American Eagle has finally cracked the marketing code by enlisting actress Sydney Sweeney to advertise for the brand. Sweeney’s involvement has led the AEO to witness groundbreaking success, with its stock soaring 25%, owing it all to Sweeney’s charm and allure that hooked the masses from the start. The brand is now basking in its newfound success, with its stock printing a good candle that is worth taking a look at. Will this stock continue to extend its gain this September? Let’s find out.

Also Read: Sydney Sweeney & American Eagle Stock: Down 2.25%, Volume +89%

American Eagle Outfitters Stock (AEO) Soars to New Highs: What’s the Latest Update?

American Eagle Outfitters (AEO) made a bold move by executing a rather strategic plan that involved actress Sydney Sweeney to take up the center stage. The firm looped in Sweeney to become the focal point of its brand campaigns, an idea that ended up delivering the best gains to AEO. As a result, American Eagle Outfitters has reported gains worth 25%, with its stock printing a god candle on its chart.

“American Eagle is up 25% in after-hours following its earnings. American Eagle (AEO) just said its partnership with Sydney Sweeney has been its “best” advertising campaign to date—CNBC.

American Eagle is up 25% in after hours following its earnings

— Evan (@StockMKTNewz) September 3, 2025

American Eagle $AEO just said its partnership with Sydney Sweeney has been its “best” advertising campaign to date – CNBC pic.twitter.com/oclXyXU9Pj

In its Q2 earnings report, the firm showcased striking price metrics, with the campaign playing a key role in fueling the stock’s momentum. Per the Investing data, AEO stock has reported an EPS of $0.45, surpassing its forecast by 125%. The brand revenue has hit $1.28B. The successful numbers have led the analysts to revise their expectations, stating how the firm is poised to deliver better gains in the future.

“(Sweeney) is a winner, and in just six weeks, the campaign has generated unprecedented new customer acquisition,” chief marketing officer Craig Brommers said during the earnings call.

God Candle Effect to Usher in September Gains?

As per CoinCodex AEO stock data, American Eagle Outfitters stock may consolidate in September and pause before resuming its ascent to new highs.

“According to our current AEO stock forecast, the value of shares will drop by -3.00% and reach $13.21 per share by October 3, 2025. Per our technical indicators, the current sentiment is neutral, while the Fear & Greed Index is showing 39 (fear). AEO stock recorded 16/30 (53%) green days with 5.79% price volatility over the last 30 days. Based on the stock forecast, it’s now a bad time to buy AEO stock because it’s trading 3.09% below our forecast, and it could be overvalued.”

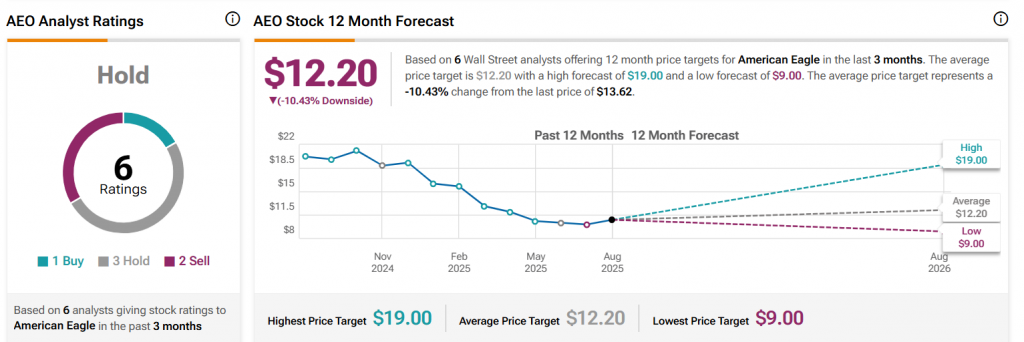

As per the latest AEO stock data by TipRanks, the stock is eyeing a new high of $19 in the near future.

“The average price target for American Eagle is 12.20. This is based on 6 Wall Street analysts’ 12-month price targets, issued in the past 3 months. The highest analyst price target is $19.00, and the lowest forecast is $9.00. The average price target represents a -10.43% decrease from the current price of $13.62.”

Also Read: Buy This AI Stock Before It Overtakes Nvidia & Palantir