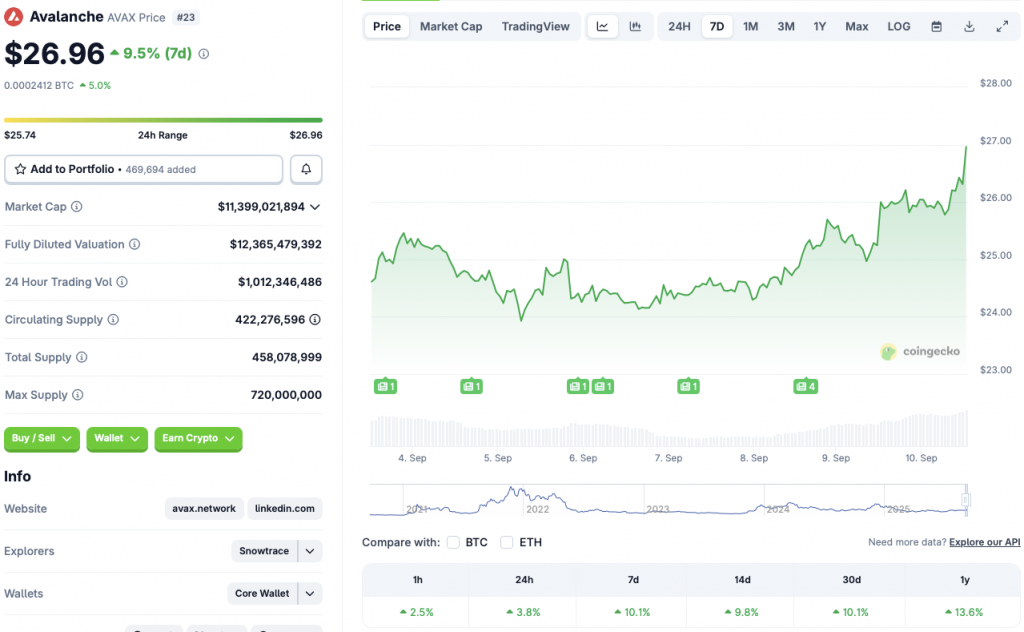

Avalanche (AVAX) is trading in the green zone across all time frames. As CoinGecko’s AVAX data reveals, the asset has rallied 3.8% in the daily charts, 10.1% in the weekly charts, 9.8% in the 14-day charts, and 10.1% over the previous month. AVAX’s rally comes amid other major assets facing slight corrections or plateauing. Bitcoin (BTC) reclaimed the $113,000 mark on two occasions this month, but has fallen to the $111,000 price point. Ethereum (ETH) is also facing substantial resistance at the $4300 level. AVAX seems to be making better progress than the two largest crypto projects by market cap. In this price prediction article, let’s discuss if Avalanche can sustain its rally or if it will face a correction.

Avalanche Price Prediction: Continued Rally or Correction?

AVAX’s latest price surge could be due to the project announcing a partnership with Toyota Blockchain Lab to build a blockchain-based robotaxi network. Robotaxis could be the next big step in the automobile space. Avalanche’s participation could lead to a boost in investor confidence. Toyota is one of the most recognized and successful automobile manufacturers. AVAX’s partnership with Toyota will likely lead to a rise in the brand’s value and image.

Another reason for the Avalanche’s price rally could be the high possibility of an interest rate cut later this month. There is a more than likely chance that the Federal Reserve will cut interest rates by 25 basis points after its next meeting. Avalanche’s price may continue to surge if interest rates fall.

Also Read: Fed Chair Powell: Current Conditions May Allow Interest Rate Cuts

According to CoinCodex AVAX analysis, Avalanche will continue to rally over the coming weeks, before facing a correction.

The platform anticipates the asset to hit $31.35 on Oct. 26, before falling to current levels by the end of November. AVAX’s price will rally by about 16.28% if it hits the $31.35 target.