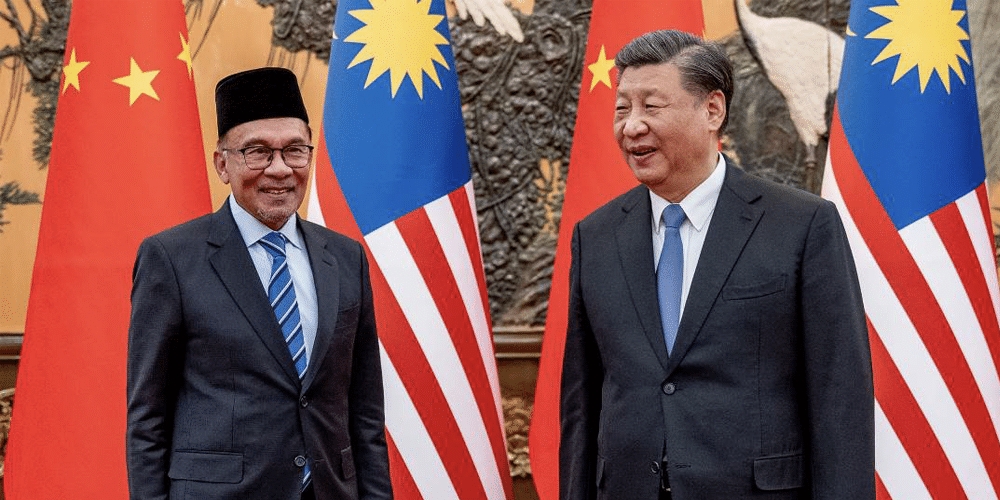

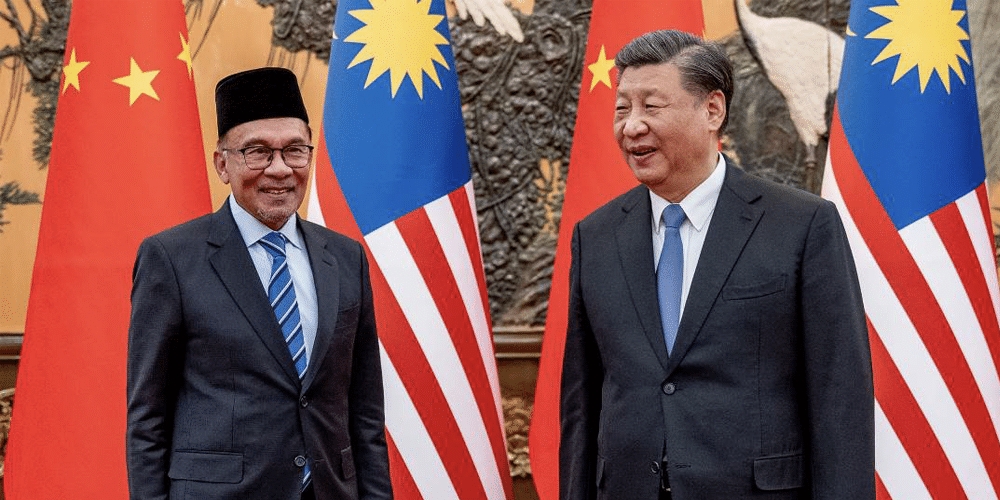

The US dollar has many foes, and it seems that the prominent ASEAN nation Malaysia has now joined the queue to echo the de-dollarization narrative. Malaysian Prime Minister Anwar Ibrahim, recently on his visit to China, floated the idea of reviving the Asian Monetary Fund to decrease the nation’s dependency on the US dollar.

Also Read: New ASEAN Country Ditches The US Dollar For Trade

Malaysia’s De-Dollarization Agenda Gains Momentum

It seems that Malaysia is now working tirelessly to form a robust relationship with China. The nation’s PM, Anwar Ibrahim, recently visited China, where he made comments about reviving the Asian Monetary Fund to end ASEAN nation Malaysia’s reliance on the US dollar. The move, at the same time, supports the growing expanse of the renminbi or yuan, giving it a chance to topple and rival the US dollar.

The Asian Monetary Fund as a concept was first introduced in 1997, in the wake of the Asian financial crisis. The idea hinged on forming an institution that would work towards establishing a regional network. A system funded by Asian countries to overcome current and future economic anomalies.

Ibrahim, who’s long been known as a staunch proponent of China, has also expressed his desire to join the growing BRICS alliance. Speaking about his decision to join BRICS, the Malaysian PM shared how he fully supports the global south and that he is ready to join the alliance.

“We have made our policy clear, and we have made our decision. We will start the formal process soon. As far as the Global South is concerned, we are fully supportive.” Ibrahim told Guancha.

The Malaysian president also shared his opinion of Xi Jinping, dubbing him an outstanding leader.

“When I first met President Xi Jinping, I was attracted to him because President Xi is one of the few outstanding leaders. The one who talks about civilization. In a sense, he is unique.”

Several experts have also weighed on Ibrahim’s comment on reviving the Asian Monetary Fund to end the ASEAN nation’s reliance on USD. He Weiwen, a senior fellow at the Centre for China and Globalization, shared how the step may be a long shot for Yuan to achieve and accomplish.

“It’s a long way to go for the yuan. He said while sharing that the proposed Asian monetary fund may help yuan internationalization. for example, cooperating with the Arab Monetary Fund, which was set up along similar lines.” As mentioned by Weiwan in SCMP

Yuan vs. US Dollar: Which Is Stronger?

Despite the growing echoes of de-dollarization spreading across the world, the US dollar remains the indisputable king of currencies.

According to Morgan Stanley experts, China will be required to relax control over its currency. By doing so, it may help push Yuan to sail past the US dollar. But this idea is something that the nation is not comfortable moving forward.

Also Read: India Aims To Earn $800 Billion From Exports to G7 Countries

“It seems unlikely to challenge the US dollar meaningfully anytime soon. To do so, we think China would need to relax control of its currency and open its capital account. It doesn’t seem likely that Beijing will want to do this anytime soon. As stated by James Lord, MG strategist

Speaking about the USD’s supremacy, James Lord, the bank’s head of FX strategy for emerging markets, shared how the US dollar will continue to remain the leading reserve currency of the world.

“Which currency would you want to own when global stock markets start to fall. And the global economy tends to head into recession? You want to be positioning in US dollars. Because that has historically been the exchange rate reaction to those kinds of events.”