Tokens from the DeFi market were one of the worst affected casualties of Bitcoin’s downswing. For its part, the king-coin witnessed a persistent downtrend from November to mid-January.

After creating a local bottom on 24 January at $32.917k, BTC began trying to overcome its immediate hurdle around $45.4k. Post subsequent failed attempts in February and the beginning of March, the coin is back at the same juncture. At press time, after noting a 3% incline over the past day, Bitcoin was trading at $44k, right below its test level.

The sweet and sour DeFi-Bitcoin relationship

Over the past few months, the Bitcoin market and the DeFi market have moved in tandem. Both the markets fared reasonably well in October and peaked in November. In fact, their consolidation phases too concurred during the beginning of this year, and now, their uptrend too seems to be aligned.

The only minor decoupling phase was, however, noted towards the latter half of December, when DeFi’s market cap went on to re-rally while BTC’s price remained stagnated.

Ethereum whales pick DeFi

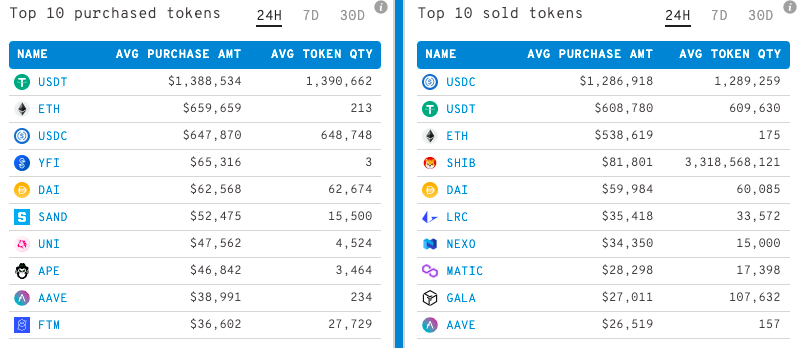

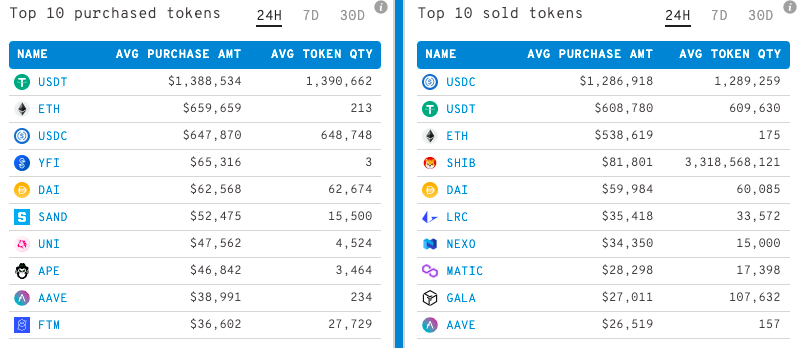

Over the past day, two of the most prominent DeFi tokens, Aave and Uniswap, made it to the top 10 purchased list by the top Ethereum whales. In effect, their respective prices have inclined by 9% and 6% over the past day.

Per WhaleStats’ data, Uniswap worth $47.5k was heaped by the said participants. The tale for Aave, nonetheless, seemed to be a little different. Despite witnessing purchases worth $38.9k, it witnessed sales worth $26.5k in the same period, bringing down the net value to merely $12.4k.

In fact, Santiment’s data too highlighted the increase in the number of whale transactions lately. Its tweet noted,

“The amount of whale moves will play a large part in whether the rally can continue. 7 $1M+ transactions were made today, indicating an early sign of potential profit-taking.”

Typically if prices are on the rise, and whale transactions are spiking, it implies profit-taking. On the contrary, if prices are falling, and whale transactions are spiking, it denotes accumulation (buying). Even though the same has not 100% been the case, late movements at least support the said narrative.

As can be noted from the chart below, post every spike on the whale transaction metric [red], Aave’s price [green] has ended up tumbling. Thus, expecting this DeFi token to continue rallying post the profit-booking phase, seems to be a little unrealistic from a technical perspective.

Keeping Bitcoin and the DeFi market’s co-related movements in mind, the re-emergence of whale interest w.r.t. to DeFi tokens doesn’t necessarily come as a surprise. But now, with Bitcoin flashing signs of a potential correction, the DeFi market can be expected to react in a similar fashion. Alongside, with the profit booking and sell pressure increasing, tokens like Aave can be expected to follow suit.