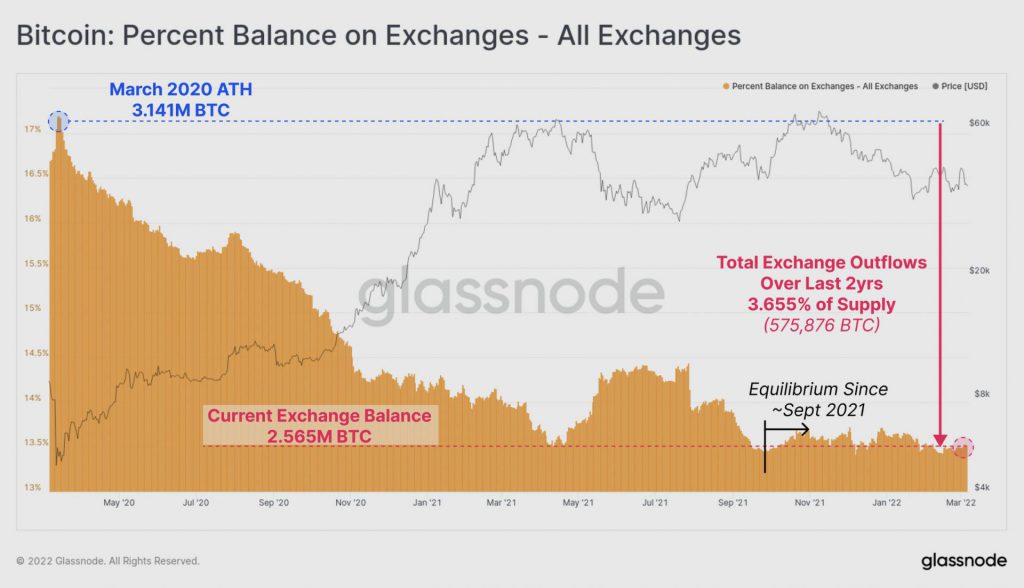

Prominent blockchain analytics firm, Glassnode, has released their data regarding the negative inflows witnessed by Bitcoin (BTC) since July 2021.

As per the newsletter, Bitcoin (BTC) prices have been fluctuating this week, starting at a weekly low of $37,333, climbing to a high of $45,039, and then giving back the majority of the gains, closing at $39,220. Bitcoin bulls are attempting to set a price floor as the global macro and geopolitical stage continues to cause uncertainty in markets.

Prices have been trading sideways in recent weeks, indicating that a relative equilibrium has been reached. Given the limited incoming fresh demand, however, any large degree of seller tiredness, or conversely, a re-invigoration of sellers, can upset this delicate balance.

Bitcoin data from exchanges

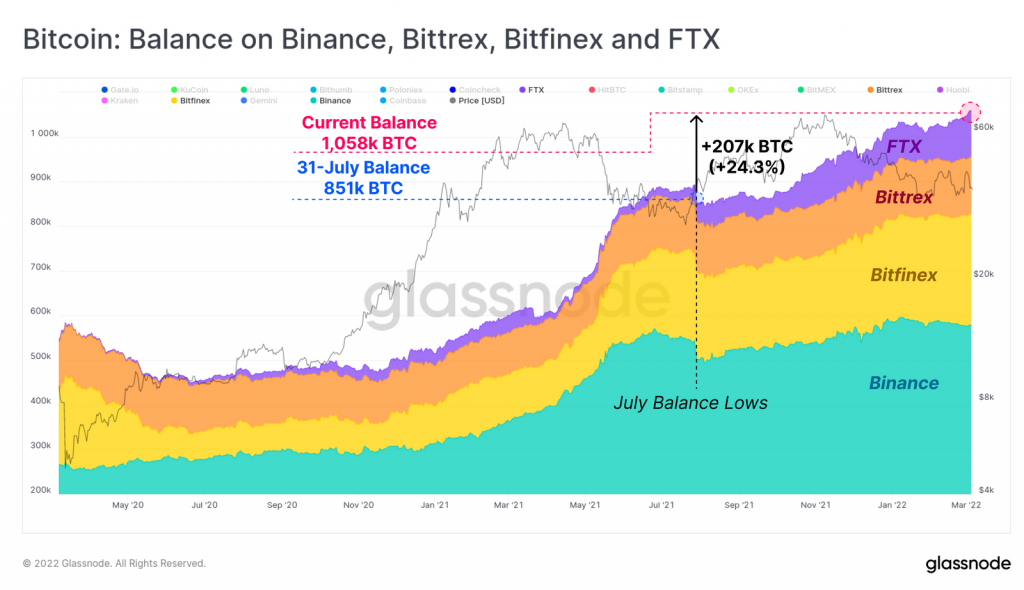

Since late July, bitcoin inflows have been net negative across all exchanges, but four big exchanges have defied the trend, with approximately equal amounts of net positive inflows.

Since July, there have been net withdrawals of 46,000 BTC (about $1.8 billion at current rates) from all crypto exchanges.

According to data from blockchain analytics firm Glassnode’s March 7 newsletter, only Binance, Bittrex, Bitfinex, and FTX have witnessed net positive inflows of 207,000 Bitcoin (BTC). During the same time period, net outflows from all other exchanges tracked reached 253,000 BTC.

Bitcoin HODLers are the most fanatical when it comes to self-custody and, as a result, are the most likely to withdraw their money. New investors, on the other hand, are much less likely to remove coins, preferring the ease of custody and trading opportunities given by exchanges.

Similarly, institutional treasuries are more inclined to choose exchange custody solutions, preferring the knowledge and risk management that such organizations provide. These coins are also more likely to be traded over-the-counter (OTC) and held in multi-signature wallets.

Bitcoin units can now be used as collateral in futures markets, therefore exchange inflows could be a result of giving greater coin margin.

Despite a modest bias towards inflows this week, exchange net-flow volumes have remained rather constant during the highly tumultuous macro and geopolitical developments of the last few weeks. This week, exchanges received around 1k BTC per day in net inflows, with Bitfinex and FTX taking the lion’s share.

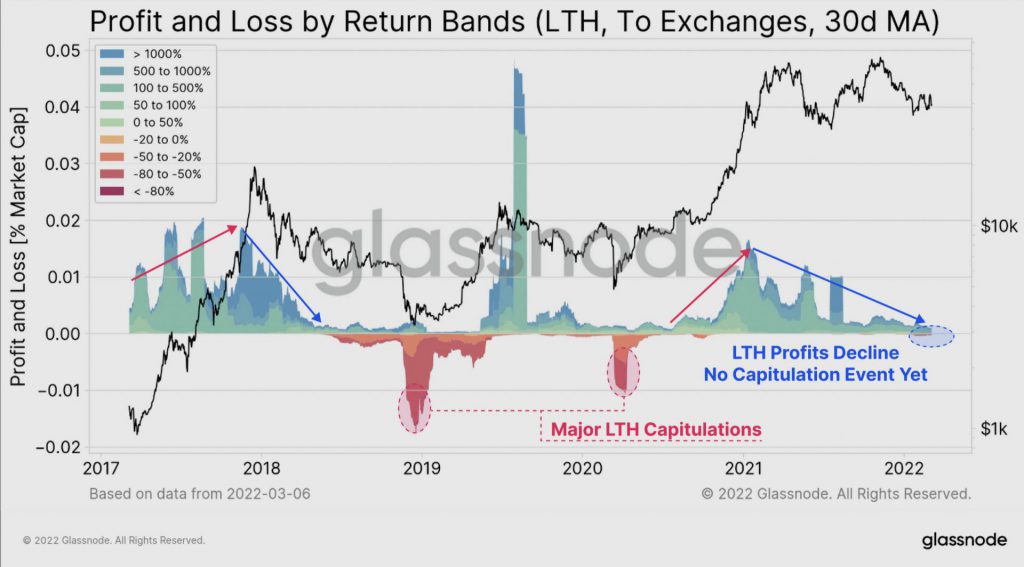

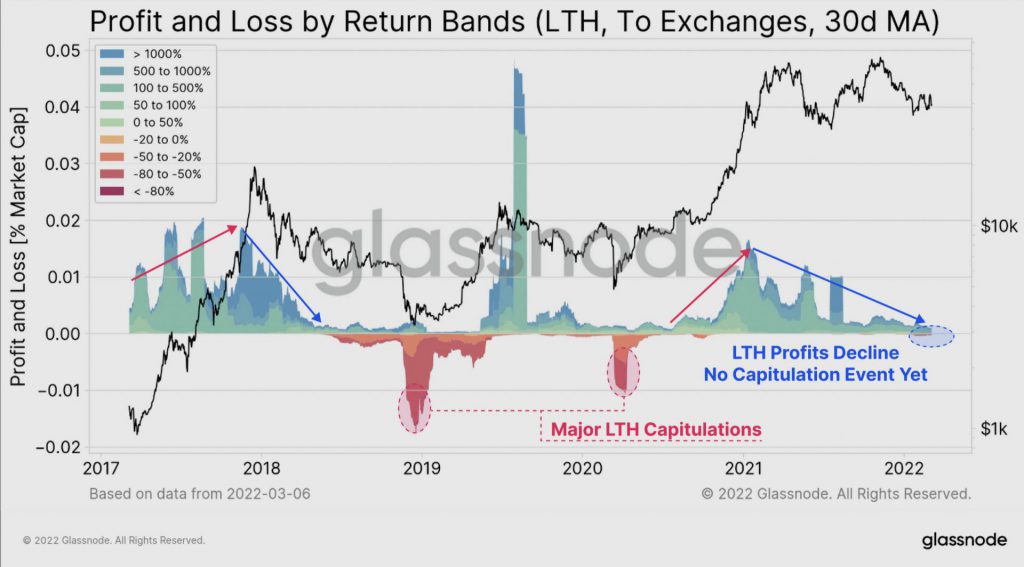

Profit and Loss ratio

The profit and loss (PnL) ratio of sellers has been flattening since the beginning of 2021, in addition to the low amount of inflows and outflows. Long-term holders (LTH) are becoming tired of selling, according to Glassnode, while stating;

“We are yet to see a major LTH capitulation event as was seen at previous cyclical bottoms.”

The newsletter warns that the risk of a final and full capitulation of both STH and LTH, which has occurred at prior cycle bottoms, still exists.

Short-Term Holders have dominated the activity of selling coins that have been held at a loss by investors who are divesting. Meanwhile, the sell-side of the Long-Term Holder has been declining since January 2021, indicating rising conviction in the face of significant economic uncertainty.

FTX and Binance, in particular, have witnessed a large growth in market share since the advent of derivative markets. This adds to the market’s preference for using futures to hedge risk rather than selling spot BTC to decrease exposure.