Owing to the inertness in the broader market, most large-cap tokens had moved up/down only in the 0.01% – 2% range over the past day. Dogecoin and Cardano were the only exceptions from the top 30 and had slid up by 8% and 3% respectively in the past 24-hours.

Dogecoin’s pump was not out of the blue. It was typically catalyst-driven. Right after the news about Elon Musk owing a 9.32% share in Twitter broke, this token glided up on the charts, the reason being the community’s expectations of the launch of the Dogecoin tip jar on the app.

What about Cardano then?

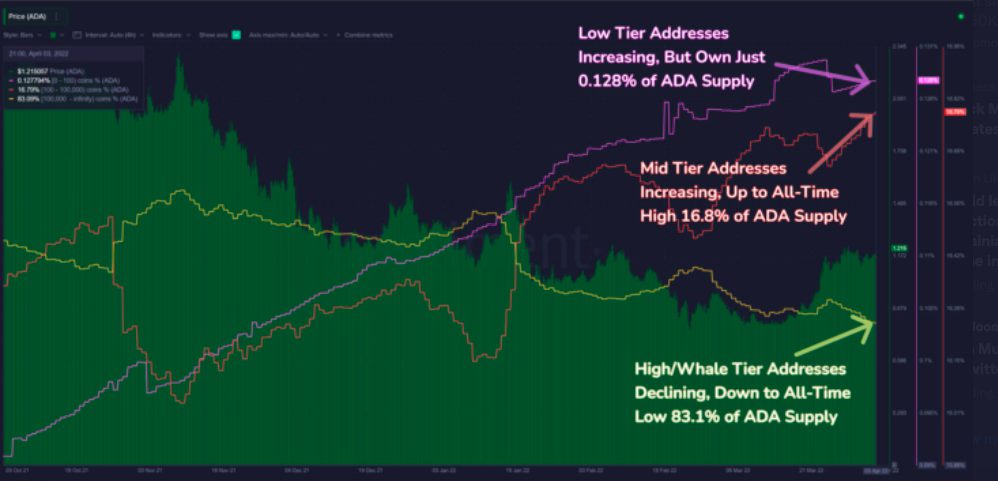

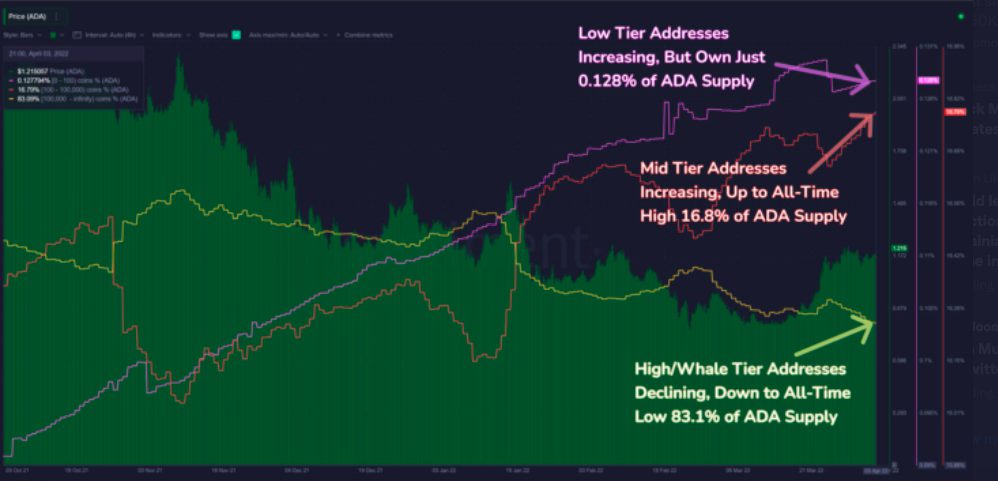

Unlike Doge’s hype rally, Cardano’s rise on the charts has been organically driven by market participants. Retail participants have been accumulating and currently, HODL has an ATH supply of 17%. Outlining the same, Santiment’s latest tweet noted,

“The low-mid and high-mid tiers are the group accumulating consistently, and these 100 to 100k $ADA holders now own their AllTimeHigh of 16.8% of the available supply.”

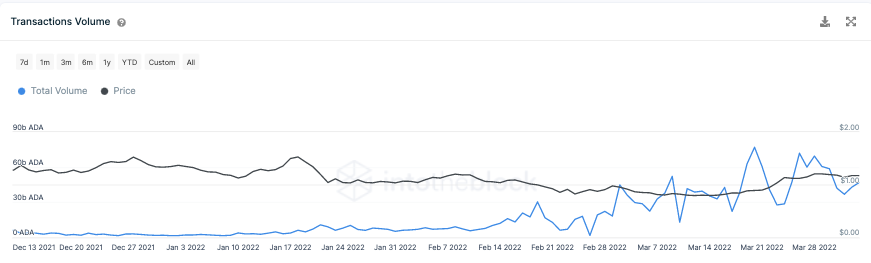

The cumulative transaction volume has also noted a macro incline since mid-February, bringing to light the renewed interest of market participants with respect to Cardano. In the said period, this metric has managed to increase by almost 8 times.

Alongside, the number of long-term HODLers [participants who HODL for more than a year] and mid-term HODLers [participants who HODL 1-12 months] has also been inclining. On the monthly frame, they’ve risen by 26% and 6% respectively, re-emphasizing that the accumulating trend is still on.

Word of caution

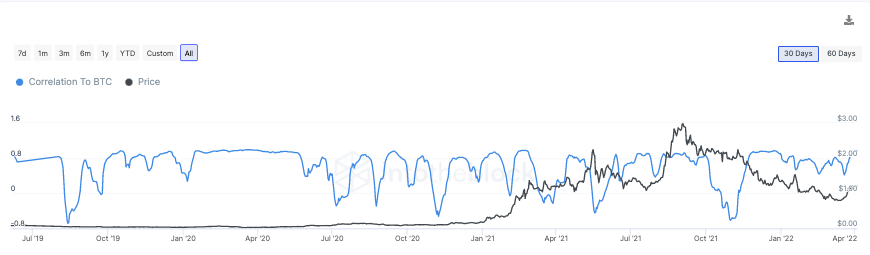

In the past, Cardano has managed to defy the broader market trend and carry out independent rallies. The July-September period right before the Alonzo hard fork is one such instance from the recent past where Cardano managed to surprise market participants.

However now, things are not the same. ADA’s correlation with Bitcoin is at a 30-day high of 0.97. The same flushes water over Cardano’s ‘decoupled’ narrative.

Thus, even though the state of the metrics do make a strong case for a prolonged upswing, nothing can be said with surety because ADA’s fate is closely tied with Bitcoin’s at the moment.