Since the Terra blowout, several proposals were made by the community to increase burns and inflate the value of LUNA tokens. While data shows that some burn transactions were being carried out, they were largely insignificant when compared to how were being created.

As investors continued to bet against LUNA and UST, Do Kwon attempted to save the sinking ship by proposing two recovery plans. The second plan detailed splitting the blockchain via a hard fork.

However, LUNA holders did not receive positive updates as both Terra’s native tokens continued to be dumped on exchanges. Separately, many holders had proposed to fast-track the LUNA burn process to inflate the value of existing tokens.

Back in November 2021, Terra dropped an anti-deflationary mechanism through its Columbus 5 upgrade. Once the proposal was passed through a community vote, 10% of LUNA’s circulating supply was burned and the same was expected to reduce overtime.

Although no official announcement has been made concerning an increase in burns, a Twitter user brought some interesting data to light.

Is LUNA being burned?

Crypto trader, under the pseudonym ‘ashwsbreal’, revealed transactions showing that 300 Billion LUNA tokens were burned on 16 May.

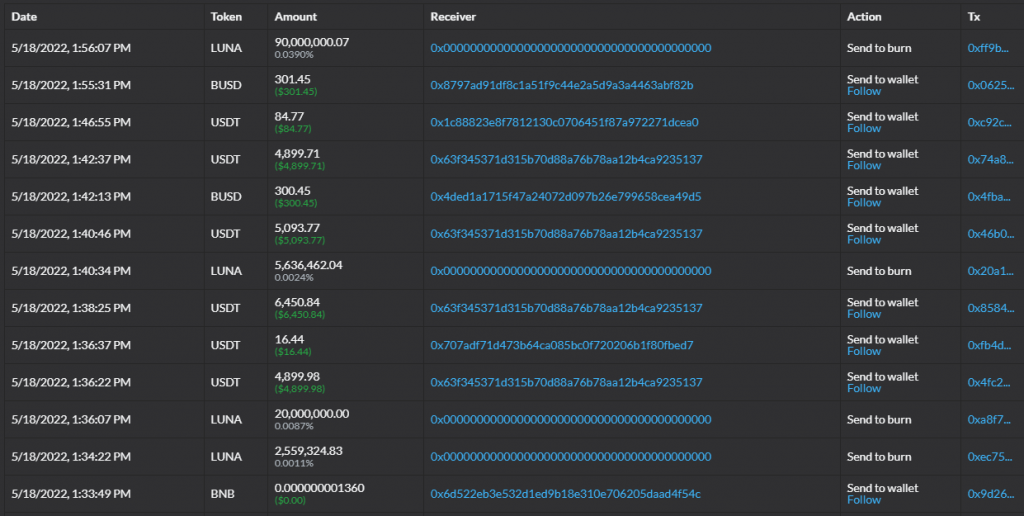

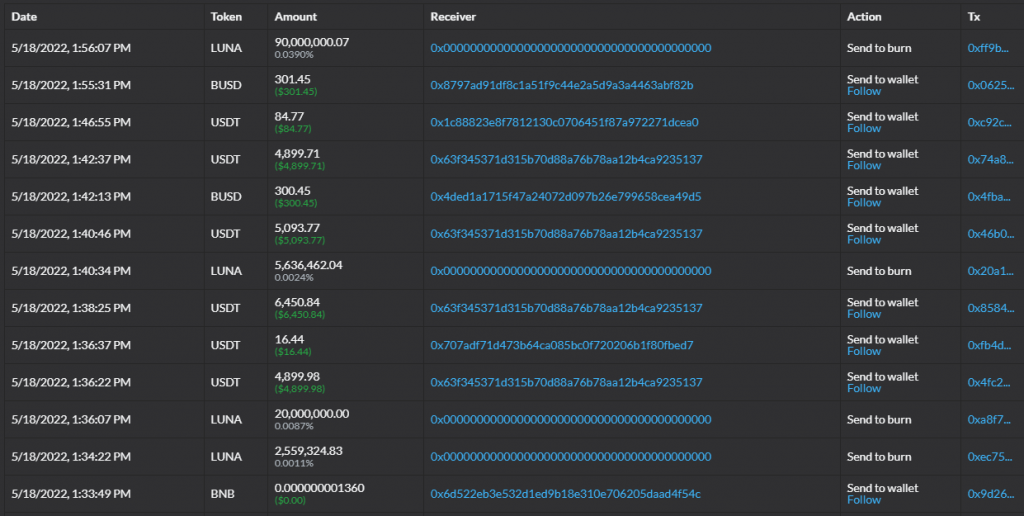

The trend had even continued over the past few days. Data from Etherscan showed that several batches of LUNA coins were being transferred to burn addresses, some even ranging as high as 90 Million tokens.

Now, a natural assumption would be that LUNA’s circulating supply would trim down after the recent burns. Well, that isn’t the case. On the contrary, LUNA’s circulating supply has increased by over 1.9 million percent after Do Kwon dropped his second recovery proposal last week. The figure spiked from 342 Million to its press-time value of 6.53 Trillion in just a single week. The increase was mainly due to the token’s interaction and relationship with stablecoin, UST. For every UST sold, more LUNA tokens had to be minted.

In retrospect, the amount of LUNA burned appears to be minuscule when compared to how many tokens were currently being minted.

The effects of this disparity were even clear after looking at LUNA’s price. Despite recent burns, the market continued to trade in the red on Wednesday morning, in line with a risk-off broader market. Its value held around $0.0001819, down by 6% over the last 24 hours.