Nvidia is leading the AI revolution as billionaire Paul Tudor Jones sells all Palantir holdings and boosts his NVDA stock position. The Tudor Investment founder’s move shows strong faith in Nvidia’s leadership and new products, making NVDA a key player in AI computing growth.

Market analysts view this shift as a significant indicator of changing investment priorities in the tech sector.

Also Read: Central Bank Digital Currencies Set to Surge 2,430% by 2031

How Paul Tudor’s Move Impacts Nvidia, AI Stock, and Market Trends

Tudor’s Massive Portfolio Shift

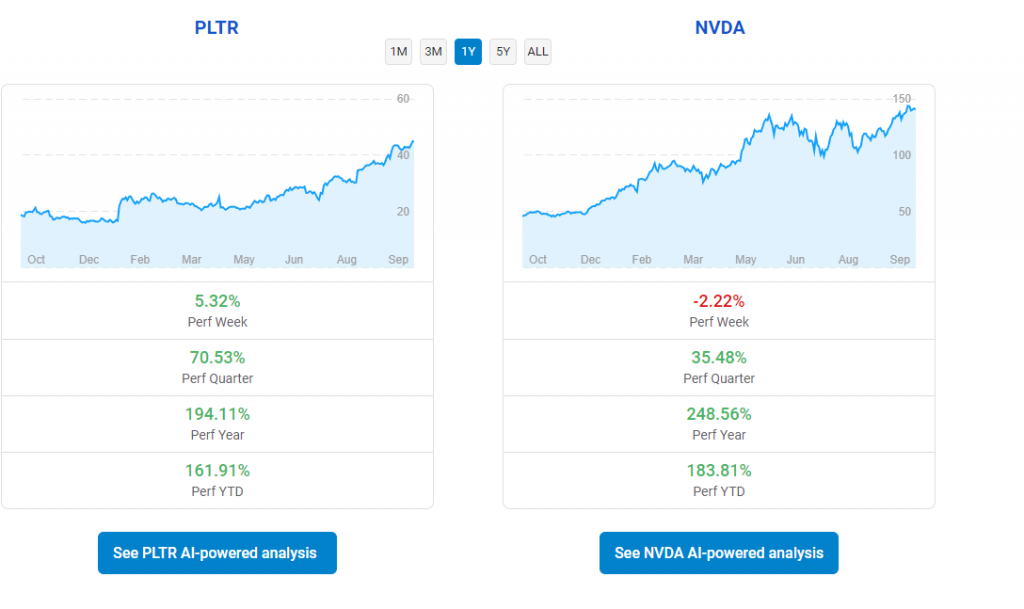

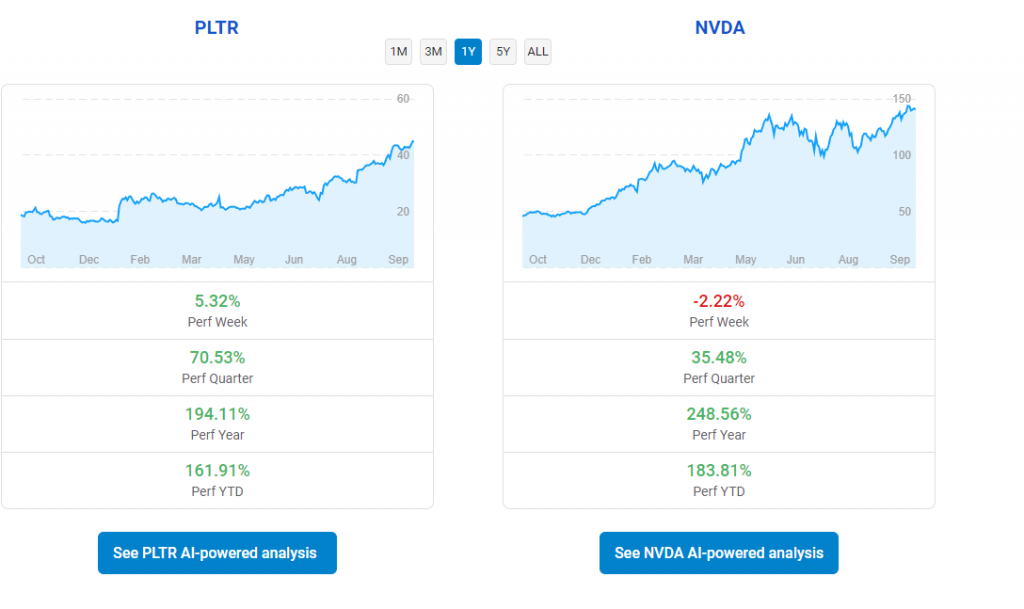

Tudor Investment sold all 126,594 Palantir shares. At the same time, they increased their Nvidia stake by 853% to 273,294 shares.

Paul Tudor Jones, known for spotting market trends early, picks AI stocks with solid growth ahead. The shift marks NVDA as a significant market catalyst in semiconductors. Investment experts note this reallocation represents one of the most significant AI-focused moves in recent months.

Valuation Dynamics

Palantir trades at 122 times forward earnings, showing a high risk. Nvidia sits at 49 times forward earnings, a more reasonable level. This gap influenced Tudor’s choice, as markets favor fairly priced companies.

The shift shows how AI stock leaders with proven sales gain more attention. Market strategists point to this valuation difference as a key driver of institutional investment flows.

Also Read: Can Binance Coin (BNB) Reclaim Its All-Time High Before Bitcoin?

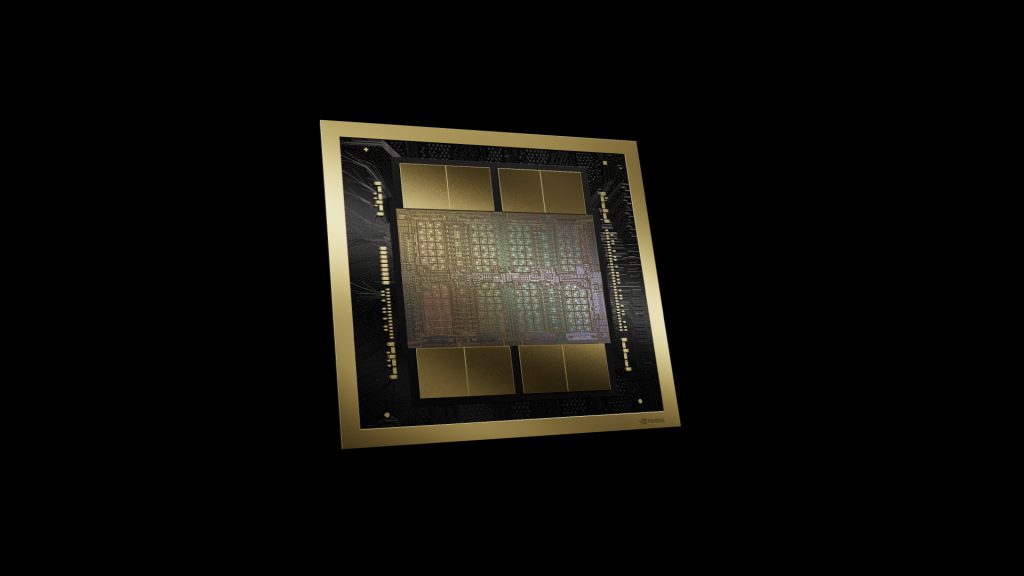

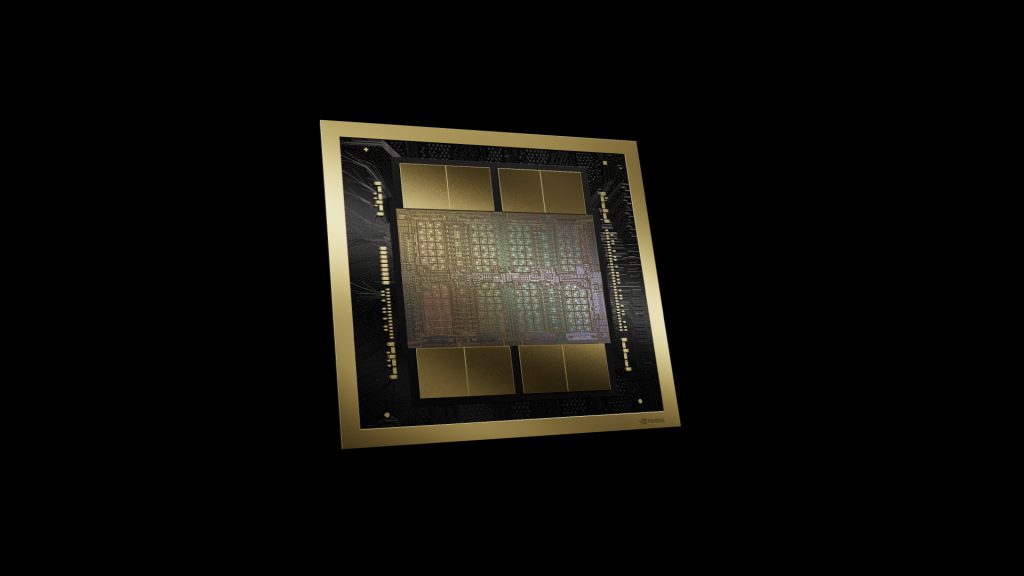

Blackwell Launch and Revenue Prospects

Nvidia plans to release its Blackwell architecture soon. This launch will act as a market catalyst for future growth. The company expects billions in Q4 revenue from this product line alone. Demand already exceeds what they can supply.

Market experts see this launch reshaping AI stock values industry-wide. Supply chain analysts predict sustained demand throughout the coming year.

Financial Performance and Market Leadership

Recent reports show Nvidia earned $30 billion in quarterly revenue. Their 75% profit margins impress investors, backing Tudor’s investment choice and Nvidia’s top spot in AI chips.

Also Read: Buy VeChain (VET): Double Digit Profits Predicted in November 2024

Strong AI computing needs have made NVDA essential for big and small investors. Industry watchers expect this momentum to continue as AI adoption accelerates globally.