The digital revolution has been going on passively for quite some time. Falling at the intersection of finance and technology, CBDCs are an integral tangent to both. At the moment, 100+ countries, representing over 95% of the global GDP, are exploring a CBDC.

Earlier this month, the Bank of England officially launched its digital pound CBDC project as a “new form of money,” for households and businesses. An official consultation paper by the Bank and the HM Treasury chalked out different facets of the digital pound.

Now, a Bank of England official has reiterated claims that novel technologies like digital currencies could bring profitable opportunities to the table for businesses.

Also Read: UK Treasury Seeking CBDC Head to Develop Digital Pound

Also Read: Bank of England Launches Digital Pound CBDC Project

UK’s Central Bank keen on digital payment tech

The Deputy Governor for Monetary Policy, Ben Broadbent, revealed that the UK central bank’s “keenest attention” revolved around the regulatory inferences of emerging payment technologies. During a BOE research conference, the official reportedly said,

“The experience of digitalization so far is that new products and services enabled by new technologies can be adopted very rapidly at scale. This obviously brings opportunities for financial institutions, businesses, for individuals. We would expect to see continued improvements, reductions in friction and cost of payment.”

According to the central bank’s paper on the project, the digital pound will “sit alongside, not replace, cash.” Moreover, the intention of the digital pound is to “ensure that central bank money remains available and useful in an ever more digital economy.”

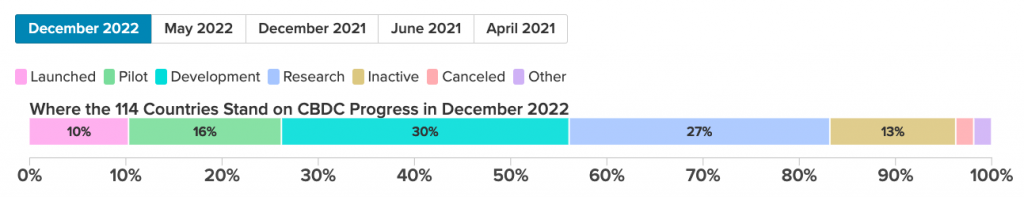

Dubbed “Britcoin,” UK’s digital pound, CBDC, shouldn’t be confused with crypto assets like Bitcoin, for it would be backed by central bank reserves. As far as the macro picture is concerned, 30% of nations testing a CBDC are in the development stage. Furthermore, according to the Atlantic Council’s CBDC tracker, a similar number of countries are in the research stage.

Also Read: Bank of England Deputy Governor States the Necessity of Digital Pound

People all over the world are becoming less reliant on cash as their digital inclination grows. In such a scenario, e-versions of currencies, like the digital pound, are primed to turn out to be handy for both retail and wholesale users.

Also Read: Would CBDCs eventually lead to the demise of Crypto?