The collapse of several cryptocurrency platforms throughout 2022 deterred the trust of investors. In order to instill faith back into the community, prominent firms began sharing details about their reserves. Binance, the world’s largest exchange did the same. However, more recently, the firm came out with a confession regarding an error.

Earlier today, Binance revealed that it was accidentally maintaining its collateral for certain tokens that it issues in the same wallet as its user funds.

In the website, reserves for over half of the 94 currencies that the firm creates, known as Binance-peg tokens or “B-Tokens,” are currently kept in a single wallet dubbed “Binance 8” that also houses customer funds. In comparison to the number of B-Tokens that the exchange released, that wallet has more tokens in reserve.

But according to the company’s own standards, collateral is not being kept apart from client assets as it was for earlier Binance-peg tokens. Rather, it is being mixed in with them. It should be noted that over 40 B-Tokens are currently listed in the Binance 8. Due to its latest mishap, it is rather challenging to verify the number of coins Binance currently entails.

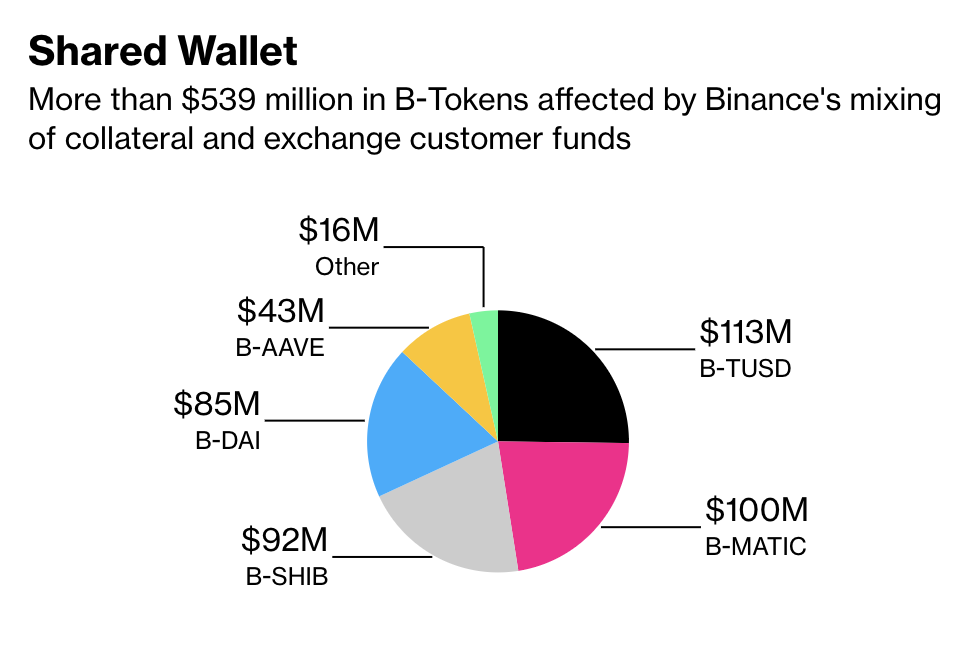

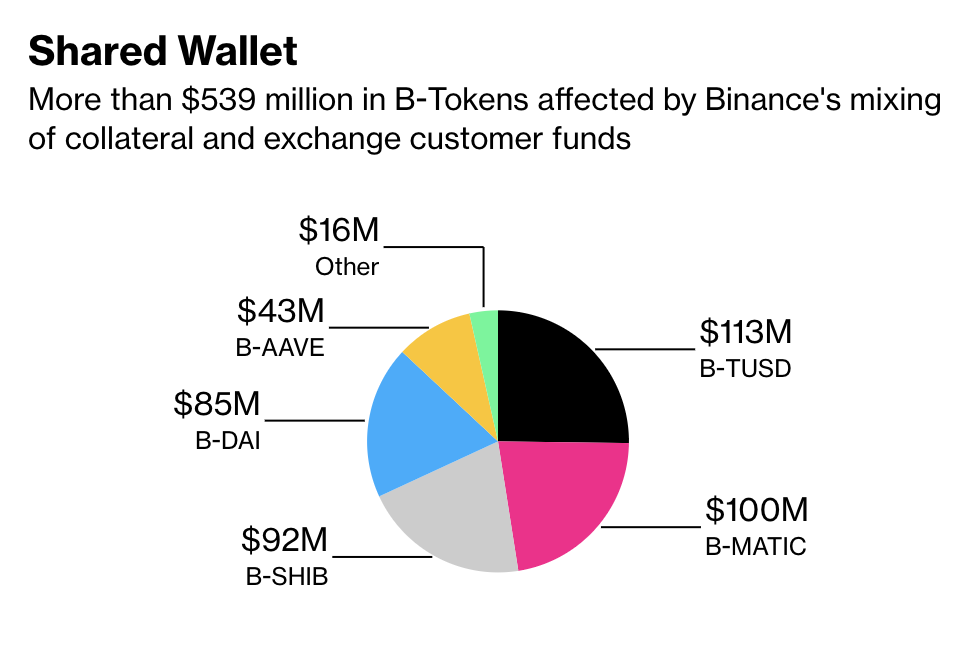

According to Bloomberg, the exchange issued more than $539 million in a total of the 41 B-Tokens that use Binance 8 as its collateral wallet. Additionally, the account itself has more than $1.8 billion in related assets.

This indicates that certain B-Tokens in the wallet contain significantly more collateral than required.

Here’s how Binance is rectifying this

A spokesperson elaborated on the same and told Bloomberg,

“Binance 8’ is an exchange cold wallet. Collateral assets have previously been moved into this wallet in error and referenced accordingly on the B-Token Proof of Collateral page. Binance is aware of this mistake and is in the process of transferring these assets to dedicated collateral wallets.”

Furthermore, the spokesperson also highlighted that the assets held on the exchange are backed by 1:1. Accounting firm Mazars was overseeing exchanges’ proof-of-reserves work. However, in December the firm abruptly cut ties with the exchange as well as its other clients in the industry.