The crypto market stepped into Tuesday on a positive note. Bitcoin, Ethereum, and other top alts like Dogecoin pocketed in 3% to 10% gains each. The aggregate valuation of all crypto’s stood at an elevated 5% at press time compared to Monday.

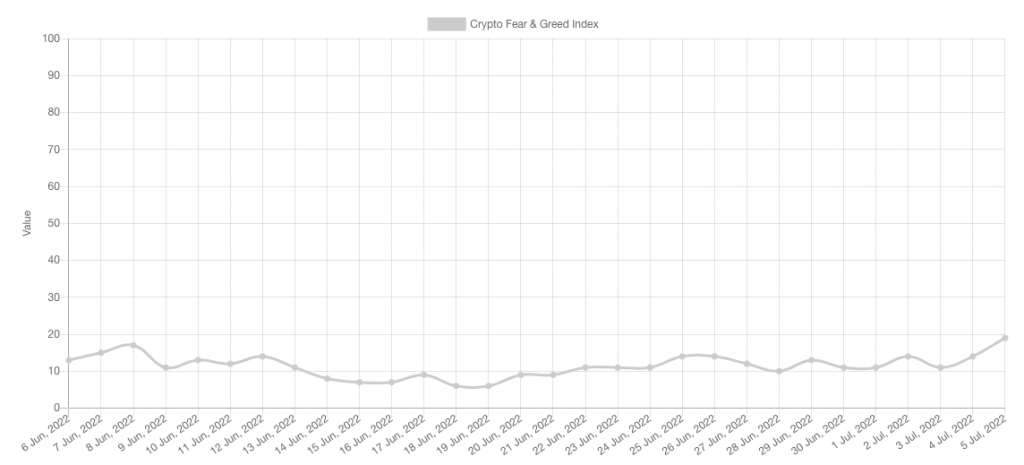

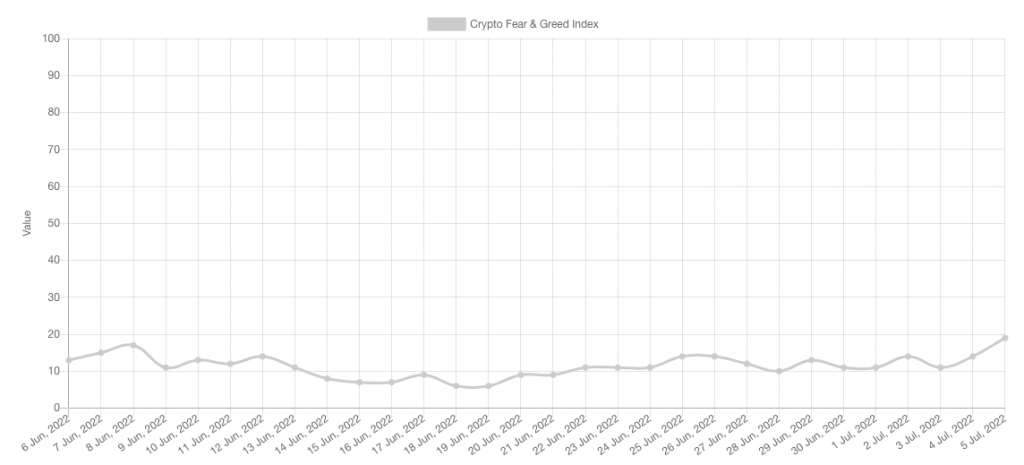

The recent price rise has reduced the intensity of fear in the market. The Fear and Greed Index’s reading has inclined from 11 to 19 since 3 July.

Market participants have jumped into the crypto arena and amassed tokens whenever this metric rebounded from its lows. Keeping the current state in mind, it can be speculated that investors might soon start encashing on the buying opportunity.

‘Good’ opportunity to buy Bitcoin, Ethereum, Dogecoin?

Investors from the East strongly believe crypto is a good investment opportunity at this stage. As reported yesterday, millennials in the US prefer investing in crypto rather than other investment vehicles like mutual funds.

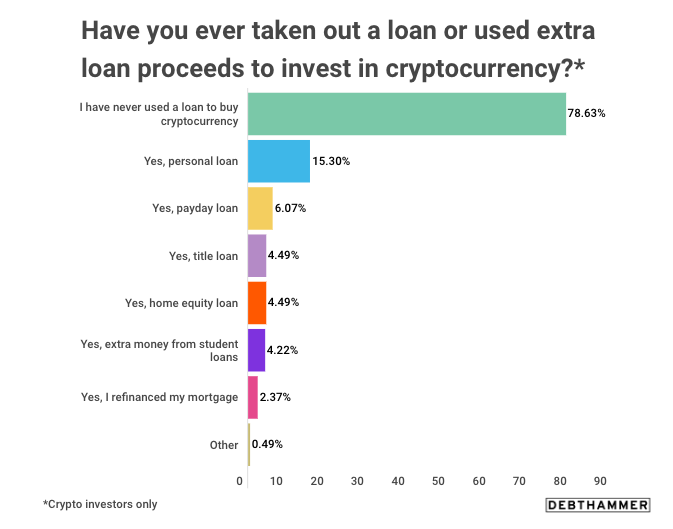

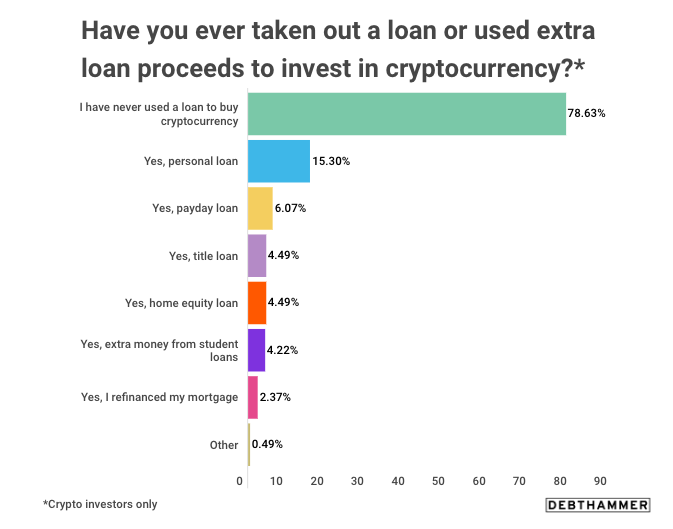

Another recent survey from DebtHammer showed that a substantial number of retail investors in the US have been borrowing money to buy crypto.

Per the survey, around 21% of the respondents said they had used a loan to pay for their crypto investments. Personal loans were the most opted option [15%] and were followed by payday loans, title loans, mortgage refinances, home equity loans, and leftover student loan funds.

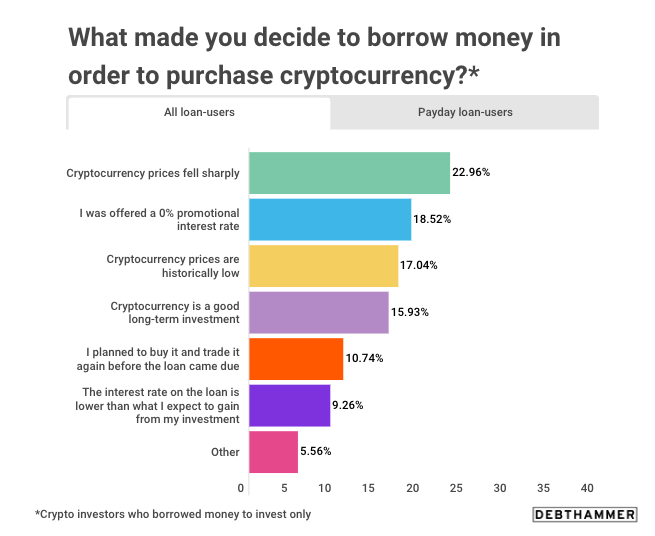

The drop in crypto prices was one of the main reasons investors were flocking into the crypto market. Apart from that, about 15% stepped into the crypto waters because they considered it an excellent long-term investment.

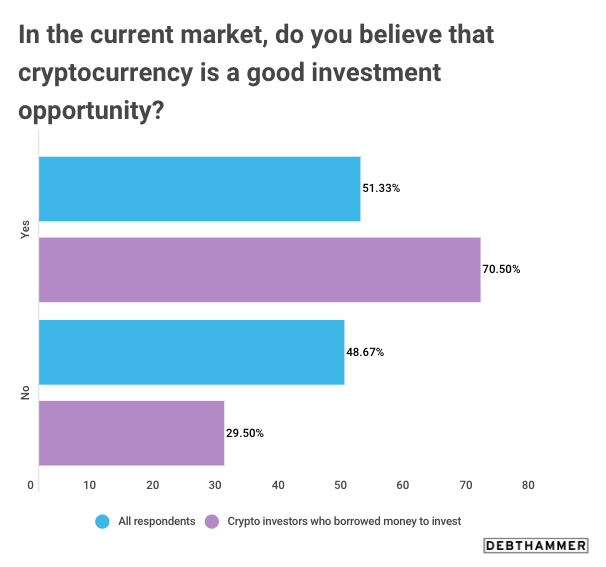

There was a relatively split among investors who believed that crypto provided an excellent investment opportunity in the current market. However, the investors who had taken a loan to buy crypto were even more optimistic.

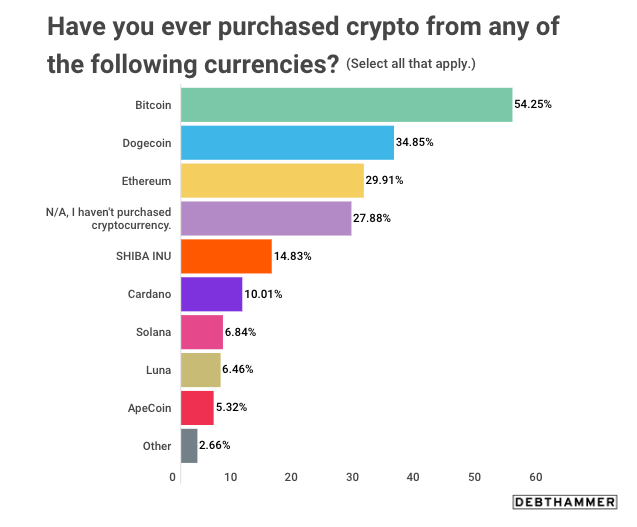

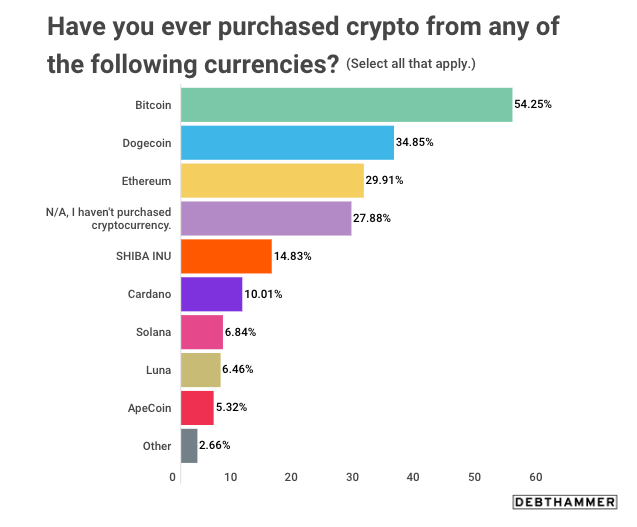

Most of the borrowed funds were diverted towards merely a handful of cryptos. The survey highlighted that Bitcoin, Dogecoin, and Ethereum were the most picked coins.

“Bitcoin is the No. 1 investment for 54% of respondents, but Dogecoin comes in second at 35%. Overall, Bitcoin, Ethereum and Dogecoin are the top three.”

Word of caution

Taking loans to buy crypto is a sign of conviction among investors. Experts, however, warned against this. Merav Ozair, blockchain expert and fintech professor at Rutgers Business School, said,

“Never take a loan to invest. Only invest money you have to spare,” says Ozair says potential investors should never leverage an asset — like their home or car — on a speculative investment.”

She added,

“A lot of people think they can become a millionaire in a day, which never happens.”