Argentina’s stablecoin adoption is rising fast. The country faces an economic crisis, and Latin America’s third-largest economy now relies heavily on crypto. Citizens use stablecoins to protect against inflation and currency devaluation.

Also Read: Wall Street Bear Turns Bullish on Stocks After 2-Year Downturn

The Rise of Stablecoins: How Argentina Adopts Crypto Amid Economic Crisis

Argentinians turn to stablecoins as a financial safeguard. Recent data shows a clear trend in the country’s crypto use.

Stablecoins Dominate Argentine Crypto Transactions

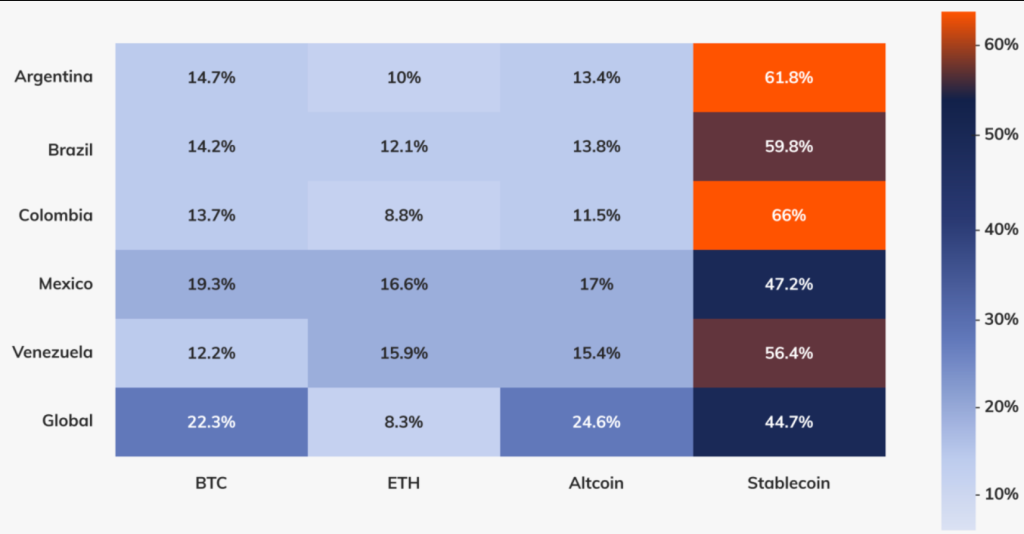

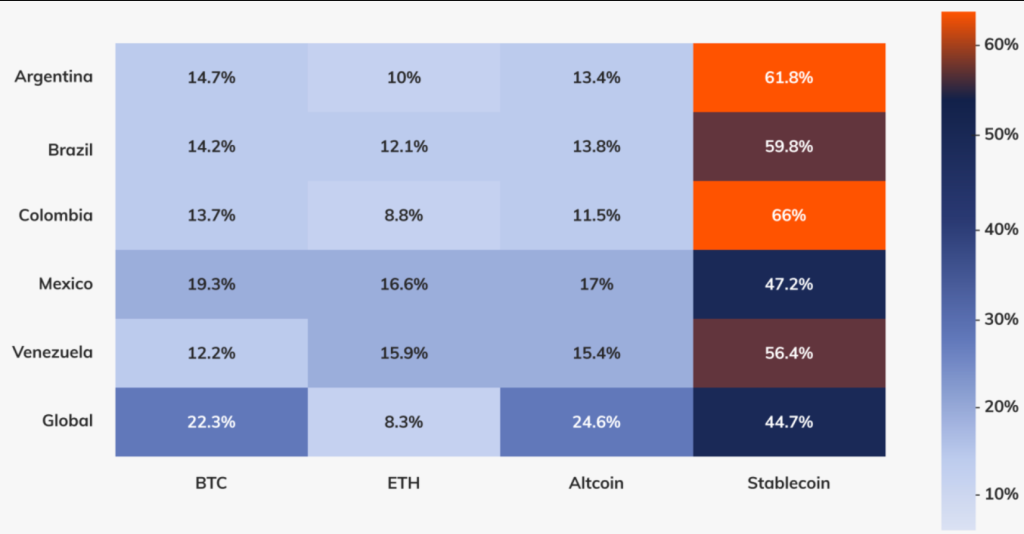

A Chainalysis report reveals stablecoins make up 61.8% of all crypto transactions in Argentina. This is 17% higher than the global average. It makes Argentina one of the world’s largest stablecoin markets.

This chart shows Argentina’s high stablecoin use compared to other Latin American countries and the global average.

Economic Factors Driving Stablecoin Adoption

Argentina’s stablecoin boom stems from its poor economy. Inflation hit 236.7% in the year to August 2024, pushing over half the population into poverty.

“The correlation between peso devaluation and a spike in stablecoin trading on exchanges really indicates how crypto is used as a financial hedge in turbulent markets,” a Chainalysis researcher noted. “That speaks, in many ways, to an ability of citizens to make independent choices about their financial futures, free from any force of official monetary policies.”

Regional Comparison and Crypto Growth

Argentina leads in stablecoin adoption, but it’s not alone. Colombia tops the list with 66% of crypto transactions in stablecoins. Brazil follows at 59.8%.

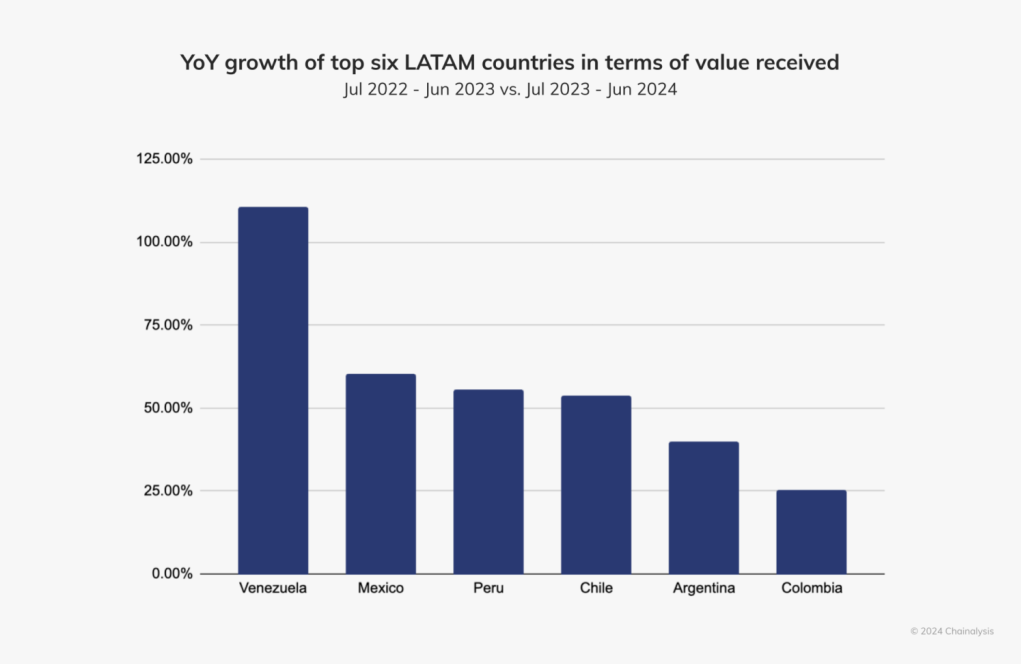

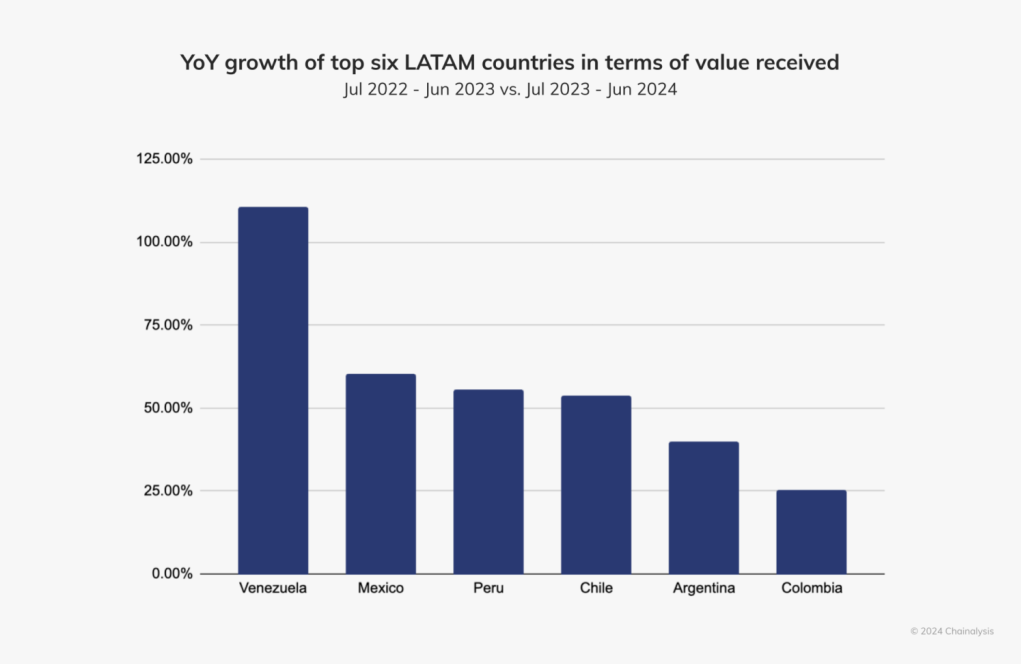

This chart shows yearly growth in crypto value received across Latin American countries.

Also Read: Vistra (VST), Utility Stocks Fall From Record Highs to Start October

Crypto Transactions Reach New Heights

Argentina now outpaces Brazil in crypto use in Latin America. From June 2023 to June 2024, Argentina’s crypto transactions totaled about $91.1 billion, slightly beating Brazil’s $90.3 billion.

This rise in crypto use comes as President Javier Milei takes drastic steps to fix the economy, including a major devaluation of the peso.

The Future of Stablecoins in Argentina

As economic troubles continue, stablecoins will likely stay popular in Argentina. They offer citizens a way to protect their money from inflation and instability.

“The interest in stablecoins among Argentinians highlights the role of cryptocurrencies in unstable markets and how citizens can better control their financial future by adopting cryptocurrencies, regardless of official monetary policies,” a Binance spokesperson commented.

Also Read: Nvidia: NVDA to Overtake Apple as Most Valuable Company?

Argentina’s stablecoin adoption keeps growing, showing how digital currencies can help in tough economic times. As Argentina deals with its economic crisis, stablecoins will play a key role in shaping its financial future.