The US dollar was once considered the pinnacle of finance. The currency was perfect in each way; whether it’s about delivering liquidity or commanding the world at its own pace, the USD was best at what it did. As a global reserve asset, the dollar was unbeatable. However, with time, as forces demanding de-dollarization gained momentum, the currency has been made to encountered troubled waters.

Moreover, the recent policy shifts and leadership overhauls have weakened the dollar further, making the currency lose its dominance streak. With a new multipolar world rising rapidly, the US dollar is not only on the brink of collapse but is also staring wide-eyed towards other major currencies that have now started to challenge the USD actively. Will we witness the fall of the US dollar in our lifetime? Let’s find out.

Also Read: Revolt Against US Dollar: ASEAN Countries QR Code Payment Gains Steam

How Many Years Are Left Till the Dollar Loses Its Crown?

The dollar collapse has now officially begun. Various nations have now started to ditch the dollar for other currencies, starting a new phenomenon. This phenomenon was unknown to the world before and came into the picture soon after the dollar was weaponized heavily to impose sanctions. Moreover, the sanctioned forces continue to rummage for alternatives, giving birth to new currency options that could challenge the US dollar on a broader spectrum. For instance, the world realized how it does not want to depend on a single currency, a movement that gained widespread momentum after Trump’s tariff decisions started to impact nations around the world.

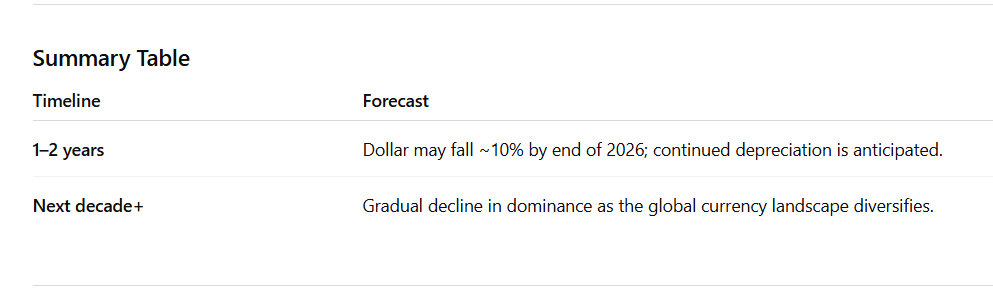

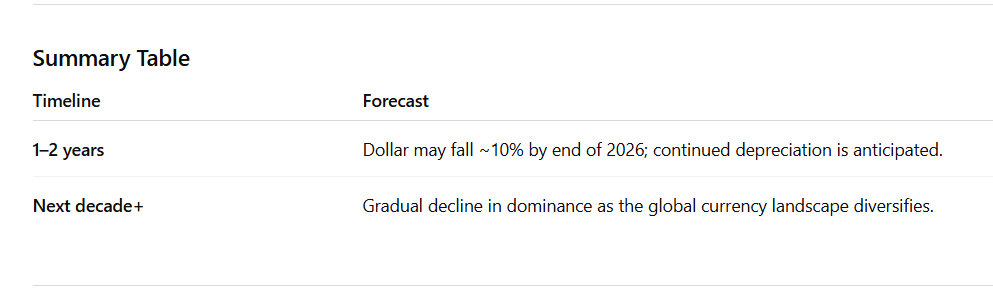

President Donald Trump also wanted a weak dollar. The frail American currency was supposed to help neutralize the economic pressure. But the idea backfired, owing to the bad economics that were at play in the end, all along. The deliberate weakening of the dollar led other currencies to take charge. Moreover, Trump’s tariffs on global nations further weakened investors’ confidence in the currency, prompting giants like Morgan Stanley to predict another 10% decline in the USD by 2026.

Dollar’s Fall: Ticking Time Bomb

Despite the economist’s stark warning, the US dollar is now on a path of gradual decay and erosion. The currency is now forecasted to degrade at a gradual pace, challenged constantly by rising currency competitors and peers.

“My thesis is that the USD is about to get knocked down a couple pegs,” said Rogoff, a professor of economics and the Maurits C. Boas Chair of International Economics. “It will still be first in global finance, because nothing is poised to fully replace it. The USD just won’t be as unique as it once was.”

To put a label on top of this decay, the US dollar collapse has already begun. Rogoff is of the opinion that by the next decade, we may encounter USD locking horns with other strong competitors, the ones that are in line to snatch its reserve status away.

Here’s a chart from the Federal Reserve that shows how foreign exchange reserves have changed since 2000. The dollar has been slowly but steadily losing its share of foreign reserves: pic.twitter.com/1CRpMWJCPu

— Genevieve Roch-Decter, CFA (@GRDecter) March 29, 2023

Also Read: End of the Petrodollar? Oil Markets Are Ditching the US Dollar