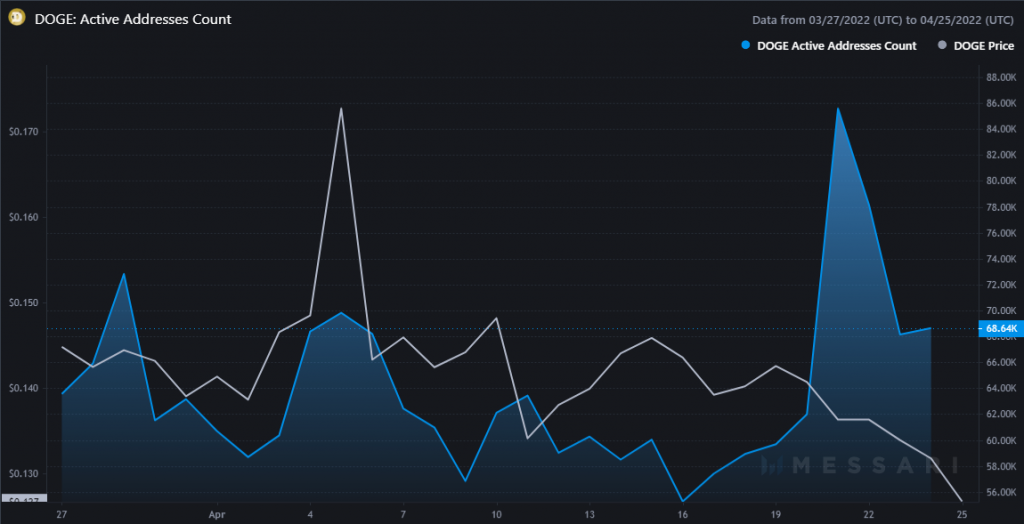

These losses have dragged DOGE to $0.126-0.12 support for the first time in over a month and while a minor uptrend is technically possible, DOGE’s on-chain metrics were a concern. For one, a large drop in daily active addresses showed that investors were not keen on engaging with their DOGE coins, given the current market situation. Between 21-25 April, the daily active address fell by 20% and were yet to recover.

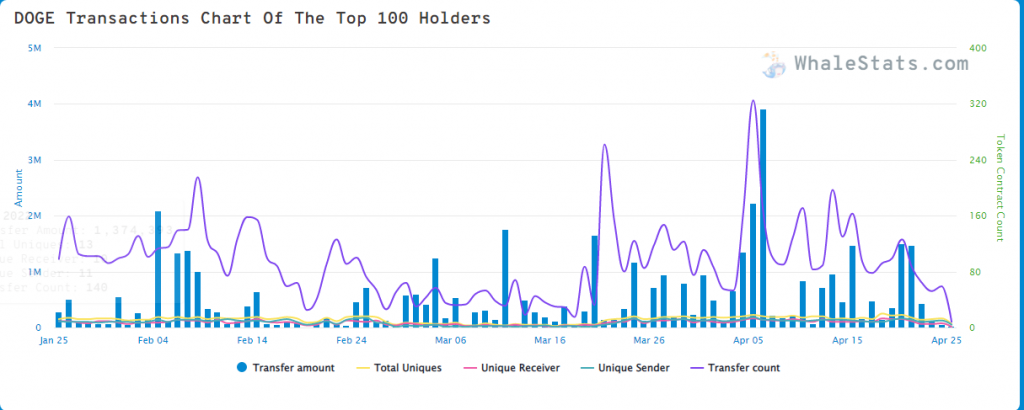

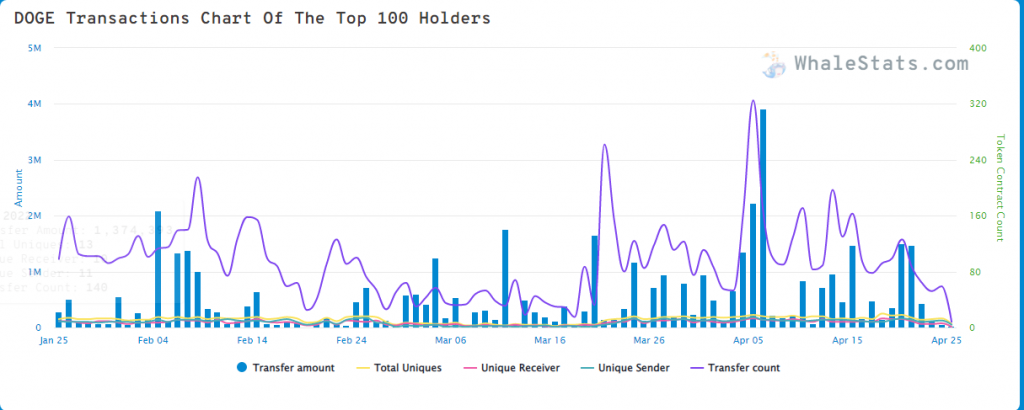

While whales usually step up their presence during market corrections and help with temporary rallies, it was not the case this time around. Top Ethereum whales, who hold a chunk of DOGE’s supply, were not adding any more coins to their portfolio. Data from Whalestats showed that DOGE transactions of the top 100 ETH whales were down to their lowest since late January.

Dogecoin Daily Chart

With minimal support from large investors, an attempt at a temporary rally would be rather difficult. On the other hand, DOGE would do well to even sustain its value above $0.12. The price just fell below its 50-SMA (yellow), which meant that another sell-off could be possible this week.

Hence, DOGE below $0.12 could be less risky than any long setups. More specifically, short positions can be opened at $0.12 and exited at $0.1097. A stop-loss can be maintained at $0.1330. The trade setup carried a 0.89 risk/reward ratio.