According to crypto analysis firm Santiment, the markets might be entering a stage of euphoria and FOMO (fear of missing out). The firm bases its argument on current social media trends that mention terms such as “buy,” “buying,” “bottom,” and “bullish.”

The current trend follows a “modest” rally for altcoins in the past few days. Santiment highlights that, historically, such words have coincided with periods of euphoria. The firm warns crypto investors to “tread carefully at this spot.”

Crypto social media and the altcoin rally

Solana (SOL) is the top altcoin over the previous week. The crypto token has rallied by 35.2% in the 7-day chart.

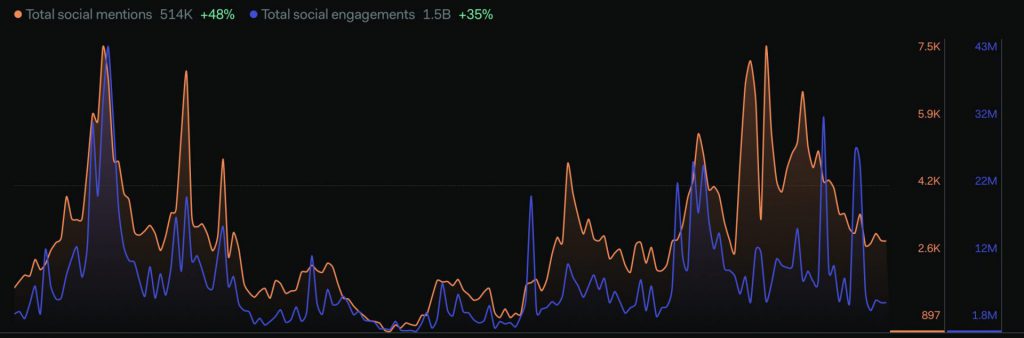

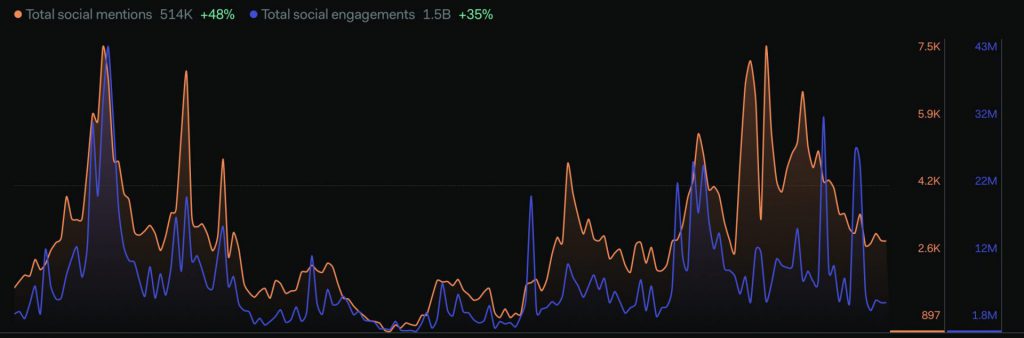

Moreover, according to data on LunarCrush, SOL’s social mentions have increased by 48%, while its social engagements have increased by 35%.

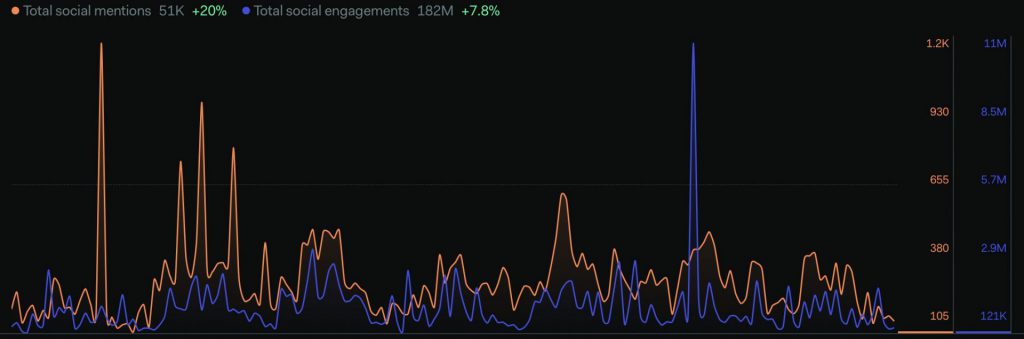

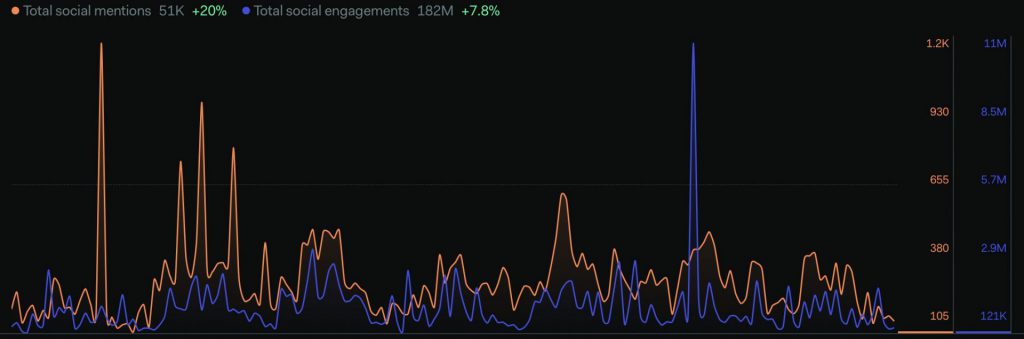

Litecoin (LTC), another popular altcoin, rallied by 14% in the last seven days. The crypto token’s social mentions increased by 20%, while engagement increased by 7.8%.

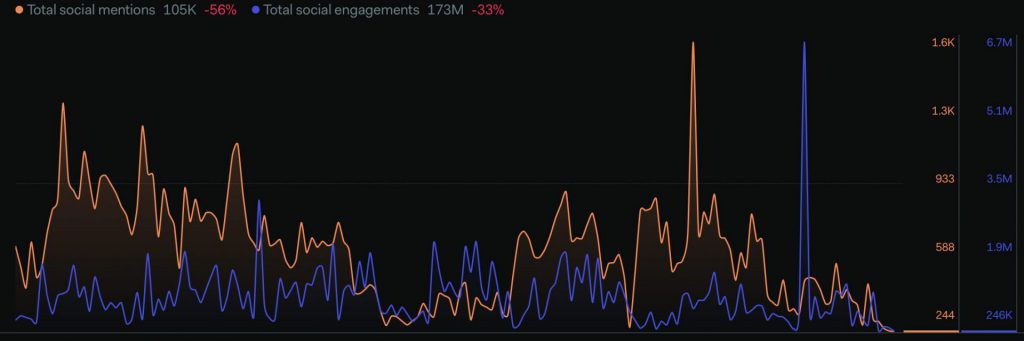

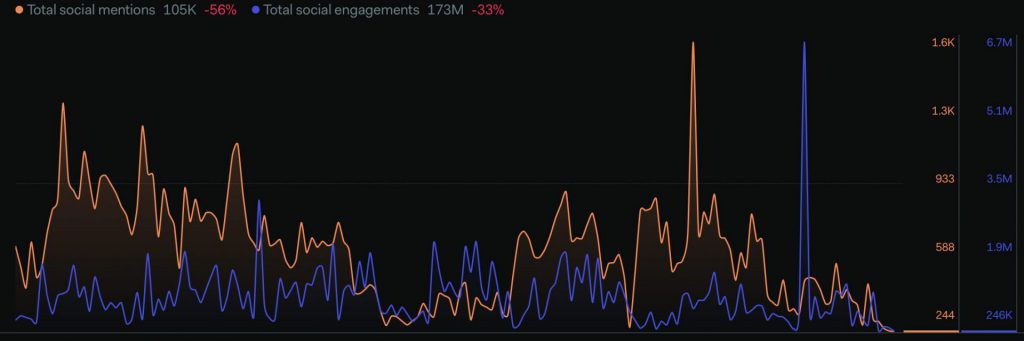

XRP, on the other hand, saw its social media performance fall significantly. Social mentions have fallen by 56%, and engagement has fallen by 33%. And unsurprisingly, the crypto token’s price has fallen by 2.9% in the 7-day chart.

Is the market really at its bottom?

As pointed out by Santiment such periods coincide with euphoria and FOMO. Moreover, U.S. Federal Reserve officials have said it is unlikely they will cut interest rates in 2023. The FED is taking draconian steps to curb inflation and bring it down to its target of 2%.

Therefore, with interest rates still showing no signs of cooling, it is unlikely that investments would flow into the crypto market. Experts predict that the next bull run could happen sometime in 2024. Economists also think inflation numbers will come down to nominal levels only after 12 months.