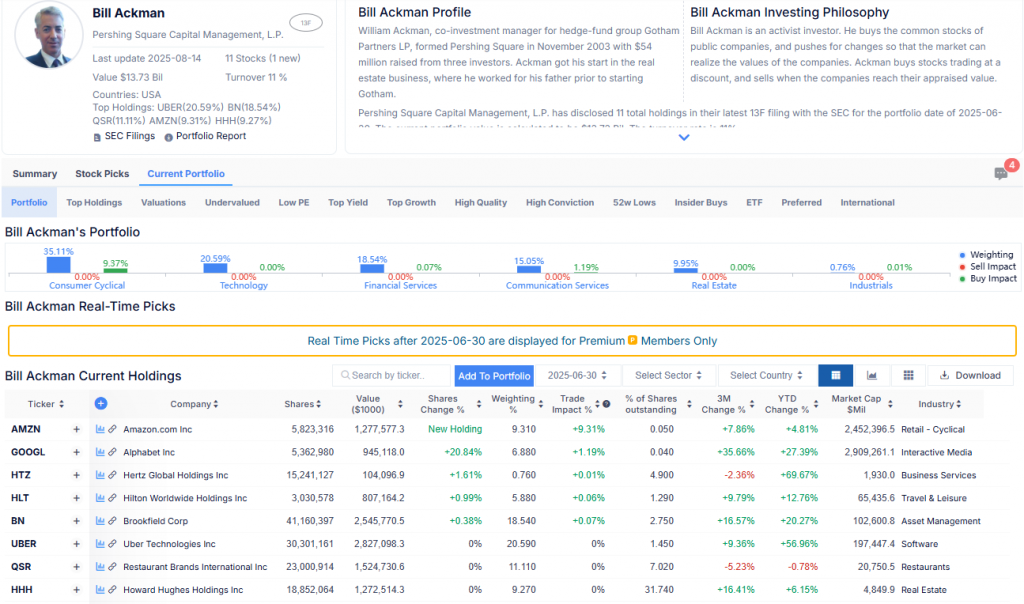

Bill Ackman has actually concentrated around 45% of his $13.7 billion Pershing Square portfolio into three key AI stocks right now: Uber Technologies (21%), Alphabet (15%), and also Amazon (9%). This massive $6 billion bet represents the billionaire’s aggressive positioning for the artificial intelligence revolution that’s happening.

Bill Ackman News On Portfolio 2025, Stocks, And Performance Insights

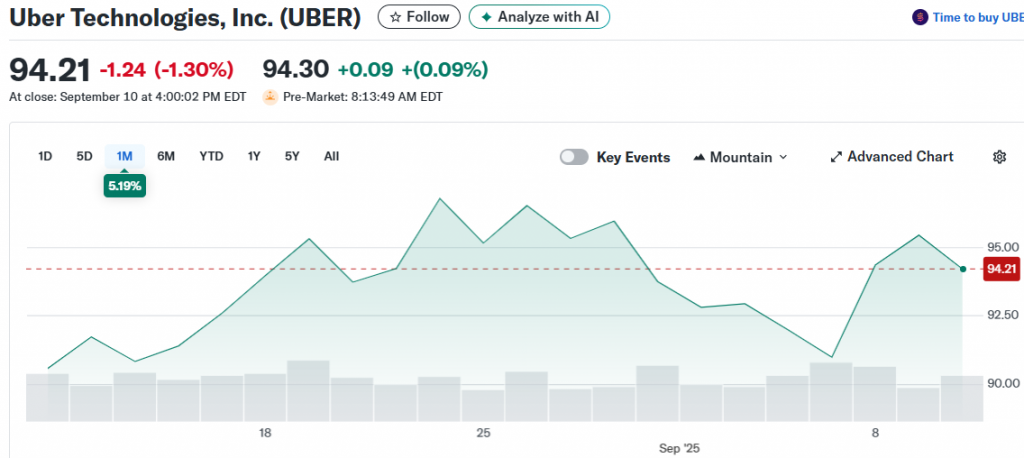

Bill Ackman’s Uber Investment Dominates Portfolio

Ackman’s largest holding, Uber Technologies, actually accounts for over 21% of his portfolio value right now. The ride-sharing leader has been transformed from an unprofitable growth story into a profitable platform, and the global ride-sharing market is expected to grow from $87.7 billion in 2025 to even $918 billion by 2033.

Ackman stated:

“Uber stock can be purchased at a massive discount to its intrinsic value”

Uber maintains around 76% of the U.S. ride-share market and operates what’s considered the world’s largest ride-sharing platform, which positions it perfectly for autonomous vehicle partnerships and such collaborations.

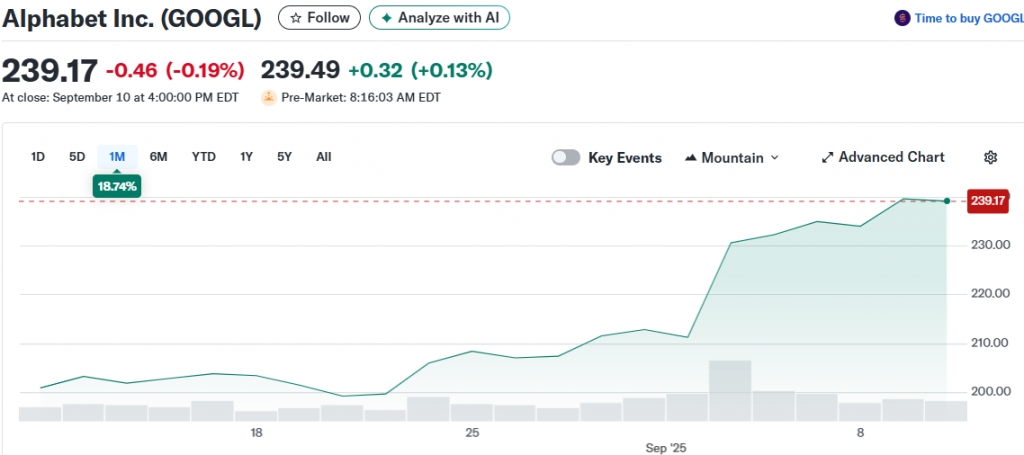

Bill Ackman Increases Alphabet AI Exposure

Bill Ackman holds over 15% of his fund in Alphabet through both Class A and Class C shares, actually increasing his position by 21% in Q2 2025. The Google parent company trades at just 20 times forward earnings, making it the cheapest among the Magnificent Seven stocks.

Despite some regulatory challenges, Ackman recognizes Alphabet’s AI leadership along with its dominant search market share of 89-93% worldwide.

Also Read: 3 Stocks That Built the World’s Richest Men and Beat Nations’ GDP

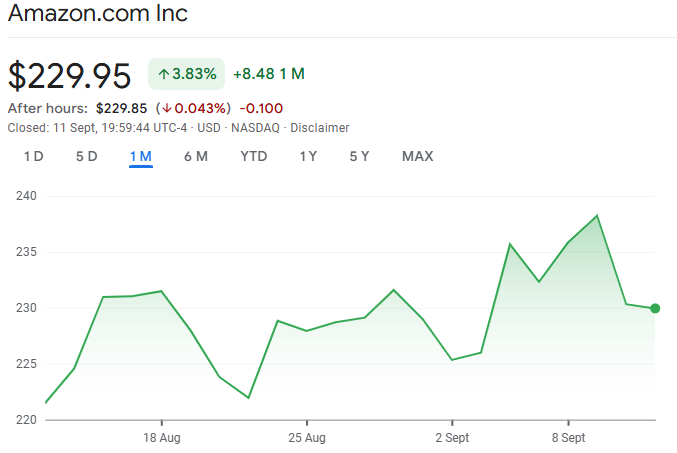

Amazon Represents Ackman’s Newest AI Play

Bill Ackman purchased 5.82 million Amazon shares worth $1.3 billion in Q2 2025, making it his fourth-largest holding at 9.3% of the portfolio right now. Amazon Web Services commands around 30% market share in cloud infrastructure, while the retail business processes over 100 million products.

Pershing Square’s chief investment officer Ryan Israel had this to say:

“We strongly believe in its two core businesses: Amazon Web Services and the large retail e-commerce business”

Ackman’s concentrated AI strategy reflects his high-conviction approach, and Pershing Square has been beating the S&P 500 by 7 percentage points over the past year. The $6 billion AI allocation positions Bill Ackman to capitalize on artificial intelligence adoption across transportation, cloud computing, and also digital advertising sectors.

Also Read: Nasdaq Files with SEC to Allow Tokenization, Blockchain Listing of Stocks