It is difficult to ignore the financial markets during an ongoing geopolitical event. The situation in Ukraine is getting worse by the hour and the crypto markets have continued to demonstrate a reaction. Over the past 24-hours, the charts were peculiarly positive. Bitcoin registered a spike of 11.50% over the past 30-hours, reaching a high of ~$40,000 from $34,400.

However, during the same period, Russia’s invasion of Ukraine took a dire turn as attacks were reported near the capital city of Kyiv. Hence, it was unclear what may have caused market recoveries. Now, the question remains; Is this period of recovery sustainable?

Recovery or Volatility; Choose your Reason

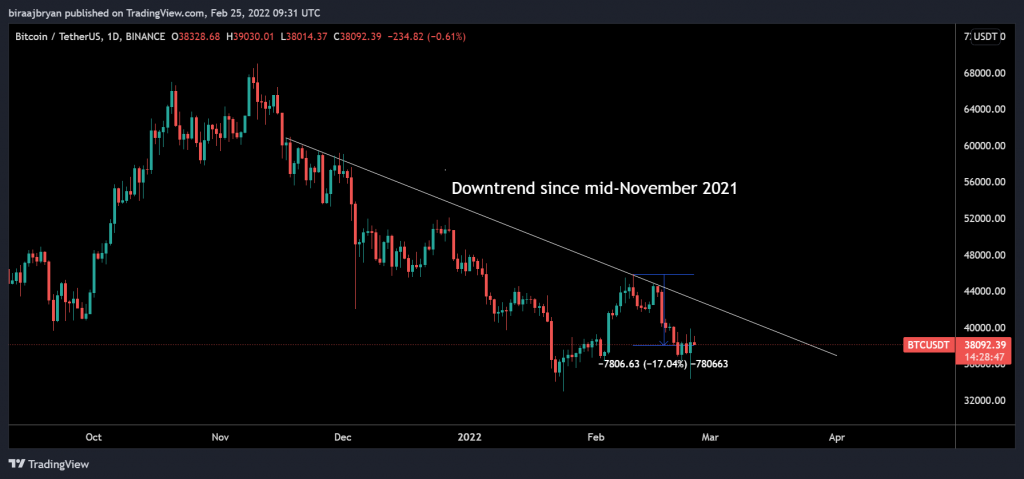

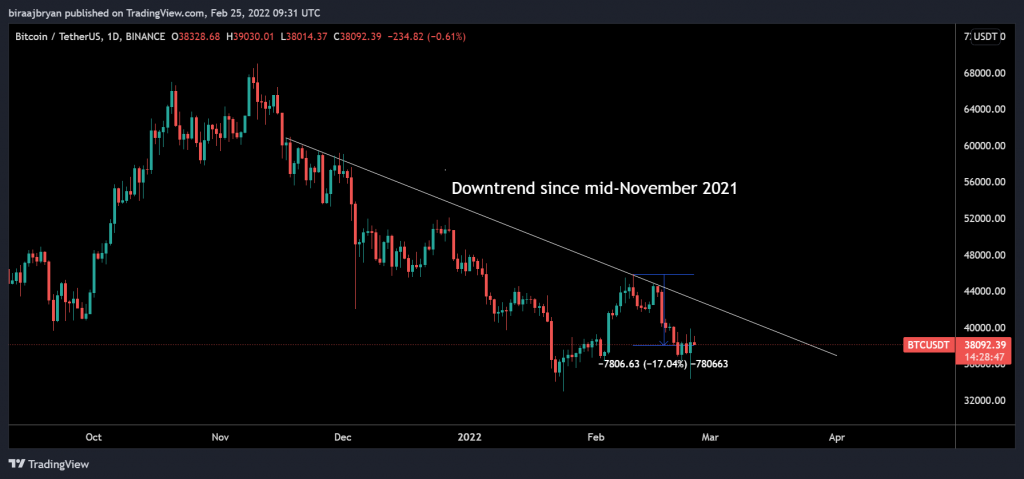

A consolidation near the $40,000 mark is pretty for Bitcoin, but the larger picture should not be ignored. Since February 10th, Bitcoin is still down by 17% at press time, and yesterday’s recovery did little to alter the bearish downtrend.

Hence, it is important to analyze the prevalent factor than price charts; Cue Volatility. A fickle market is a constant reminder that geopolitical events cannot be predicted and right now, the collective financial sector is the prime example. However, there are a few key examples that may ease investors’ anxiety.

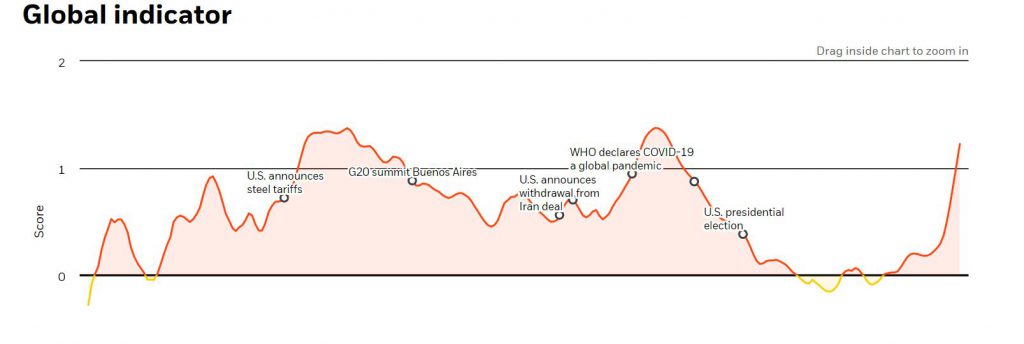

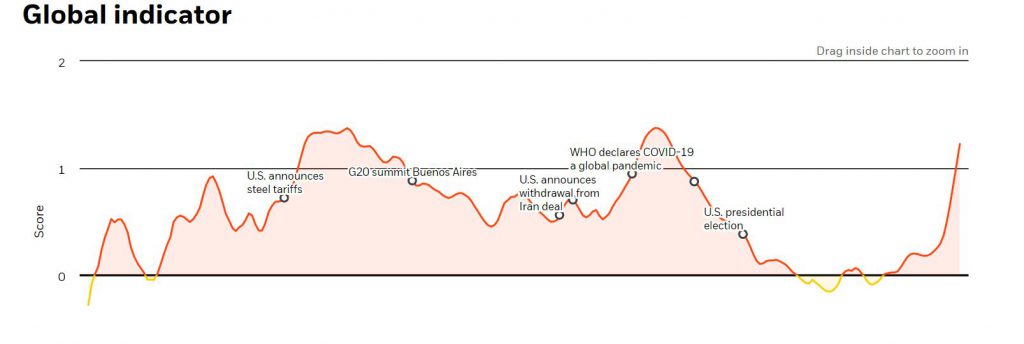

Back in March 2020, it was observed that cryptocurrency markets recovered fast from the Pandemic Crash. After the initial shock wore down, the price rebound was impressive. Now, according to Blackrocks’ Global Risk Indicator, the intensity of the Pandemic and the current War/Conflict is fairly similar, as observed in the chart below.

Therefore, it isn’t beyond reason that Bitcoin can and may recover quickly from the current situation as well. For a complete outlook, let us gauge traditional market dependence and correlation.

Bitcoin and SPX correlation pulling strings?

One of the major talking points over the past few days is that Bitcoin isn’t acting like a commodity or safe-haven asset. Its all-time high correlation with SPX has investors idolize the digital asset more towards a tech stock.

Now, while SPX and Bitcoin may recover collectively from here on, it is important to inculcate the situation for Eastern European Currencies. Russian stock market index was down by a whopping 44% at one time, and destabilization of the Eastern European financial system could be in full swing.

Therefore, now, it is being speculated that a larger group of investors in Russia and Ukraine, could be looking at other alternatives, and Bitcoin might be one of the options. It is a massive claim but not off-limits. As indicated above, past market projections suggest that BTC does tend to recover fast during uncertain times, and this might be one of those situations yet again.

Sanctions on Russian Banks; Push come to Shove?

In light of the earlier argument, the case for utilizing Bitcoin further strengthens as heavy sanctions are currently being pledged against Russian Banks and businessmen. According to reports, halting fundraising abroad, the $11 billion gas pipeline project to Germany, and limitation to high-tech items such as semiconductors have already been carried forward.

With foreign investors currently coy with Russia, the present autocratic regime may have to turn towards Bitcoin as a solution. However, there hasn’t been any activity yet. According to Caroline Malcolm, Chainalysis’ head of international policy, Russian crypto exchanges haven’t registered any spike in unusual volumes over the past few days.

Additionally, she also added that it is a complicated process to bypass sanctions using decentralized assets if the sum is a significant amount of capital. Organizations will be monitoring such activity on the other side. The parent company may also refuse to transact in such wallet addresses entirely. While Bitcoin can be used to bypass these sanctions theoretically, it is a whole different situation when it comes to practical implementation.