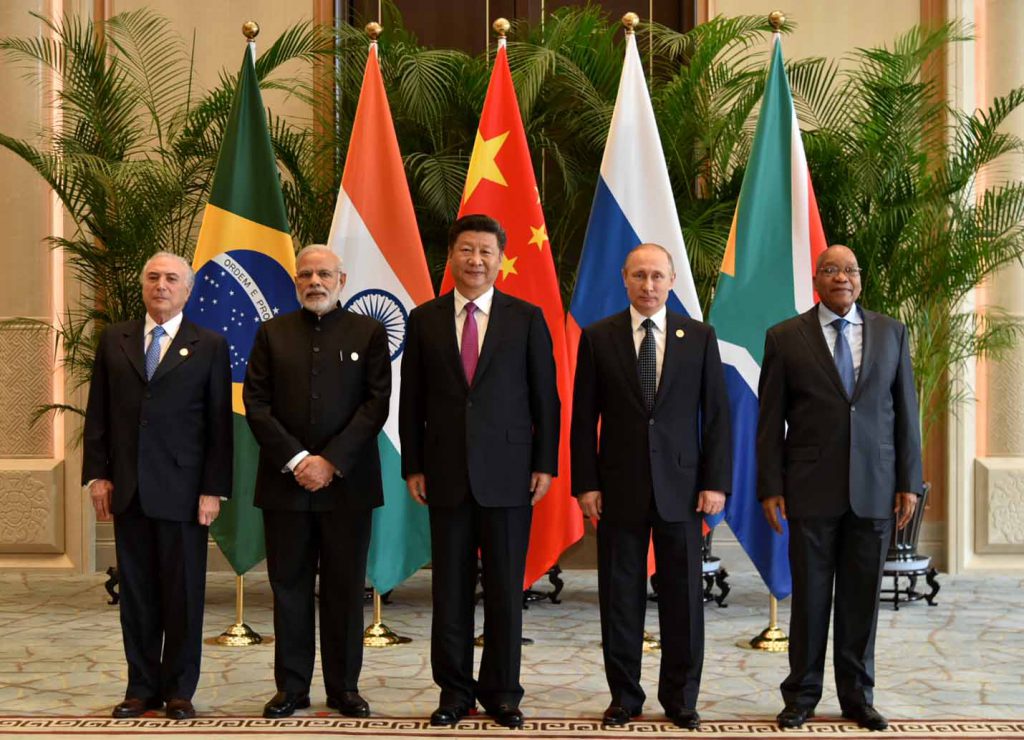

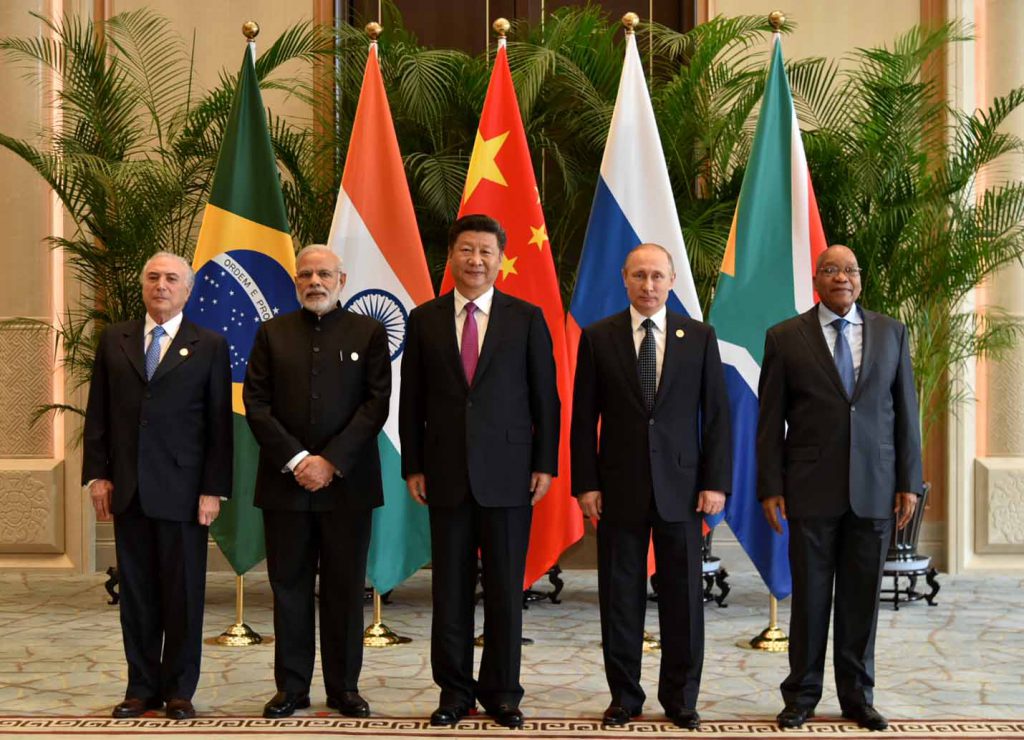

A handful of developing countries in Asia, Africa, and Eastern Europe are looking to join the BRICS alliance in 2024. South African Foreign Minister Naledi Pandor confirmed recently that around 36 countries have formally applied to join BRICS this year. Amid the joining frenzy, another country has thrown its hat in the ring in the hopes of joining the alliance. The development indicates that the bloc is becoming powerful in its agenda to de-dollarize the world and promote local currencies.

Also Read: 36 Countries Apply To Join BRICS Alliance in 2024

BRICS: New Country Shows Interest To Join Alliance

The latest and new country to express its interest in joining the BRICS alliance is the African nation Cameroon. Russian Ambassador Georgy Todua confirmed that Cameroon has expressed its interest in being a part of the bloc in 2024. Cameroon is on the Gulf of Guinea and is a Central African country with varied terrain and wildlife.

Also Read: BRICS Provides Update On The New Currency

“BRICS is becoming an increasingly more prestigious international organization. Cameroon closely follows the transformations that are taking place in the world, changes in the international architecture and economic models of development,” he said.

“In this regard, the BRICS issue takes its place in Yaounde’s foreign policy planning, given the close and diverse ties the republic has with China, India, South Africa, Egypt, Brazil and, of course, Russia,” said the Ambassador.

Also Read: BRICS Urges Middle East To Ditch US Dollar For Oil Trade

A new expansion could make several countries stand in line to trade in local currencies and not the US dollar. Read here to know how many sectors in the US will be affected if BRICS ditches the dollar for trade.

BRICS is convincing the majority of developing countries to join the alliance and strengthen their native economies and local currencies. The move adds pressure on the US dollar and economy as America will find it hard to import its currency. If the USD returns to the homeland, the chances of the American economy reaching hyperinflation remain high.