In what is looking like a hit to the iPhone developer, Apple (APPL) has seen billionaires ditch the tech stock in favor of one company that is poised to surpass it in 2025. Indeed, the company has seen a host of notable names decrease their position in the largest company by market cap. It appears as though they’ve done it anticipating it won’t remain atop the list throughout next year.

Apple has recently debuted its first batch of AI products, a move they expected to be huge for the company. However, it hasn’t appeared to have made the impact the company would have hoped. Alongside the ongoing iPhone ban in Indonesia, there are expectations that it is set to be usurped for the foreseeable future.

Also Read: Apple (APPL) Keeps Setting Records as Samsung Loses Market Share

Why Billionaires are Ditching Their Apple Stock for This Company Set for a Massive 2025

Over the last decade, Apple has firmly established itself as a technology market leader. A favorite on Wall Street, it was the first company to surpass a $2 trillion value. Yet, it would only one up itself several years later when it became the first to reach $3 trillion in value.

Now, as it eyes its status as the first company to reach $4 trillion, there has been some emerging competition. Indeed, Apple has seen billionaires sell their positions in the company in favor of one alternative that is assured to surpass the iPhone maker in 2025.

Also Read: Apple or Nvidia? Polymarket Traders Pick Their Favorite

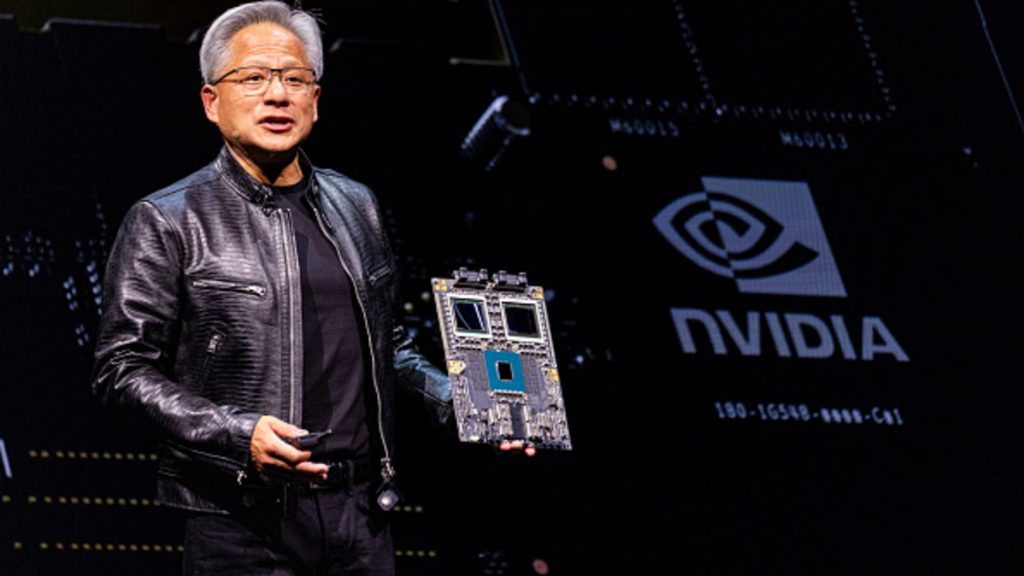

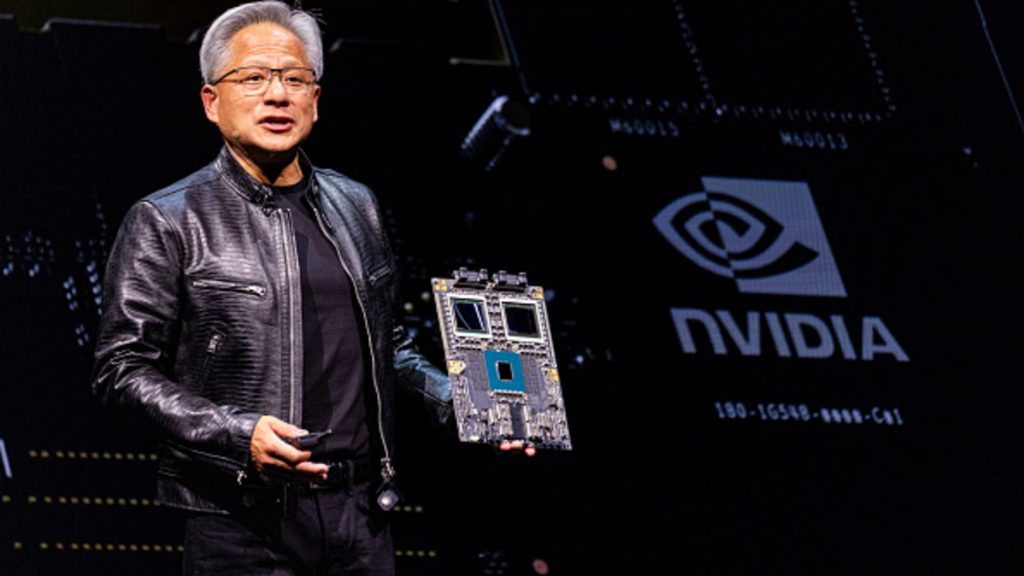

Specifically, a host of prominent investors have opted to increase their Nvidia (NVDA) holdings recently. Among them is Cliff Asness of AQR Capital, who increased his stake in the chipmaker by 5%. Alternatively, Asness reduced his Appel position by 1%. The move made NVDA the largest holding in his portfolio.

Moreover, Point 72 Steven Cohen purchased 1.5 million shares in Nvidia, raising his position by 75%. Cohen then sold all 1.5 million shares of Apple, while making Nvida the largest holding in his portfolio. The movements are no surprise, as NVDA is expected to continue to lead the ongoing AI tech revolution that is expected to continue next year.

In its Q32025FY report, sales had increased 84% to reach $35 billion. That showcases the upward trajectory that the company is already on. Not to mention, it had previously dethroned Apple as the largest company in the world by market cap. Although APPL took the crown back, it is not expected to hold onto it into next year.