Losses of 14% have now made Avalanche the biggest weekly loser among the top 15 coins by market cap, according to CoinMarketCap. This decline has brought AVAX’s price at a critical juncture on both the daily and 4-hour timeframe. As buyers and sellers engage at this price level, expect AVAX to trade sideways until a clear market trend develops. At the time of writing, AVAX traded at $104, down by 10% over the last 24 hours.

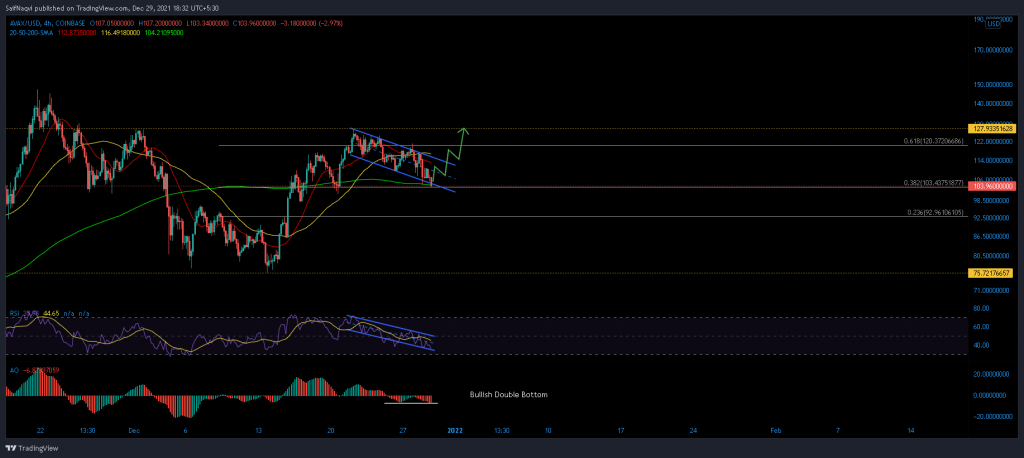

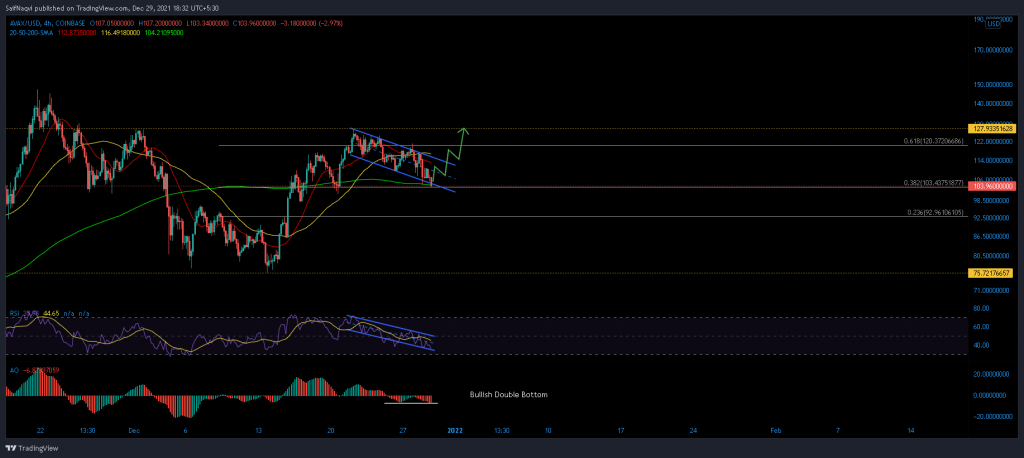

Avalanche 4-hour chart

AVAX has been on a downtrend since bagging a near 1-month high at $127 just a week ago. The price has formed three lower highs and three lower lows as a down-channel emerged on the lesser timeframe. Usually, the pattern leads to an upwards breakout as bulls initiate buy orders at reliable support levels.

Fortunately for AVAX, the bulls had a good chance to reignite a rally. The price traded close to the 200-SMA (green) and the 38.2% Fibonacci level, both of which functioned as support. This area was also significant on the daily time frame as it coincided with the 20-SMA and 50-SMA (not shown). A rebound from here would allow AVAX to retag its 18 December swing high of $117. Should AVAX close above its 50-SMA (yellow), and upwards breakout can even push AVAX by another 10% before sellers hit back.

On the flip side, a close below the 200-SMA (green) could quickly turn into unwanted losses. This would open the market to an 8%-11% sell-off before buyers respond around the $92-support.

Inidcators

An expected recovery stemmed from some interesting observations on the Awesome Oscillator and RSI. The Awesome Oscillator formed a bullish double bottom pattern – a setup that usually invites buying activity. The RSI was also close to the oversold zone and awaited a down-channel breakout as well.

Conclusion

AVAX is in a prime position to rebound as its price traded close to the 200-SMA (green). Aggressive buy entries can be made at AVAX’s press time level and take profit can be set at $128. This would allow investors to bag a 24% profit over the coming week. Safer bets can be placed once AVAX registers a daily close above $103.