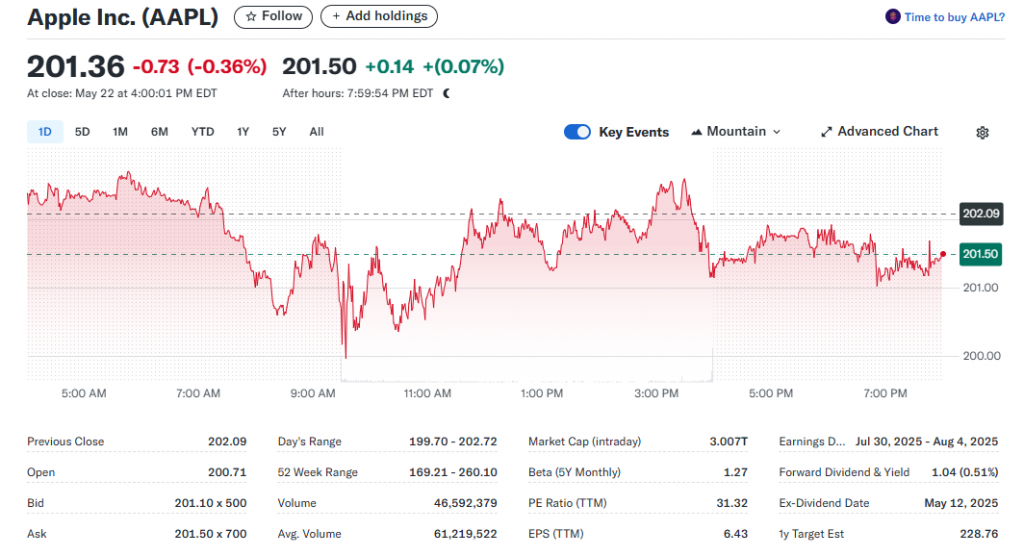

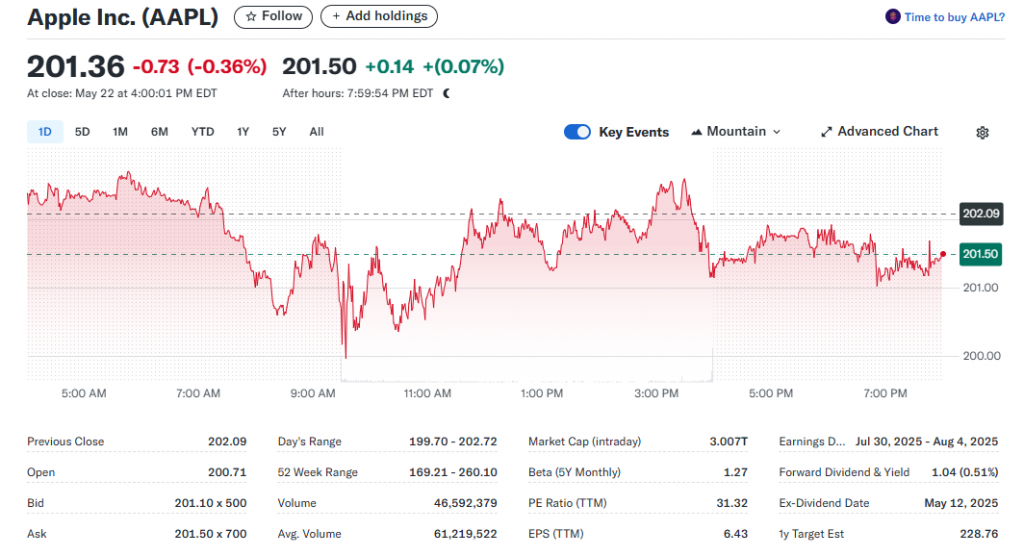

Apple’s expansion in India is picking up steam right now, and it’s happening despite President Trump’s vocal opposition to the tech giant’s overseas manufacturing plans. The company’s aggressive manufacturing India strategy, backed by Foxconn’s massive $1.5 billion investment, could be the key driver that pushes AAPL stock toward that coveted $250 mark. At the time of writing, Trump tariffs impact discussions are heating up, but Apple seems determined to build out its India electronics supply chain regardless of political pressure from Washington.

Also Read: US Stocks, Bonds Sink as Debt Fears Caused by Trump Persist

How Apple’s India Expansion Navigates Trump Tariffs And Supply Chain Risks

Foxconn’s $1.5 Billion Chennai Investment

Apple’s India expansion continues to gain momentum through Foxconn‘s ambitious Chennai facility project, and this investment is all about display module assembly for iPhones. The Apple manufacturing India strategy is positioning Tamil Nadu as a critical manufacturing hub, despite the political headwinds coming from the White House. This massive commitment represents one of the largest investments in India electronics supply chain development to date.

Trump had this to say:

“We are treating you really good, we put up with all the plants you built in China for years. We are not interested in you building in India.”

The new facility will create around 14,000 jobs and supply display modules specifically for iPhones that are destined for US markets. Tamil Nadu officials approved a hefty Rs131.8 billion ($1.54 billion) investment by Yuzhan Technology India in the ESR Oragadam Industrial & Logistics Park, and this facility will be positioned right next to Foxconn’s existing iPhone manufacturing plant.

Supply Chain Diversification Strategy

Apple’s expansion in India reflects a broader supply chain restructuring as Trump tariffs impact continues to influence global manufacturing decisions. Apple’s Apple manufacturing India operations contributed about 18 percent of global iPhone production in 2024, and projections suggest this could jump to 32 percent in 2025 according to Counterpoint Research.

Also Read: Cardano ADA Price Surges 27%: $5 a Possibility?

Government officials committed an additional $2.7 billion to production-linked incentive schemes for the India electronics supply chain sector just last month. Right now, Foxconn employs around 80,000 people across its Indian operations, and the new Chennai display facility will add significant capacity to the mix.

$250 AAPL Price Target Potential

Apple India expansion could very well drive the stock toward that $250 target as manufacturing costs decrease and supply chain risks diminish. Apple’s manufacturing India strategy reduces dependence on Chinese facilities while maintaining production quality, and that’s exactly what investors want to see right now. Trump tariffs impact makes Indian operations increasingly attractive for US-bound iPhone production.

The Financial Times reported that Apple intends to source all 60 million US-sold iPhones from India by next year, which is pretty ambitious. This major shift in the Indian electronics supply chain could significantly improve profit margins and justify higher valuations for AAPL stock.

Also Read: BRICS Give Major Update on Ten-Year De-Dollarization Plan

Apple’s determination to proceed with this expansion in India despite all the political pressure shows real confidence in their long-term strategy. The company’s manufacturing investments position it well for sustained growth regardless of Trump tariffs impact developments. Success in building out a comprehensive electronics supply chain in India could establish Apple as the model for supply chain diversification, and that could drive AAPL toward new highs around $250.