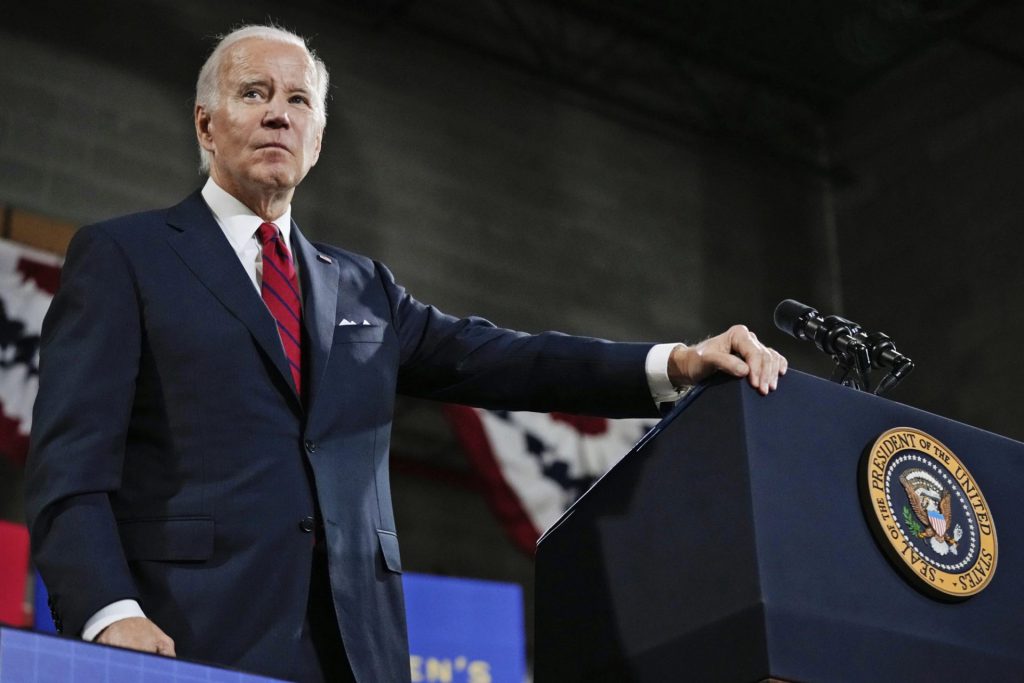

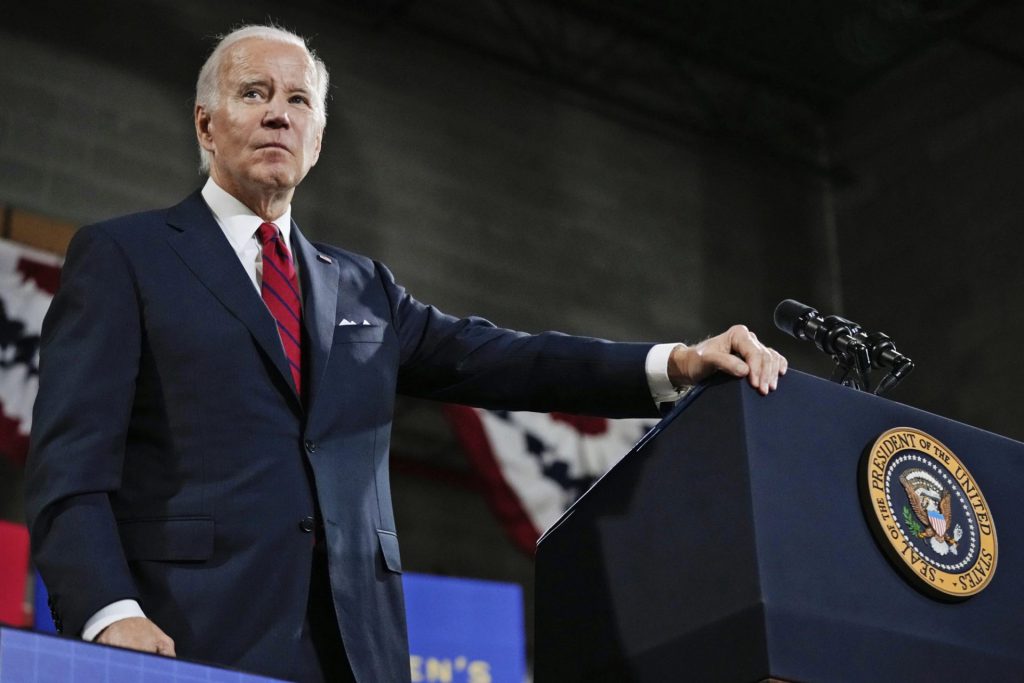

US President Joe Biden is set to implement a new federal rule to increase payments to homebuyers with good credit. Moreover, the federal decision to incur higher fees against better credit scores aims to subsidize more risky mortgages.

The increase will go into effect on May 1st as part of the Federal Housing Finance Agency’s affordable housing endeavor. Additionally, the plan will affect mortgages originating at various private banks throughout the United States.

Biden Plan Penalizing Homebuyers with Good Credit

There is little argument to be made about the difficulty of the state of the US economy. Yet, as inflation rates continue to affect citizens, a new Biden plan will increase payments for homebuyers with good credit. Moreover, the federal rule seeks to subsidize risky mortgages.

The new change is coming from the Federal Housing Finance Agency’s affordable housing plan, according to the Washington Times. Additionally, federally backed mortgage companies, Fannie Mae and Freddie Mac, are enacting loan-level price adjustments, or LLPAs.

The report noted that mortgage specialists expect homebuyers with credit scores above 680 to pay more. Specifically, by facing a $40 per month increase on a home loan of $400,000. Conversely, homebuyers with down payments between 15% and 20% will face the largest fees.

The changes will apply to any Americans who are either buying or refinancing a house after May 1. Moreover, there is an expectation that the changes will have an effect on homebuyers. Subsequently, punishing those who have maintained a healthier financial position.

The development will undoubtedly impact an already struggling housing market. Specifically, by deterring those in positive and healthy financial circumstances from refinancing or buying new homes. Compounding a market already hit hard by interest rate hikes executed by the Federal Reserve.