Despite the macro-landscape chaos, crypto-centric investment products have been able to maintain their ‘inflow streak‘ over the past few weeks. Bitcoin had been noting positive flows for the past five weeks, and the flows noted last week upgraded that number to six.

Ethereum, on the other hand, broke its 9-week spell of outflows with inflows in the second week of February but registered outflows worth $15 million in the subsequent week. Nonetheless in the week that ended on 28 February, ETH was back on the rails and noted a positive flow of $4.2 million.

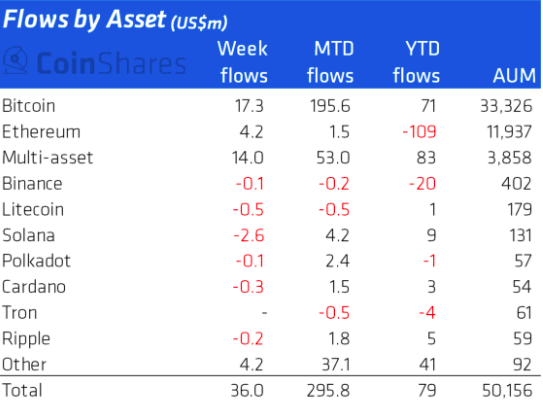

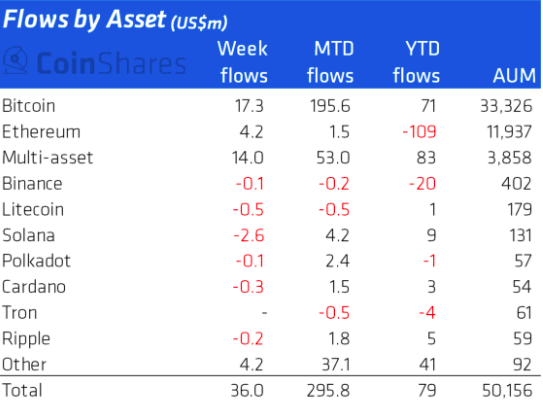

As illustrated by CoinShares’ table attached below, no other major alt—may it be Litecoin, Solana, Polkadot, Ripple, or Cardano—witnessed inflows last week.

Institutional box ticked by Ethereum, but what about the rest?

Well, Ethereum’s broader landscape looks pretty in-tact at the moment. The number of addresses HODLing more than 0.01 coins just reached an ATH of 21,942,028 a few hours back. Parallelly, the non-zero addresses also registered peaked at 76,102,939 earlier during the day.

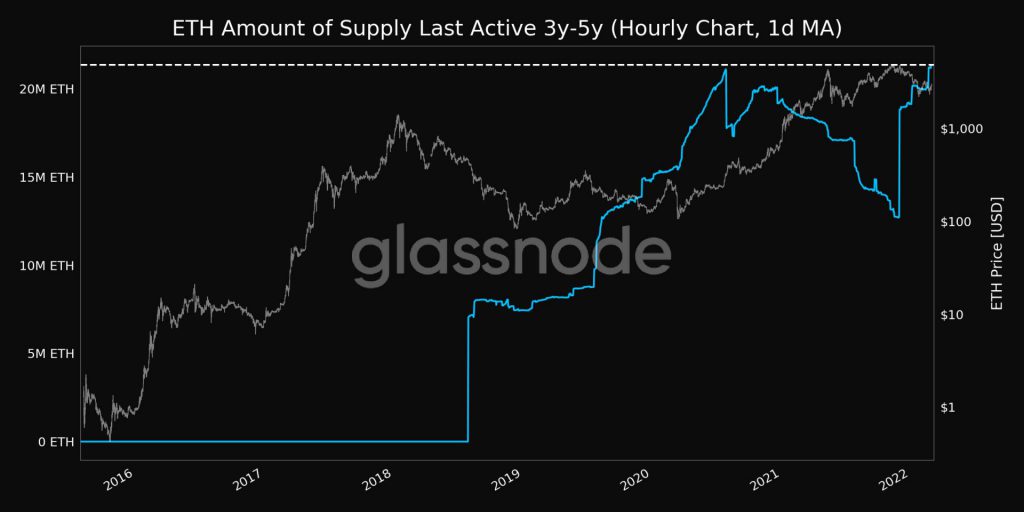

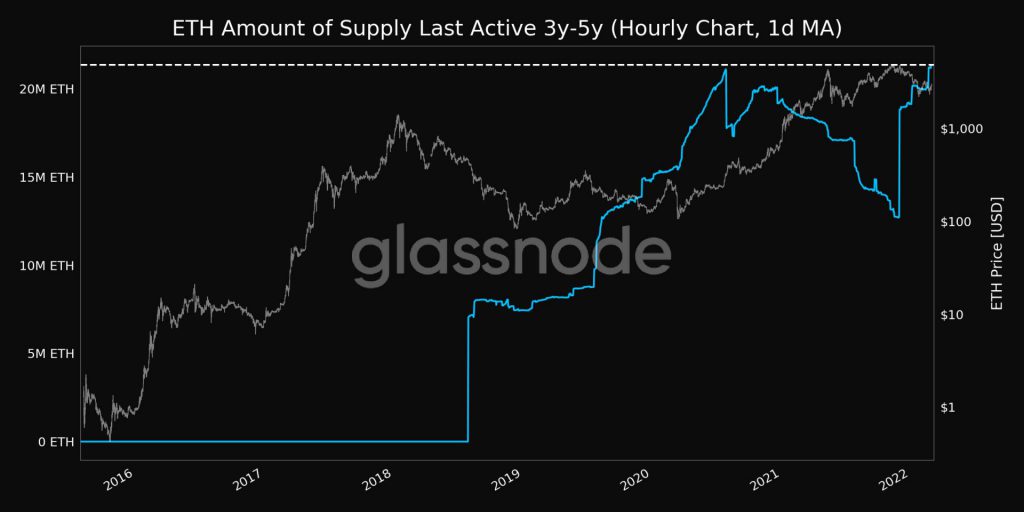

Alongside, long-term HODLers too have been clinging onto their tokens despite the trembly state of the market. As evidenced by Glassnode’s chart attached below, the circulating supply last moved between 3 years to 5 years ago is currently at its yearly highs of 21,353,007.943 ETH.

What about other big players?

Whales, at this point, have been in action as well. Consider this – Prominent BNB whale “Light” just bought 380 and 372 ETH tokens [worth 1,140,241 and $1,113,898 respectively] in two separate transactions over the past few hours.

What’s more, Glassnode’s data also outlined that the number of HODLers possessing more than 100 ETH also reached a 1-month high of 42,573 during the late hours of Monday.

Thus, with market participants all across the board taking advantage of the macro-dip and re-filling their bags, and HODLers not abandoning their tokens, Ethereum’s prospects do seem to be in safe hands at the moment.