Basic Attention Token’s [BAT] price has been on a downtrend since the end of November last year. In fact, for the most part of 2022, BAT has been trading below its moving averages – a crystalline sign of weakness.

As a result, this token’s market cap has eroded by $1.6 billion in a period of fewer than 4 months. For context, the cumulative value of all the BAT tokens was worth $2.6 billion on 27 November 2021. But now, the same has shrunk down to merely $1 billion.

Have things started shaping up for BAT now?

Amidst the humdrum state of the broader market, Basic Attention Token has managed to register three back-to-back green candles on its daily chart and is on the verge of breaking above its downtrend strip.

Consequentially, BAT’s valuation has inclined by over 7% in the said timeframe.

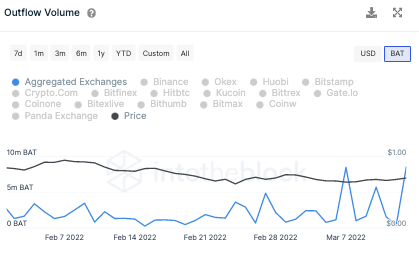

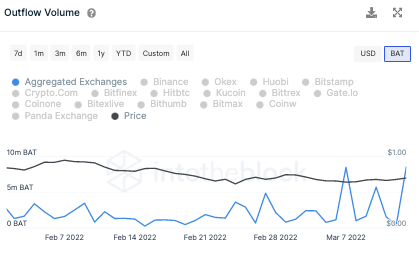

The said hike has been organic and has been accompanied by an increase in the exchange outflow volume. A spike in this metric usually points towards the movement of tokens from exchanges into private wallets and cold storage. In fact, the same also indicates the establishment of buy-side momentum.

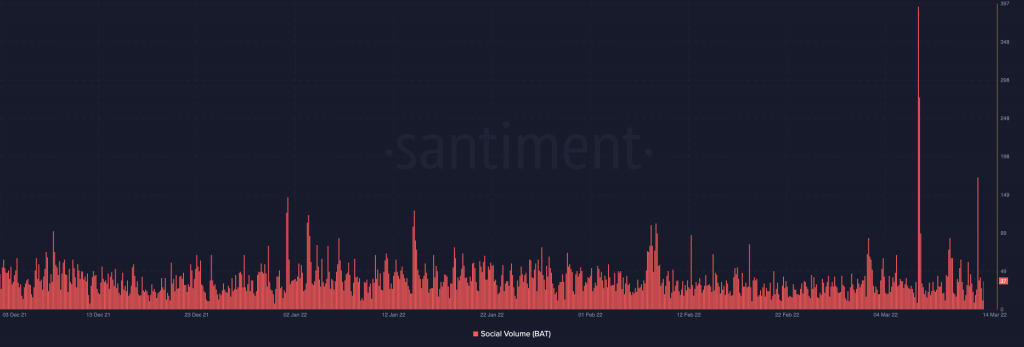

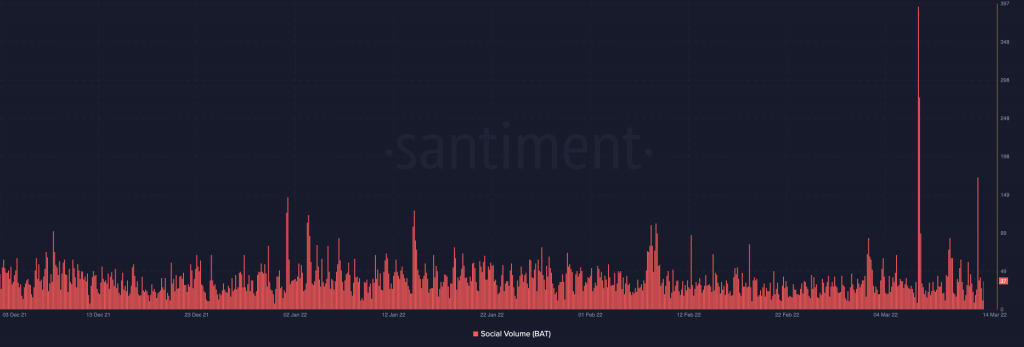

Further, the social sentiment associated with Basic Attention Token has also tremendously ramped up of late. As can be observed from Santiment’s chart attached, the spike registered yesterday [13 March] was the second-highest since December last year.

The same suggests that the community interest with respect to Basic Attention Token has been brewing. In the past, price trend reversals have more or less coincided with spikes noted on the social volume chart. Thus, if the community continues showing interest in this token, its uptrend might take an even more concrete shape going forward.

The healthy indications on the metric front do hint at a price trend reversal. However, the same must be taken with a grain of salt, for BAT’s performance would also depend on how the broader market performs.