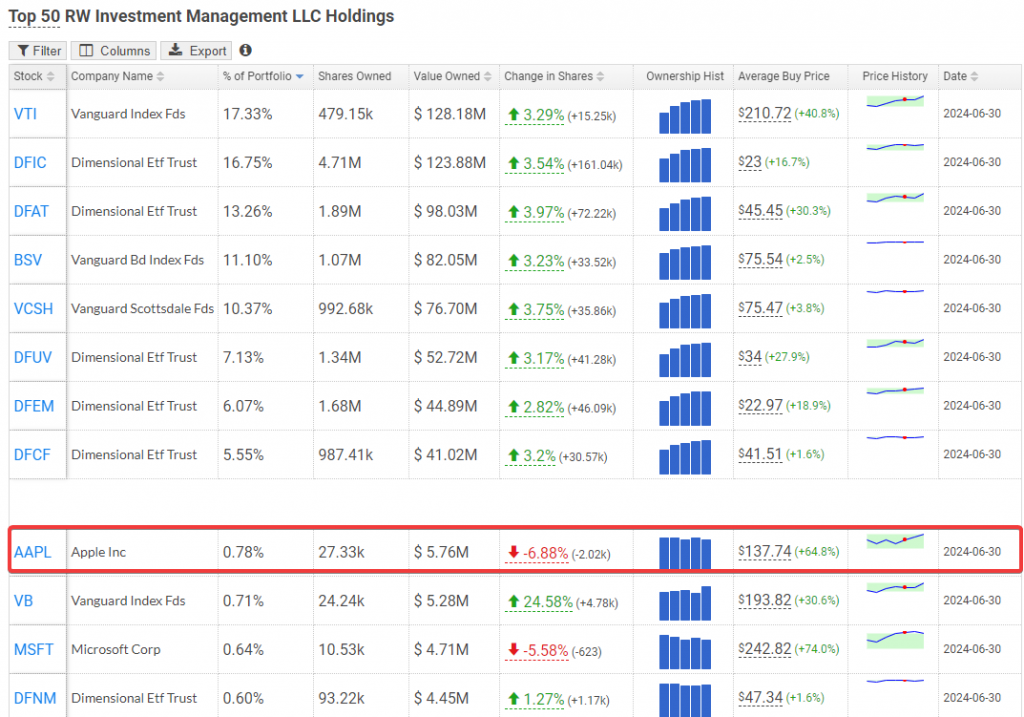

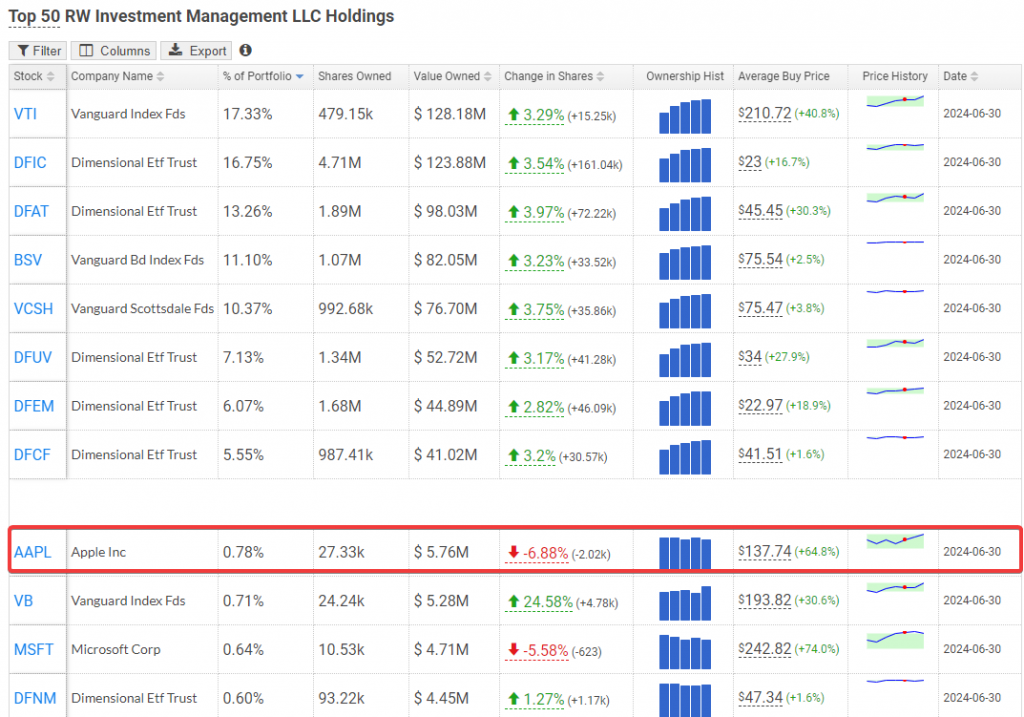

Apple stock seems to be pretty hot right now, with major investment firms shuffling around their positions on the NASDAQ giant. RW Investment Management LLC still looks pretty committed to the tech stock performance scene – they’re holding onto what’s currently about $5.7 million worth, making it their 9th biggest bet for now.

Also Read: Russia’s De-Dollarization: Putin Blames US for Kicking Them Out

Investment Surge: How RW Investment Management LLC Bets Big on Apple

Portfolio Adjustments and Market Impact

RW Investment Management LLC trimmed their Apple holdings by something like 6.9% in Q2 – looks like they’re sitting at around 27,331 shares these days. The NASDAQ’s been seeing quite a bit of action lately in tech stock performance, and this move seems more about balancing things out than anything else.

Institutional Movement Signals

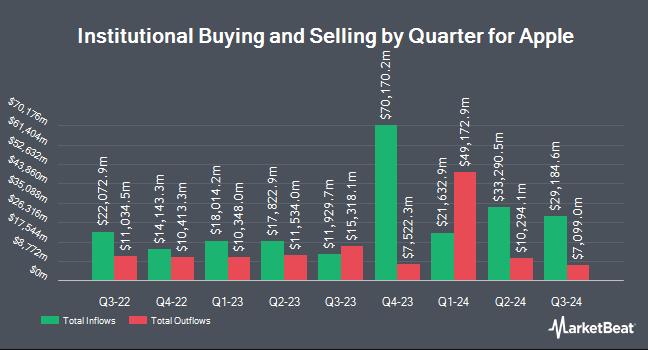

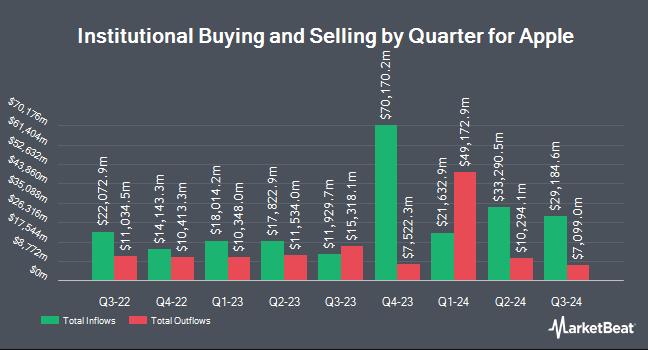

It seems like several investment firms have been moving pieces around:

- Access Investment Management LLC just jumped in with about $140,000

- Hoese & Co LLP bumped their stake up 6.7% to 912 shares or so

- Sage Financial Group Inc. put down around $206,000

- SMH Capital Advisors Inc. has about $209,000 in play

- Big institutions are holding something like 60.41% of Apple stock right now

Executive Trading Activity

The insiders have been pretty busy, too:

- CEO Timothy Cook let go of 223,986 shares at $224.46, working out to about $50.3 million

- Chris Kondo sold off 8,706 shares at $225.00 each

- Looks like insider sales hit around $93 million last quarter

Also Read: Tim Cook’s Crypto Portfolio: Apple CEO’s Bitcoin Holdings Exposed

Market Performance and Analysis

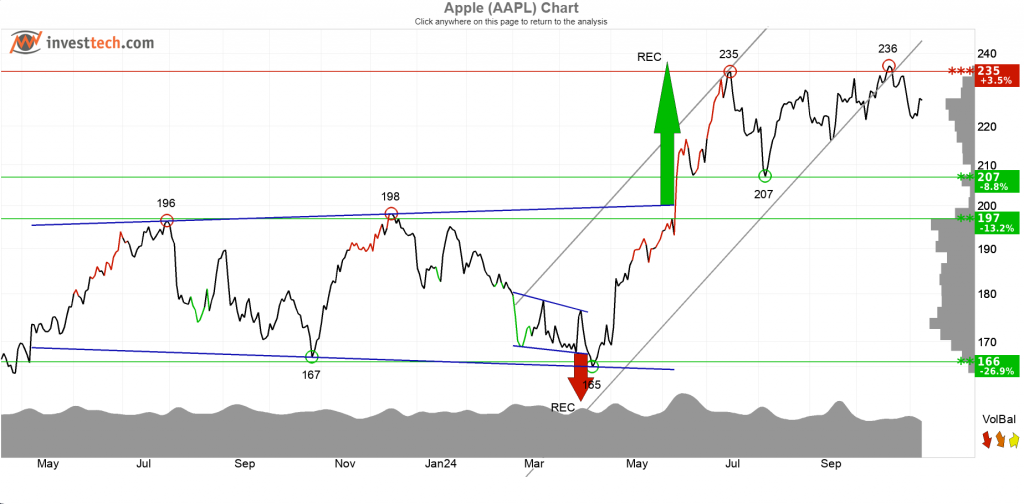

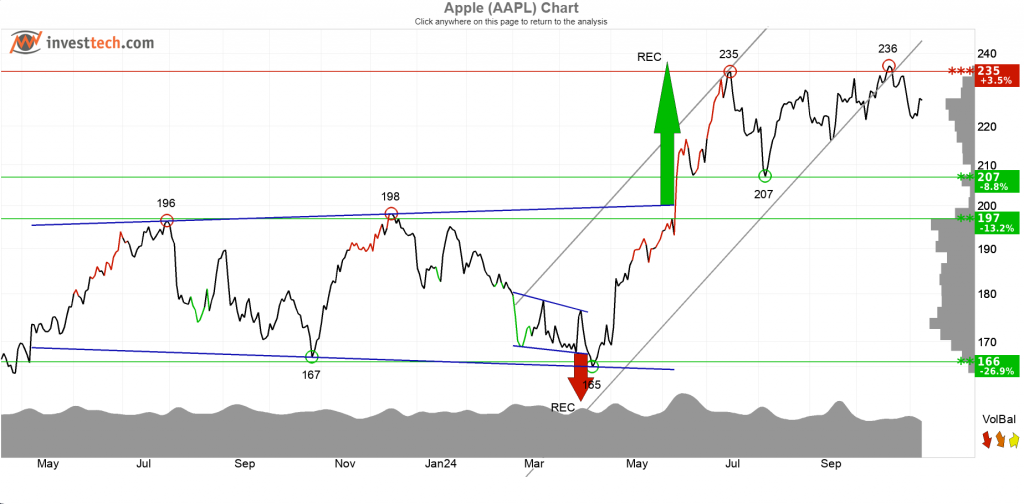

Apple’s stock is trading at about $226.96 these days, and the numbers are pretty interesting:

- Been bouncing between $164.07 and $237.49 over the year

- Market cap is sitting at roughly $3.43 trillion

- The P/E ratio is around 37.33

- Revenue is up about 6.1% from last year

- They’re paying out $0.25 per share in dividends

Also Read: 2 U.S Stocks To Buy on Monday