Not a long time ago, Polkadot and its ‘sister protocol’ Kusama had everyone’s attention. Parachains and seamless interoperability were buzzwords, and to a certain extent, their development was credible. Yet, a bearish market undermined everything. Discussions slowed down, a massive 93% correction took place, and the community lost interest. In 2023, the DOT token is not setting the world on fire. However, true to its identity, the ecosystem has continued its deep development work. In this article, we will assess DOT’s current network credentials, and analyze its present status.

Also Read: Ethereum, Solana, Polkadot On-Chain Staking Enabled on Crypto.com

Polkadot: Q2 2023 Outlook

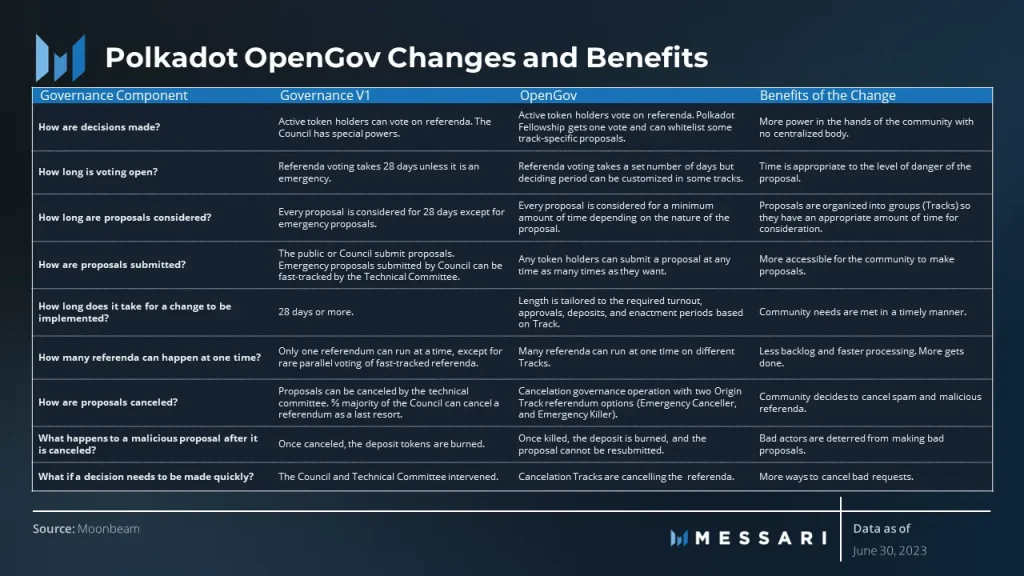

According to Nick Garcia, Messari analyst, Polkadot has taken major ‘strides on its roadmap’, which involves certain upgrades. DOT’s OpenGov is officially launched, which is a fully-decentralized governance protocol. Without getting into the technical bits, the objective of OpenGov remained a community-centric model, which will facilitate a democratic and efficient decision-making process.

Its Cross-Consensus Message Format or XCM is its other recent milestone. Launched on June 15, XCM V3 is expected to bring further improvements to communications between parachains and other consensus-driven protocols. The new update would improve fee payments, cross-chain locking, and NFTs support. Ideally, it is difficult to comprehend its importance in theory because, at the moment, non-asset transfer use cases accounted for only 18% of total XCM messages. Yet, it will play an important role in the Web3 phase since the idea remains to improve cross-chain communication.

Stake On It

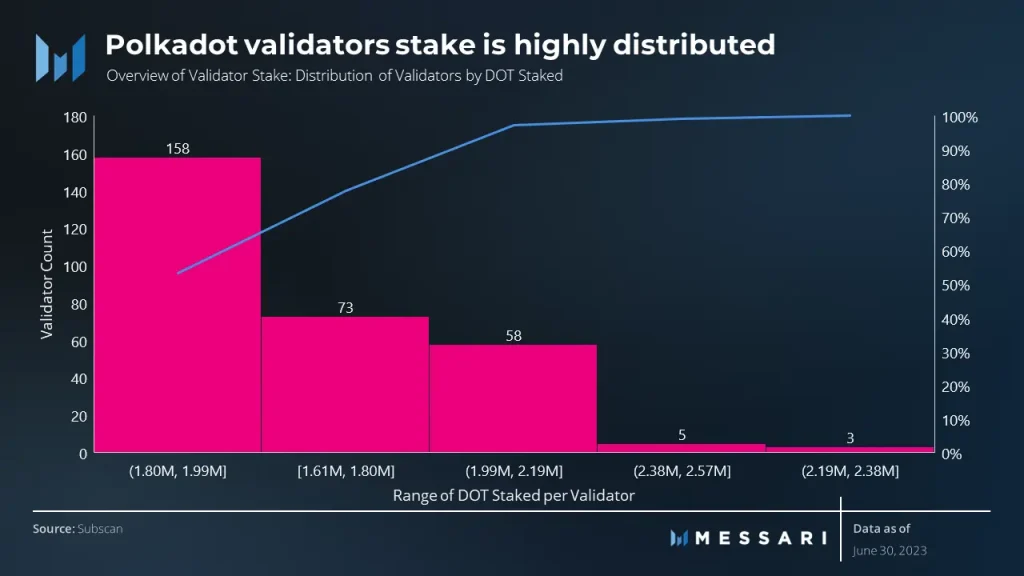

Staking is an activity widely popular with Ethereum but Polkadot’s NPoS should not be slept on. Unlike Ethereum, validators receive payments every 24 hours based on the completion of the payable activity. Now, a massive concern with staking activity is centralization. However, in Q2 2023, the active validator count for Polkadot remained stable at 297. According to the analysis,

“The validator reward model continued to demonstrate its effectiveness in promoting validator stake decentralization. Out of the 297 validators, 97% (289 validators) maintained stake amounts ranging from 1.6 million to 2.2 million DOT.”

This is Polkadot’s Major Advantage

While fundamental and technical traits are important, the digital asset’s image in front of the community plays a massive role. Consequently, the community or industry per se, also involves the regulators. In line with that, Polkadot received a major boost when the SEC did not mention DOT in this ‘securities’ list. DOT’s competitors were listed as well which included the likes of Solana, Cardano, and Polygon.

While SEC does not conduct the ‘cleanest’ assessment, DOT’s omission is a positive for the token. The price has not emulated bullish behavior yet, but a shift in market structure would place Polkadot, at a position of strength.

Also Read: 61 Crypto Including ADA, SOL, BNB Deemed as ‘Securities’ by the SEC