Two top analysts clash over Alphabet stock’s future. GOOGL faces both challenges and opportunities. The stock prediction debate emerges as markets show positive returns after rate cuts, with expansion cycles yielding up to 20% gains within 12 months.

Also Read: Sanctions Backfire: European Exporters Suffer More Than Russia

Analyzing Divergent Opinions on Alphabet Stock’s Future

Jim Cramer’s Warning Signs

Cramer owns Alphabet shares but worries about two main issues. “The government has made it much harder to own it with this antitrust lawsuit. I’m also concerned about Alphabet’s ability to keep putting up strong earnings. It has become more of a media business and is in a very competitive space,” he told CNBC viewers.

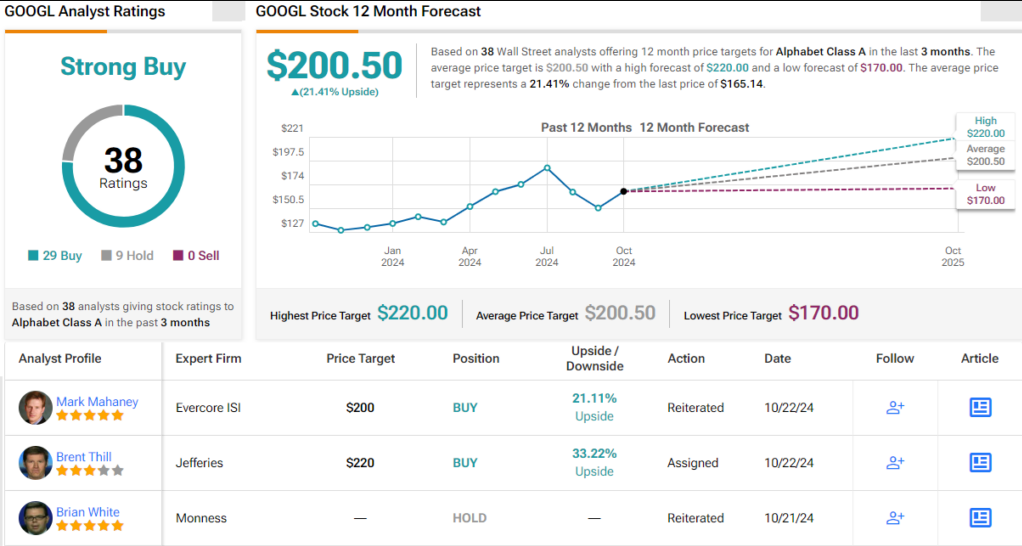

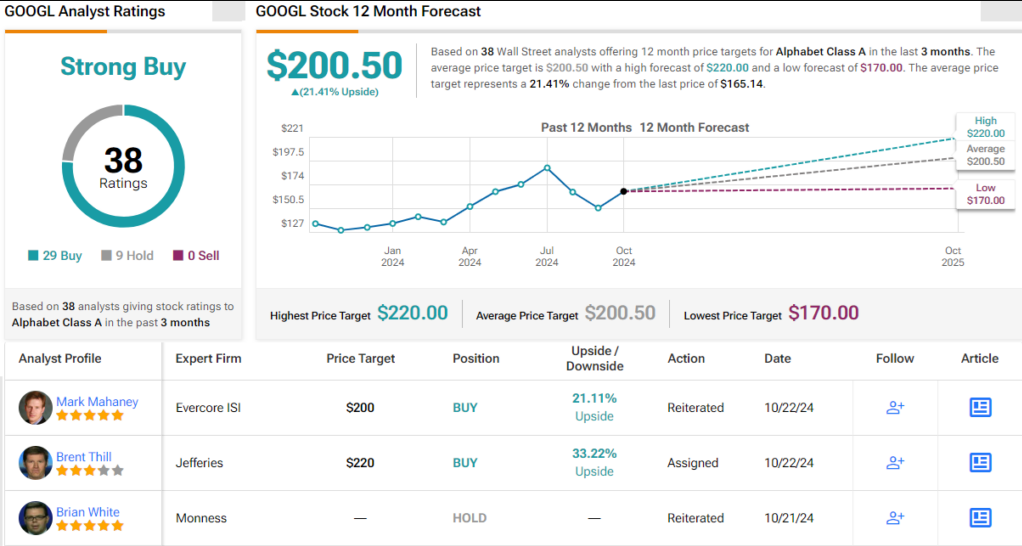

Brian White Sees Mixed Signals

A different analyst opinion comes from White. “After years of operating in the shadows of the arcane world of the internet, the DOJ is now shining a light on Google’s sins of the past,” he states. Yet his numbers tell a positive story. He expects Q3 revenue of $87.44 billion. This beats Wall Street’s $86.31 billion target.

Also Read: Ripple: How Long Will It Take To Turn $1000 XRP Into $500,000?

Market Context Supports White’s Alphabet Stock Ideas

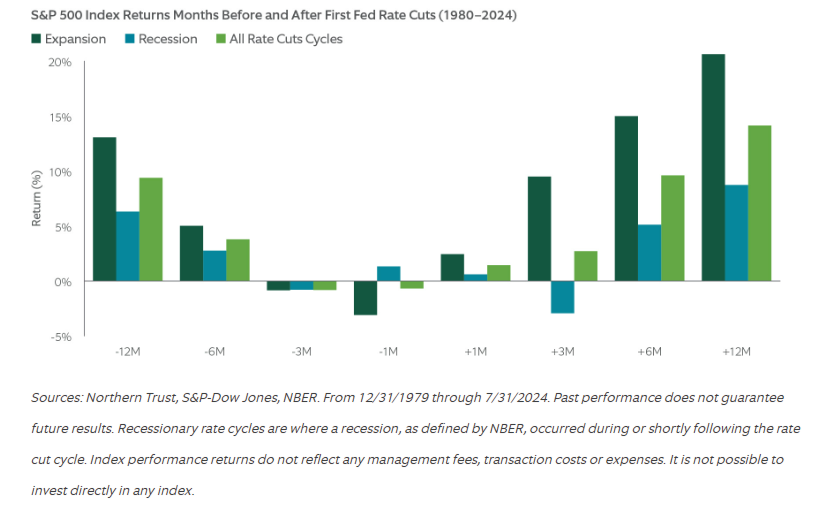

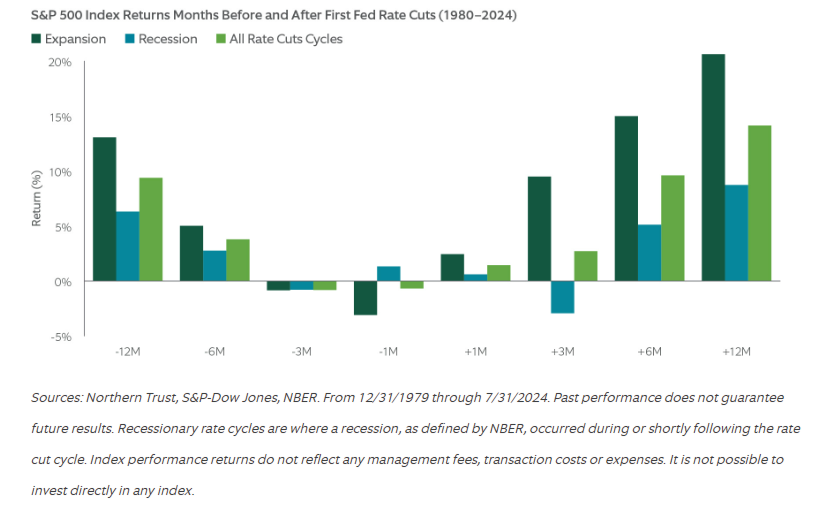

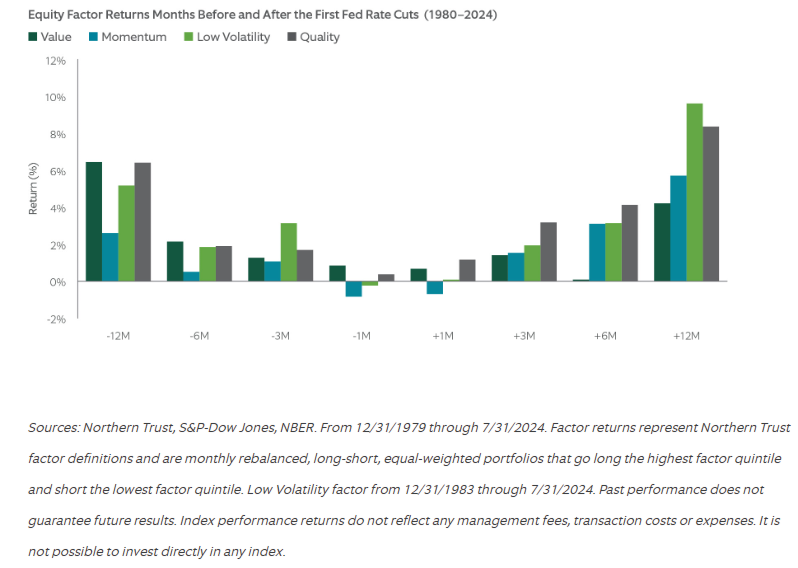

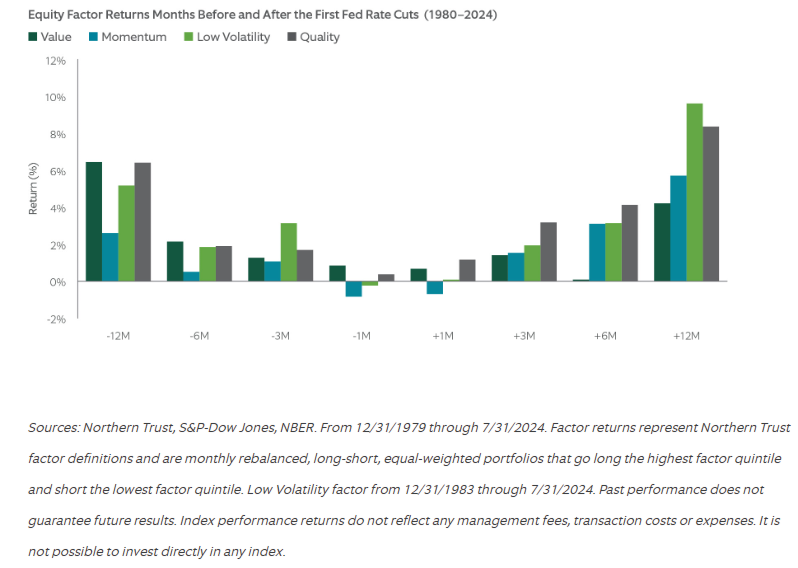

Historical data shows market volatility stays consistent around rate cuts, ranging from 15-20%. Julian Emanuel notes: “The wall of worry is still very, very intact.” Yet market returns during these periods remain positive, especially in expansion cycles.

Why White Wins This Debate

Cramer focuses on two risks: legal problems and market volatility. However, quality stocks, as shown in factor returns, gained over 8% in the year after rate cuts. White’s analysis aligns with this data. His Q3 forecasts show strong earnings despite market uncertainty.

Also Read: Shiba Inu: How Much Could Your $1,000 Be Worth if SHIB Reaches $0.003?

The numbers favor White’s view. His predictions match GOOGL’s steady growth pattern. Most experts agree – 29 say buy, while only nine suggest holding. They set a $200.50 price target. White’s data-driven analysis proves more reliable than Cramer’s broader market concerns.