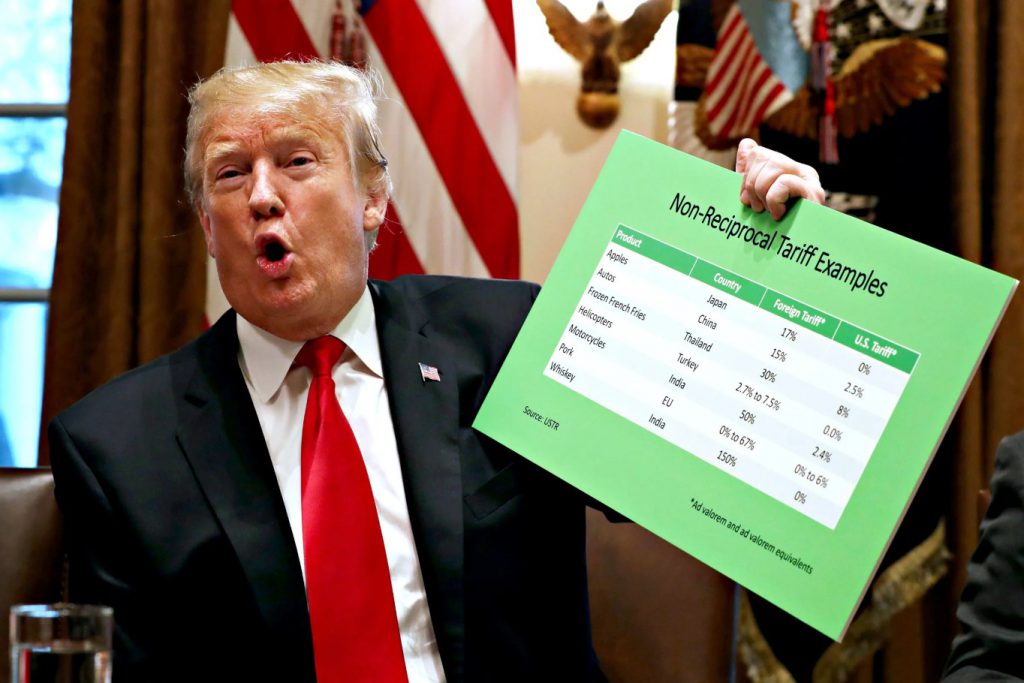

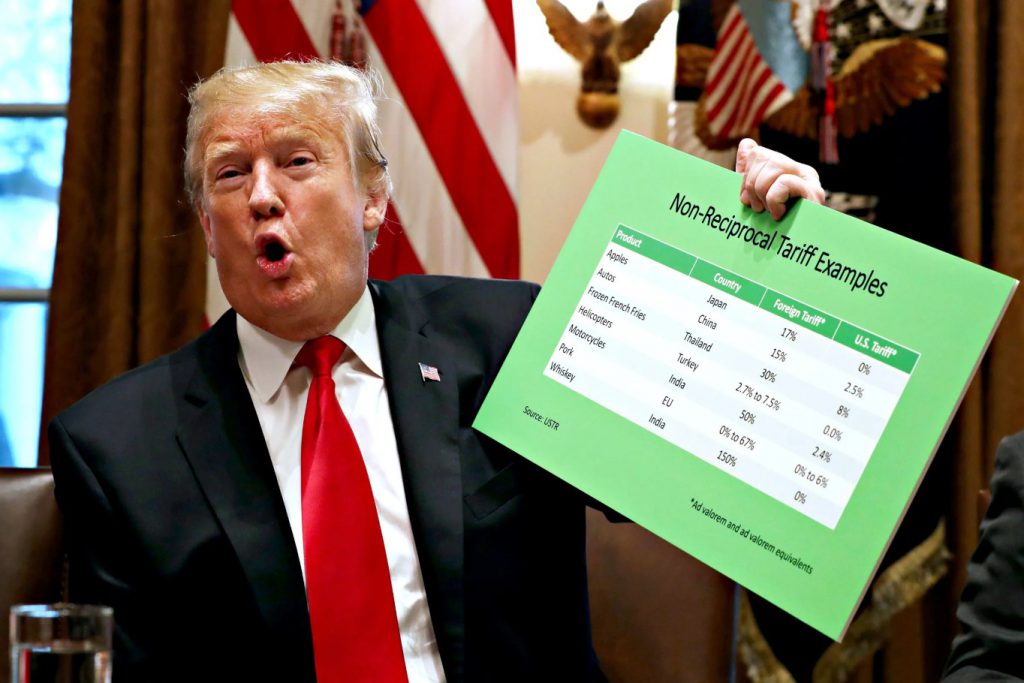

Ever since Donald Trump assumed the reins of the White House, the stock markets of the world have shown a bumpy stance in response. For instance, the markets surged meteorically when he was elected as the 47th US president of the United States. The moment he commenced his tariff policy deployment, the markets were once again down, portraying a consistent ebb and flow pattern, rather than averaging at a steady pace. While many have considered this as a normal response of the markets to the changing geopolitical narratives, one analyst claims that this is not an ordinary pattern, with Trump deliberately trying to crash the market to cater to a serious economic issue.

Also Read: AI Predicts Cardano (ADA) & Solana (SOL) Price For Crypto Summit Day

Trump Is Deliberately Crashing The Market: Analyst Boldly Claims

A notable analyst on X, Amit, recently shared his new analysis on the current market dynamics. His post consisted of elements claiming how Donald Trump is deliberately crashing the stock market to pay off the mounting US debt that the nation is currently embroiled in.

Speaking about his analysis at length, Amit stated how the US has trillions in debt that the nation needs to pay in the next 6 months. If the US fails to do so, it will have to refinance, causing more pressure in the process.

The expert later shared how the Trump administration is deliberately slowing the market by imposing tariffs on nations to ease the aforementioned process by simmering it down a notch.

“1. We have $7T of debt we need to pay in the next 6 months. If we don’t pay it, we’ll have to refinance. 2. The Trump admin does NOT want to refinance at a 4%+ rate…The 10-year at one point this year was 4.8%. 3. How do you get the 10-year to come down? Markets need to show weakness in growth. DOGE has to be perceived as actually working, and interest rates need to come down.”

In essence, Amit stated how the Teno administration is deliberately crashing markets to increase volatility to bolster the bond purchases instead of equities. Which in turn may establish economic equilibrium to an extent.

“The way to do that is to create massive uncertainties—aka tariffs. Which can slow down growth in the short term. Get the bond market to start BUYING bonds ASAP because of how scared they are of touching stocks (causing yields to fall, which is what we need to refinance the debt), and then that gives the Fed the authority to lower rates, which continues to bring yields down. So, although conventional wisdom says tariffs are inflationary. And the 10-year should be spiking on more tariffs—it’s actually going down because it’s bringing so much uncertainty to equity markets that people are selling stocks and buying bonds!”

WHY DONALD TRUMP WANTS THE MARKET TO CRASH

….in the short term ⬇️

This chart below sums up the reasoning behind what the current adminstration is doing and why it is having adverse effects on the market.

Kris @KrisPatel99 did a great job today explaining this more in depth… pic.twitter.com/8II6cALjJG— amit (@amitisinvesting) March 4, 2025

US Markets Continue To Fall Due To Rising Trade War Fears

On the other hand, Donald Trump’s fierce tariff import policies have heavily impacted the US markets. The S&P index has noted a fall and has hit its lowest since Trump won the elections in 2024. At the same time, nations have also declared reciprocative tariffs on the US, sparking widespread trade war fears in the market.

“The moment U.S. tariffs came into effect this morning, so did the Canadian response. Canada will be implementing 25% tariffs against $155 billion of American products. Starting with $30 billion worth of goods immediately and the remaining $125 billion in 21 days’ time.”

The moment U.S. tariffs came into effect this morning, so did the Canadian response.

— Justin Trudeau (@JustinTrudeau) March 4, 2025

Canada will be implementing 25% tariffs against $155 billion of American products.

Starting with $30 billion worth of goods immediately, and the remaining $125 billion in 21 days’ time.

Also Read: Walmart (WMT): Top Stock to Accumulate as Tariffs Kick In